Tankers: Saudi Arabia Crude Oil Exports Keep Declining

The downward trend of Saudi Arabia’s crude oil exports has persisted so far in 2025, following the same pattern as during 2024. In its latest weekly report, shipbroker Banchero Costa said that “in Jan-Dec 2024, global crude oil loadings went up by a modest +0.4% yo-y to 2194.6 mln tonnes, excluding all cabotage trade, according to vessels tracking data from LSEG. This year started even worse, with global crude oil loadings in Jan-May 2025 down by -2.0% y-o-y to just 909.9 mln tonnes. Exports from the Arabian Gulf were down by -1.4% y-o-y to 362.8 mln t in Jan-May 2025, accounting for 39.9% of seaborne crude trade. Exports from Russian ports (including oil of Kazakh origin) also declined by -7.3% y-o-y in Jan-May 2025 to 92.5 mln tonnes, or 10.2% of global trade. From South America, exports increased by +2.0% y-o-y to 86.6 mln t, with a share of 9.5%. From the USA, exports volumes declined by -9.8% y-o-y at 75.7 mln t in Jan-May 2025, an 8.3% share. From South East Asia exports declined by -13.5% y-o-y to 48.0 mln t in JanMay 2025 (but this inevitably also reflects changes in the re-export of Russian origin volumes)”.

Source: Banchero Costa

According to Banchero Costa, “in terms of demand, the top seaborne importer of crude oil in Jan-May 2025 was Mainland China, accounting for 22.8% of global trade. Volumes into China declined by -4.1% y-o-y to 204.2 mln t in Jan-May 2025. Imports to the EU27 declined by -6.7% y-o-y to 186.4 mln t, accounting for 20.8% of global trade. To ASEAN, imports increased by +1.1% y-o-y to 114.5 mln t (again this includes Russian volumes later reexported elsewhere in Asia). To India, volumes increased +1.9% y-oy to 101.3 mln t in Jan-May 2025”.

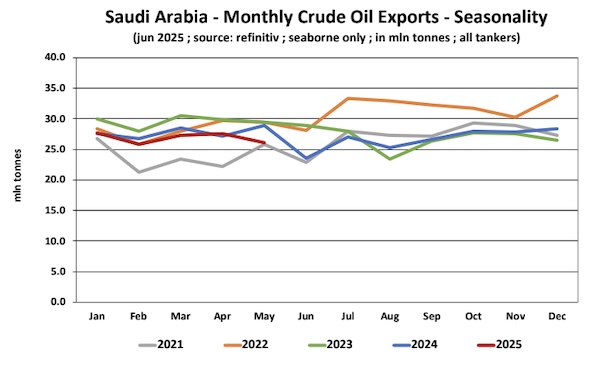

“Saudi Arabia is the single largest seaborne exporter of crude oil in the world, ahead of Russia, Iraq and the USA. In 2024 it accounted for 14.9% of global seaborne crude oil exports. In the 12 months of 2024, Saudi seaborne crude oil exports declined by -3.2% to 325.5 mln tonnes, excluding cabotage, after declining by -7.5% y-oy in 2023. Volumes were still above the 310.2 mln tonnes of 2021. In Jan-May 2025, Saudi crude exports declined a further -3.2% y-o-y to 134.6 mln tonnes, from 139.0 mln t in the same period of 2024. About 92.9% of volumes loaded in Saudi Arabia in Jan-May 2025 were carried in VLCCs, 5.4% were carried in Suezmaxes, and 1.8% in Aframaxes. These proportions increased in recent years in favour of the largest tankers, as Suezmaxes and Aframaxes were diverted to carry more Russian cargoes”, the shipbroker said.

Source: Banchero Costa

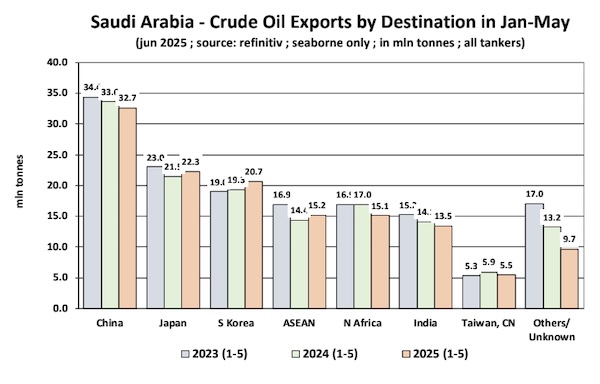

“The main crude oil export terminals in Saudi Arabia are: Ras Tanura (112.7 mln tonnes, or 83.7%, in Jan-May 2025), Yanbu (16.3 mln t, or 12.2%), Ras al Khafji (5.5 mln t, or 4.1%). In terms of destinations for crude oil shipments from Saudi Arabia, the focus in recent years has clearly shifted to Asia. In Jan-May 2025, the top destination was Mainland China, accounting for 24.3% of the total Saudi crude exports, followed by Japan with 16.5%, South Korea with 15.4%, ASEAN with 11.3%, India with 10.0%, Taiwan with 4.1%. Direct shipments to the USA now account for just 3.3% of Saudi exports, and direct shipments to the European Union for just 0.2%. Another 11.2% of Saudi crude exports are shipped to the Ain Sukhna Terminal in Egypt to feed the Sumed pipeline, and will eventually mostly end up in Europe. In Jan-May 2024, Saudi Arabia shipped 32.7 mln tonnes of crude to Mainland China, which represents a -2.9% y-o-y decline from 33.6 mln tonnes in JanMay 2024. Saudi Arabia also shipped 22.3 mln t this year to Japan, which represents an increase of +3.4% y-o-y from 21.5 mln t in the same period last year. The third top destination was South Korea, with 20.7 mln t, up by +7.2% yo-y from 19.3 mln t in Jan-May 2024. Shipments from Saudi to ASEAN increased by +5.7% y-o-y to in Jan-May 2025 to 15.2 mln tonnes. Volumes to India declined by -4.4% yo-y in Jan-May 2025 to 13.5 mln t. Direct shipments to the EU declined by -83.6% y-o-y in Jan-May 2025 to just 0.2 mln t, from 1.2 mln t in the same period last year”, Banchero Costa concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide