Tankers: Can Oil Escape a Global Trade War?

In the aftermath of Liberation Day, tanker market participants are still trying to evaluate the potential impact. In its latest weekly report, shipbroker Gibson said that “on Wednesday the 2nd of April, the much-anticipated Liberation Day came to pass. US President Donald Trump made true his threats and passed a 10% tariff on all imports from all trading partners from the 5th of April. Additionally, reciprocal tariffs coming into force on the 9th of April will be applied to specific trading partners designed to match tariffs those trading partners impose on US imports. For example, Trump announced a 20% fee on the European Union, 24% on Japan, 27% on India, and 34% on China. All these tariffs are on top of already existing tariffs implemented by the current administration. Crucially, the White House clarified that crude oil and refined products will not be subject to the additional 10% tariffs. Notable for tanker markets is also that tariffs on Canada and Mexico will continue as they are, with both Canadian and Mexican oil and products trading into the US tariff free, so little rerouting is expected to occur here yet. As with all announced tariffs, this may be subject to change”.

According to Gibson, “with oil and refined products exempt, the immediate consequences for tanker markets are unclear. We saw a prompt reaction in oil prices as markets priced in reduced demand as well as OPEC+ announcing their plan to accelerate production increase in May. In the short term, price sensitive buyers or those looking to build reserves, such as China, may be incentivized to take advantage of cheaper oil. In the medium and long term, fears of muted economic growth and oil demand may be realized”.

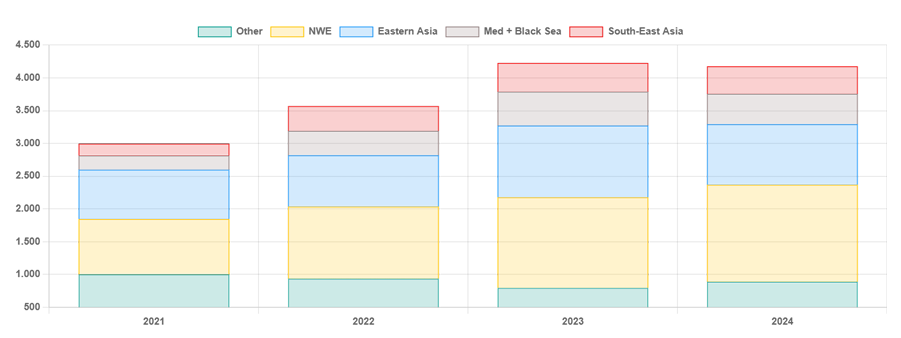

Source: Gibson Shipbrokers

“Despite being exempted by the US, trading partners may respond with tariffs of their own that do target oil and refined products. The US imported 3.3 mbd of seaborne crude and DPP in 2024, of which the majority came from countries in Latin America and the Middle East. The US exported nearly 4.2 mbd of crude and DPP in 2024, of which 1.9 mbd (46%) went to Europe and the Med, and a further 1.3 mbd (32%) went to East and Far East Asia, which may become subject to retaliatory tariffs. However, many of these countries, especially in Europe, have few alternative sources of supply, though with OPEC+ accelerating supply hikes this may change sooner than expected. In terms of the CPP trade, the US imported 900 kbd from a diverse range of sources and exported 1.9 mbd, of which 74% was to Latin America”, the shipbroker said.

Meanwhile, “trading partners have promised strong responses, with China moving quickly to impose a 34% tariff on all US effective from April the 10th, including on oil and products. Chinese imports of US crude were limited in 2024, amounting to just 240 kbd. Overall, tanker markets have so far been spared most of the direct consequences of tariffs, and indirect consequences will be harder to assess. It is possible that further trade partners target oil and product imports from the US with their own tariffs, though likely only if alternative sources of supply are readily available”, Gibson concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide