Tanker Supply to Grow Despite Lower Orders in 2025

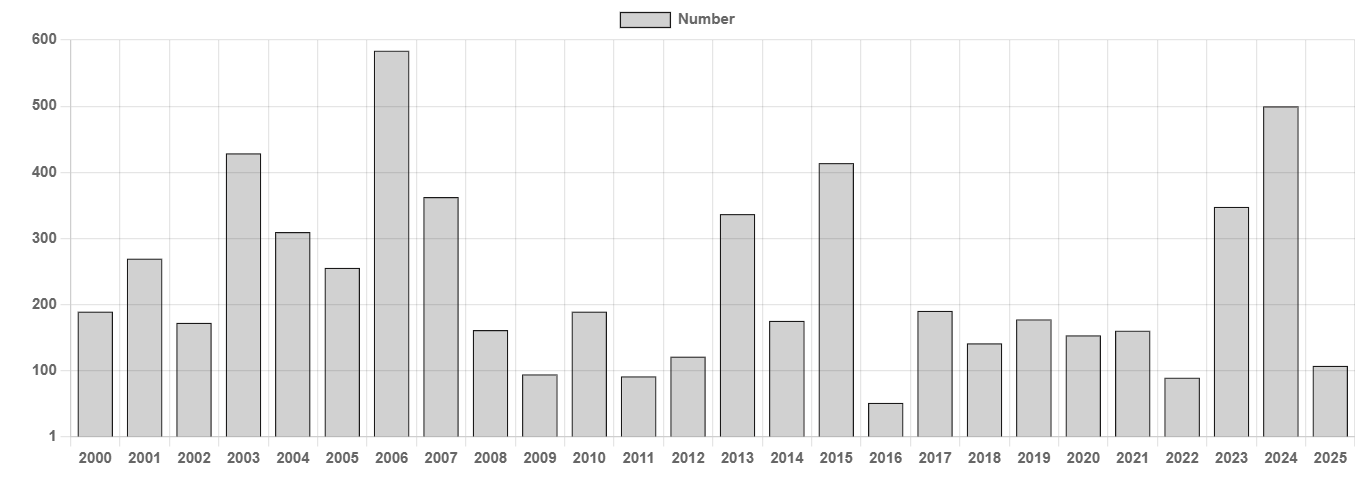

Tanker supply is expected to keep growing throughout 2027, despite slow newbuilding activity since the beginning of 2025, since a large number of orders during the 2023-2024 will hit the water. In its latest weekly report, shipbroker Gibson said that “tanker ordering activity for vessels above 25,000 dwt has dropped sharply this year, with total orders around 110 units. This decline reflects a mix of regulatory and market uncertainties, along with persistently high newbuilding prices. Current prices remain just below the multiyear peaks seen last year, while shipyards face little pressure to offer significant discounts. 2025 orders are well below the nearly 850 tankers contracted in 2023 and 2024, and broadly in line with the limited ordering activity seen between 2016 and 2022. The only segment where fresh contracting has remained relatively robust is Suezmaxes, with 36 tankers ordered so far this year”.

According to Gibson, “on its own, restricted new investment always has the potential to constrain fleet growth a few years down the line, especially if accompanied by higher scrapping volumes. However, this needs to be looked at in the context of robust ordering activity that took place in recent years. Suezmaxes currently have the largest orderbook relative to its current size, with 20.4% of the existing fleet on order. This is followed by MRs and Aframaxes/LR2s, with orderbook in these segments at 19% and 18.8% respectively. The VLCC orderbook is notably smaller at 12.2%, while Handies have the smallest share at just 6.6%, reflecting owners’ preference to move up to larger segments. In contrast, the LR1/Panamax orderbook has grown significantly, reaching 16.6% of its fleet size after renewed interest sparked a surge in new orders last year”.

The shipbroker added that “scheduled tanker deliveries are set to peak next year at their highest level since 2009 and will remain elevated into 2027, although delivery profiles somewhat differ by segment and some degree of slippage is likely. Accelerated deliveries pose a clear risk to market earnings in the coming years, but the rapidly ageing fleet offers robust prospects for tanker demolitions to offset that. Depending on vessel type, between 19% and 41% of the fleet is already 20 years or older, while a further 21% to 44% is in the 15 to 19 year range. LR1/Panamaxes and Handies have the oldest age profiles, while Suezmaxes and VLCCs are comparatively younger”.

Source: Gibson Shipbrokers

Gibson said that “in reality, though, the demolition outlook remains much more complicated. Scrapping activity is still limited, as ageing tankers continue to carry Russian or other sanctioned barrels despite a rapidly expanding list of sanctioned vessels. Aframax/LR2s, Suezmaxes, and VLCCs are most exposed, with around 23%, 14%, and 13% of these fleets already sanctioned by various jurisdictions and another 8-9% potentially at risk due to questionable trading. Despite an intensifying wave of sanctions, a meaningful uptick in removals has yet to materialise, with scrap values notably below sale prices of 20 year-olds intended for further trading”.

“With Ukraine-Russia peace negotiations stalled and the EU planning additional measures, arguably Russia’s need for ‘dark’ ships remains strong, dampening scrapping prospects particularly for Aframaxes and Suezmaxes, unless circumvention routes are cut off. Meanwhile, a breakthrough in US–Iran talks could reduce demand for illicit trades on larger crude carriers, but for now the likelihood of such a deal appears slim”, the shipbroker noted.

Gibson concluded that “taken together, although fresh tanker orders have slowed considerably this year, the sizeable existing orderbook means tanker supply is set to grow over the next few years. Large increases in demolition activity are needed to offset this growth but for that to happen a major political breakthrough related to Russia and Iran is needed and/or a much tougher enforcement of existing tanker sanctions. Still, despite weak scrapping for now, the ageing fleet means that except for 2026 the size of tanker fleet under 20 years of age is projected to decline in the coming years. Ultimately, demolition will have to happen eventually”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide