Trade flows are bound to be disrupted from the spillover of trade tensions in the shipping market. In its latest weekly report, shipbroker Gibson said that “on October 14, both the US and China imposed prohibitively expensive port fees on tonnage linked to the other country. The USTR’s Section 301 measures were published and analysed well in advance. In contrast, China’s measures arrived with little notice; Beijing issued only a late-September warning that it would retaliate. China’s special port fees apply to any ship with clear US links calling at Chinese ports: vessels owned or operated by US companies or individuals; vessels owned or operated by entities in which US companies, organisations, or individuals directly or indirectly hold 25 percent or more of the equity (voting rights or board seats); US-flag vessels; and US-built vessels. There are two notable exceptions: first, vessels built in China are exempt; and second, ships arriving in ballast solely for repairs are also exempt. The fee levels are extreme – roughly $6 million per call for a VLCC and about $750,000 for an MR – clearly designed to have an impact”.

According to Gibson, “on the tanker side, US shipowners are few, and US-flagged or US-built deep-sea tonnage is insignificant. However, the US-operated fleet is sizable because oil majors and refiners typically maintain large time-chartered fleets. The real challenge lies in screening for the 25 percent US equity-control test. Many publicly listed owners have complex structures, and beneficial ownership can fluctuate over time. Several major non-US owners, particularly in Greece and Scandinavia, are listed on the NYSE or Nasdaq, further blurring the lines between “US-linked” and “international” for the purposes of the rule”.

The shipbroker added that “when all US-listed companies are included, the portion of vessels captured by China’s fees rises. For tankers, it averages around 17% once China-built ships are excluded, though this varies by size class. It is worth stressing, however, that this figure remains a broad estimate. Some large US-listed owners, particularly those not based in the US, may fall below the 25% threshold and thus be exempt. Conversely, some companies with no obvious US ties may still have US equity stakes at or above 25%.

Source: Gibson Shipbrokers

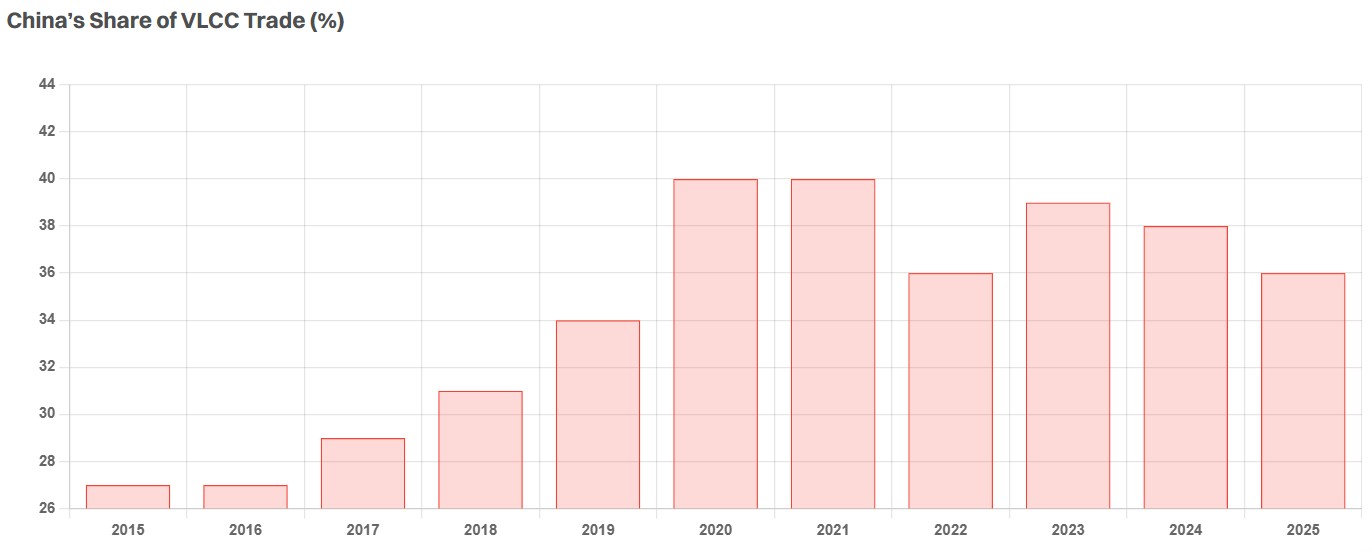

Gibson noted that “VLCCs are the most exposed, as China is the single largest destination for this class, accounting for about 38% of VLCC trade on an export-volume basis last year. Other classes will also feel the impact, though to a considerably lesser extent, given their more diversified trading patterns and lower reliance on China. In the near term, the uncertainty over who is safe to trade into China could fuel additional freight volatility. The VLCC market is already very tight, supported by rising OPEC+ crude production, refinery maintenance, reduced direct crude burn for power generation in the Middle East, and a larger pull of Atlantic Basin crude eastward during September”.

“Trade flows will inevitably be disrupted. With no advance warning, some tankers affected by the Chinese measures were likely already en route to China when the announcement was made. More ballast miles are expected as owners and charterers reshuffle tonnage. The need for additional documentation checks could also lead to greater congestion in ports. In the longer run, the market will adjust. Companies hovering just above the 25% US ownership threshold may explore structural options to limit their exposure, though this is likely to take time and could have implications for their share prices. Still, the broader picture is that this tit-for-tat at the terminals will carry economic consequences for both countries once other shipping sectors are also taken into account. This raises the inevitable question: are negotiations on the table, and could this standoff be resolved over time, with port fees eventually lifted or substantially reduced?”, Gibson concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide