Tanker Market Stages August Recovery

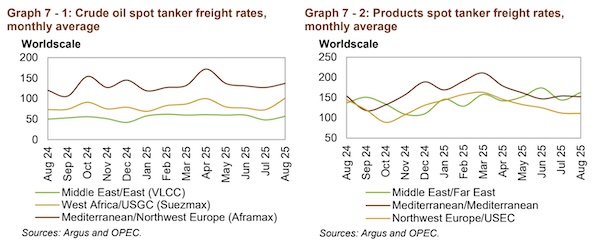

Dirty tanker spot freight rates largely recovered from the previous month’s declines. Suezmax rates saw the strongest gains, up 34% on average, m-o-m, and 38%, y-o-y, OPEC said in its latest monthly report. Spot freight rates on the West Africa-toUS Gulf Coast (USGC) route jumped 38%. VLCC spot freight rates were lifted by routes terminating in the East of Suez. Spot freight rates on the Middle East-to-East route rose 19%, m-o-m, while rates on the Middle East-to-West route rose by a more moderate 3%.

The Aframax market was mixed. Spot freight rates around the Mediterranean rose by about 9%. In contrast, rates on the Indonesia-to-East route declined 7%, m-o-m. In the clean tanker market, spot rates were broadly lower, with only the Middle East-to-East route registering positive growth, up 13%. Rates around the Mediterranean declined by 1%, m-o-m.

Dirty tanker freight rates

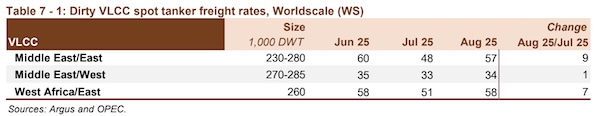

Very large crude carriers (VLCC)

VLCC spot freight rates rose, m-o-m, in August, driven by gains East of Suez. On average, VLCC spot freight rates increased 11%, m-o-m, and were up 7% compared with the same month last year. On the Middle East-to-East route, rates averaged WS57 in August, representing a gain of 19% from the previous month. Rates were 14% higher, y-o-y.

Spot freight rates on the Middle East-to-West route also increased, up 3%, m-o-m, to average WS34. Rates were similarly higher compared with the same month in 2024, increasing by 3%. On the West Africa-to-East route, spot freight rates rose by 14%, m-o-m, to average WS58. Compared with the same month in 2024, rates were 5% higher.

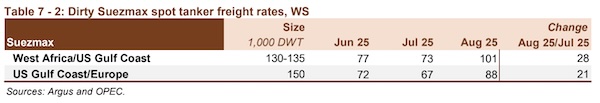

Suezmax

Spot freight rates for Suezmax vessels showed a strong performance on average in August, surging by 34%, m-o-m. Compared with the same month last year, average rates for the vessel class were 38% higher. On the West Africa-to-USGC route, spot freight rates in August averaged WS101, representing an increase of 38%, m-o-m. Compared with the same month in 2024, spot rates on the route were up by a similar 38%. Rates on the USGC-to-Europe route rose 31%, m-o-m, to average WS88. Compared with the same month in 2024, rates were 40% higher.

Aframax

Aframax spot freight rates also saw gains in August. On average, Aframax rates rose by 9%, m-o-m. Compared with the same month last year, rates for the vessel class were up 10% on average. The Indonesia-to-East route was the one exception to the positive performance across all monitored dirty tanker routes in August. In August, dirty spot freight rates on the route fell 7%, m-o-m, to WS109. Y-o-y, rates on the route were down 23%.

In contrast, spot freight rates on the Caribbean-to-US East Coast (USEC) route jumped 23%, m-o-m, to average WS160. Compared with the same month last year, rates were 44% higher. Spot freight rates around the Mediterranean saw more moderate gains. Cross-Med rates rose 10%, m-o-m, to average WS144. Y-o-y, spot rates on the route were up 14%. Rates on the Med-to-Northwest Europe (NWE) route rose 8%, m-o-m, to average WS137. Compared with the same month in 2024, rates were up 14%.

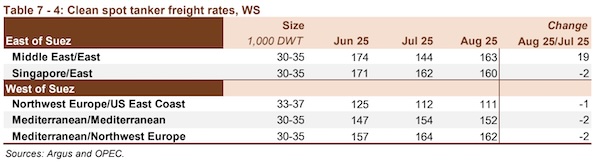

Clean tanker freight rates

Clean spot freight rates were slightly lower on most monitored routes, with the exception of Middle East-toEast voyages, which registered a positive performance. This allowed East of Suez rates to record an increase of 5% on average, m-o-m, while West of Suez rates declined by 1%. Compared with the previous year, East of Suez rates were up 12%, while West of Suez rates fell by 8% on average.

Rates on the Middle East-to-East route bucked the general downward trend, rising 13%, m-o-m, to average WS163. Compared with August 2024, rates were 19% higher. Clean spot freight rates on the Singapore-toEast routes slipped by 1%, m-o-m, to average WS160. However, this was still a 6% increase compared with the same month in 2024. In the Atlantic Basin, clean rates on the NWE-to-USEC route averaged WS111, representing a drop of 1%, m-o-m, and 23%, y-o-y.

Rates around the Mediterranean also edged lower, with the Cross-Med averaging WS152, representing a drop of 1%. Rates on the Med-to-NWE route averaged WS162, also representing a 1% decline. Y-o-y, spot freight rates on both routes were down by 1% each.

Nikos Roussanoglou, Hellenic Shipping News Worldwide