ThPA S.A.: Historic high in revenue and profitability

Robust operational performance fueled the strong financial performance in 2024, with a record high in revenues and volumes, despite the significant challenges in an increasingly adverse and uncertain environment, where intense geopolitical instability, escalating conflicts, and supply disruptions were strongly present.

The Group achieved record revenues, profits, throughput, and volumes for another year almost in all core sectors of its operations. The strong results in 2024 are an outcome of overperformance in throughput and in volumes in all core services and of improved operating efficiency. Container Terminal throughput reached 566k TEUs, increased substantially by 46k TEUs (+9%), year over year. Conventional Cargo attained 3,2 million tons, higher by 250k tons (+9%) vs prior year. Cruise calls reached a record high of 81 vessels vs 68 in prior year (+19%) with total passengers at 125k, increased YoY by 64k passengers (+105%).

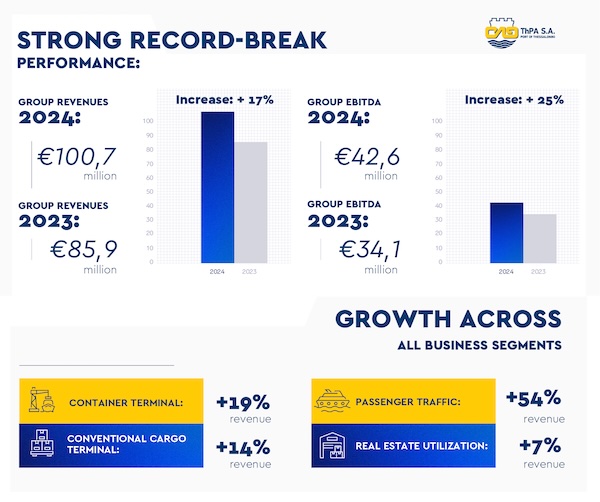

Group Revenues reached € 100,7 mil. in 2024, compared to € 85,9 mil. in the previous year, significantly increased by € 14,8 mil. (+17%), fuelled by higher revenues in all Company’s main sectors: the revenues of the Container Terminal increased by € 11,5 mil. (+19%), of the Conventional Cargo Terminal by € 2,9 mil. (+14%), of the Passenger Traffic by € 0,5 mil. (+54%), and of the Real Estate by € 0,3 mil. (+7%).

Regarding the Group’s profitability for 2024, gross profits reached € 47,1 mil., increased by € 9,5 mil. (+25%) vs 2023. Earnings before interest, taxes, depreciation and amortization (EBITDA) surpassed € 42,6 mil., compared to € 34,1 mil. in 2023, reflecting a growth of € 8,6 mil. (+25%) while EBITDA margin reached 42% increased by 3pp compared to the prior year. ThPA S.A.

Earnings before taxes, reached € 36,3 mil. compared to € 26,4 mil. in 2023, reflecting an increase of € 9,9 mil. (+37%) while net earnings after taxes improved notably and reached € 28 mil., compared to € 20 mil. in the previous year, reflecting an increase of 38%. As a result, Earnings per Share are in the region of € 2,78/share.

Considering all the above, the total dividend will be proposed at € 2 per share, increased by 54%, compared to the previous year (€ 1,3 per share), which is subject to approval by the Ordinary General Meeting of Shareholders on May 14th, 2025.

Total capital expenditure reached € 6,3 mil.

The Group maintains healthy levels of financial liquidity due to consistent and strong production of operating cash flows, reaching € 123 mil. total cash, cash equivalents and financial assets, including term deposits with a duration of more than 3 months of € 76,4 mil., reflecting an increase of € 28 mil. compared to the previous year.