Tonnage Finally Finds Its Way To Indian Sub-Continent

Escalatory and retaliatory moves kept key trading routes and markets on edge as freight rates propped up this week, with the Baltic Exchange Dry Index reporting a whopping 7.4% overall increase, reports cash buyer GMS.

Capesize, Panamax, and Supramax indices all firmed in unison to the tune of 1.0%, 0.4%, and 0.5% respectively. As trading rates jumped, so did crude oil—albeit marginally—ending the week at USD 62.74/barrel (vs. USD 62.14/barrel at the start of the week).

“Mixed in with the craziness of tariffs is the growing and murky collection of sanctioned units that continue to trickle into the markets along with legitimate ones,” says GMS. “This week also delivered an early Christmas surprise as tonnage that had been missing from the bidding tables for weeks on end somehow managed to find its way onto Indian sub-continent recycling beaches—marginally in Bangladesh and en masse into India, with over 155K Tons LDT and a few behemoth LNGs arriving at both waterfronts. Certainly an “ice-cube down the back” kind of flashback moment to the glorious days of loaded recycling beaches.”

Hong Kong Convention approvals remain the bright spot in Bangladesh as 18 ship recycling yards are now fully accredited to global standards, says GMS. Pakistan remains far behind.

Currencies also nailed down the week’s pressure points—especially in India—as virtually all recycling nation currencies depreciated in the teens against the U.S. dollar. Steel plate prices, by contrast, flatlined across the spectrum—even in China—as fresh tariff rumors made the rounds once again.

“Overall, as the stasis of inactivity evaporated in Alang this week, India remained whipsawed by the INR’s ongoing collapse and protectionist-minded headwinds from local buyers will likely greet sellers with tumbling demand and pricing in response. Bangladesh remains inert overall, as its interim regime fails to revive activity and beachings are like drops of rain in the desert. Pakistan stays eager but forcibly idle, unable to secure vessels while freight trades rich and local buyers remain unwilling to discard their precious DASRs on small LDT units. Turkey remains in the cellar, red tape intact, and activity nil.”

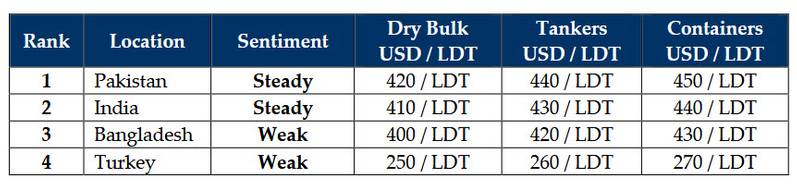

GMS demo rankings / pricing for week 37 of 2025 are: