Tanker Market Showed Mixed Movements in June

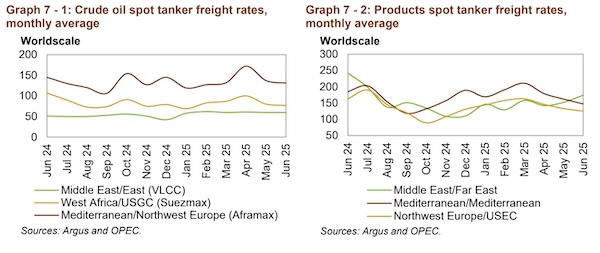

The tanker market exhibited mixed performance during the previous month, OPEC said in its latest monthly report for June. Dirty tanker spot freight rates continued to see mixed movements in June. VLCC rates were volatile over the month due to geopolitical developments, although the mid-month spike in rates was matched by a decline near the end of the month, resulting in VLCC rates remaining broadly flat in monthly terms. On the Middle East-to-East route, VLCC spot freight rates were unchanged, m-o-m, but rose 6% on the Middle East-to-West route, recovering from low levels seen in the previous two months. VLCC rates on the West Africa-East route fell 6%, amid lower flows to China.

Suezmax rates declined on average in June, despite geopolitical-driven volatility, as activities remained sluggish. Spot rates on the US Gulf Coast-to-Europe route declined 3%, m-o-m. In contrast, Aframax rates showed slight gains on average in June, supported by improving activities East of Suez at the end of the month. Rates around the Mediterranean were down by about 3%. In the clean tanker market, spot rates were also mixed. East of Suez rates rose 11%, m-o-m, driven by geopolitical concerns mid-month, followed by a pick-up in activities. West of Suez rates declined by 8%, m-o-m, amid softer fundamentals around the Mediterranean.

Dirty tanker freight rates

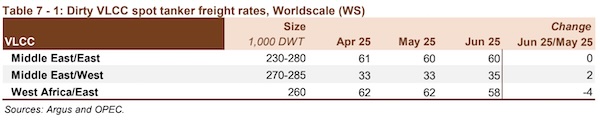

Very large crude carriers (VLCC)

VLCC spot freight rates were broadly stable on average, m-o-m, in June, as marginally softer rates on the Middle East-to-East route were balanced by an improvement on the Middle East-to-West route. On average, VLCC spot freight rates were unchanged, m-o-m, but were up 9% compared with the same month last year. On the Middle East-to-East route, rates averaged WS60 in June, unchanged from the previous month, as the mid-month spike in rates was matched by a decline near the end of the month. Rates were up 18%, y-o-y. Spot freight rates on the Middle East-to-West route rose 6%, m-o-m, to average WS35, recovering from the relatively low levels seen in the previous two months. Compared with the same month in 2024, rates were unchanged. On the West Africa-to-East route, spot freight rates declined 6%, m-o-m, to average WS58. Compared with the same month in 2024, rates were up 2%.

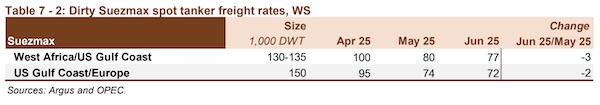

Suezmax

Spot freight rates for Suezmax vessels declined in June, down 4% on average, m-o-m, as activities remained sluggish. Compared with the same month last year, rates for the vessel class were down 25%. On the West Africa-to-USGC route, spot freight rates in June averaged WS77, following a decline of 4%, m-o-m. Compared with the same month in 2024, spot rates on the route were 28% lower. Rates on the USGCto-Europe route continued to edge lower, falling 3% to average WS72. Compared with the same month in 2024, rates were down 22%.

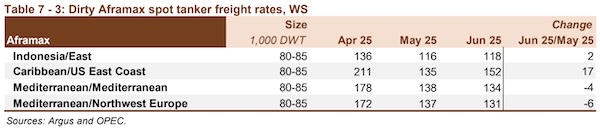

Aframax

Aframax spot freight rates picked up in June in monthly terms, despite weakening around the Mediterranean, with East of Suez activities providing support. On average, Aframax rates rose 2%, m-o-m. Compared with the same month last year, rates for the vessel class averaged 24% lower. On the Indonesia-to-East route, dirty spot freight rates rose 2%, m-o-m, to an average of WS118 in June. Y-o-y, rates on the route were down 33%.

Spot freight rates on the Caribbean-to-USEC route partially recovered from the sharp loss seen the month before. Rates were up 13%, m-o-m, to average WS152, but were down 29% compared with the same month last year. Cross-Med spot freight rates edged lower, m-o-m, down 3% to average WS134. Y-o-y, spot rates on the route were 19% lower. Similarly, rates on the Med-to-NWE route declined 4%, m-o-m, to average WS131. Compared with the same month in 2024, rates were down 10%.

Clean tanker freight rates

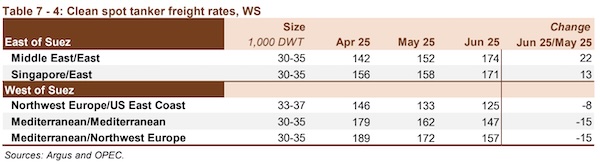

Clean spot freight rates were also mixed in June. East of Suez rates increased 11%, on average, driven by geopolitical concerns mid-month, followed by a pickup in activity. West of Suez rates were down 8%, m-o-m, amid softer fundamentals around the Mediterranean. Compared with the previous year, East of Suez and West of Suez rates were down by 34% and 21%, respectively.

Rates on the Middle East-to-East route jumped 14%, m-o-m, to average WS174, amid a mix of geopolitical concerns and improving activities over the month. Compared with June 2024, rates were down 28%. Clean spot freight rates on the Singapore-to-East route also saw gains over the previous month in June, rising 8% to average WS171. This still represents a 39% decline compared with the same month in 2024.

In the Atlantic basin, clean rates declined on all monitored routes, as availability outpaced tanker demand. The NWE-to-USEC route averaged WS125, representing a decrease of 6%, m-o-m, and 23%, y-o-y. Rates around the Mediterranean fell by 9%, m-o-m, with the Cross-Med averaging WS147 and the Med-to-NWE route averaging WS157. Y-o-y, spot freight rates on these two routes were down 21% and 19%, respectively.

Nikos Roussanoglou, Hellenic Shipping News Worldwide