Tanker Market: Saudi Arabia Crude Oil Exports Down During 2024

Tanker demand from Saudi Arabia has been declining steadily since the start of 2023, with this year proving to be the same, as a result of declining crude oil exports from the Kingdom. In its latest weekly report, shipbroker Banchero Costa said that “2023 has been another positive period for crude oil trade, despite the high oil prices and risks of economic recession. In Jan-Dec 2023, global crude oil loadings went up +4.7% y-o-y to 2186.8 mln tonnes, excluding all cabotage trade, according to vessels tracking data from Refinitiv. The positive trend continued in Jan-Nov 2024, when global loadings increased by +0.4% y-o-y to 2007.4 mln t, from 2000.2 mln t in the same period of 2023. Exports from the Arabian Gulf were down by -1.7% y-o-y to 790.4 mln t in Jan-Nov 2024, and accounted for 39.4% of global seaborne trade. Exports from Russian ports also declined by -3.0% y-o-y to 204.7 mln tonnes, or 10.2% of global trade. From the USA, exports surged by +4.0% y-o-y to 186.4 mln tonnes in Jan-Nov 2024. From South America, exports surged by +12.1% y-o-y to 181.4 mln t. From West Africa, exports declined by -3.1% y-o-y to 152.7 mln t. From ASEAN exports surged by +19.0% y-o-y to 127.2 mln t in Jan-Nov 2024”.

Source: Banchero Costa

According to Banchero Costa, “in terms of demand, the top seaborne importer of crude oil in Jan-Nov 2024 was Mainland China, accounting for 23.2% of global trade. Volumes into China declined by -0.8% y-o-y to 467.5 mln t in Jan-Nov 2024, from 471.4 mln t in Jan-Nov 2023, but were still well above the 405.7 mln t in Jan-Nov 2021. Imports to the EU27 declined by -1.2% y-o-y to 425.9 mln t, accounting for 21.2% of global trade. To ASEAN, imports increased by +6.7% y-o-y to 241.9 mln t. To India, volumes increased by +2.2% y-o-y to 213.6 mln t in Jan-Nov 2024. To S. Korea, imports increased by +2.4% y-o-y to 131.1 mln t. To Japan, imports declined by -8.1% yo-y to 102.2 mln t in Jan-Nov 2024”.

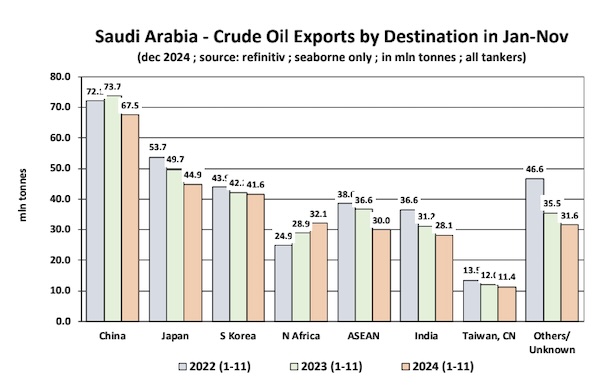

The shipbroker added that “Saudi Arabia is the single largest seaborne exporter of crude oil in the world, ahead of Russia, Iraq and the USA. In 2023 it accounted for 16.6% of global seaborne crude oil exports. In the 12 months of 2023, Saudi seaborne crude oil exports declined by -7.5% to 336.4 mln tonnes, excluding cabotage, after surging by +17.2% y-oy to 363.6 mln tonnes in 2022, the highest annual volume since 2013. In Jan-Nov 2024, Saudi crude exports declined a further -7.3% y-o-y to 287.2 mln tonnes, from 309.8 mln t in the same period of 2023. About 93% of volumes loaded in Saudi Arabia in Jan-Nov 2024 were carried in VLCCs, 5% were carried in Suezmaxes, and 2% in Aframaxes. These proportions increased in favour of the largest tankers, as Suezmaxes and Aframaxes were diverted to carry more Russian cargoes. The main crude oil export terminals in Saudi Arabia are: Ras Tanura (234.5 mln tonnes in Jan-Nov 2024), Yanbu (37.6 mln t), Ras al Khafji (14.7 mln t). In terms of destinations for crude oil shipments from Saudi Arabia, the focus in recent years has clearly shifted to Asia”.

Source: Banchero Costa

“In Jan-Nov 2024, the top destination was Mainland China, accounting for 23.5% of the total Saudi crude exports, followed by Japan with 15.6%, South Korea with 14.5%, ASEAN with 10.4%, India with 9.8%, and Taiwan with 4.0%. Direct shipments to the USA now account for just 3.8% of Saudi exports, and direct shipments to the European Union for just 0.7%. Another 11.1% of Saudi crude exports are shipped to the Ain Sukhna Terminal in Egypt to feed the Sumed pipeline, and will eventually mostly end up in Europe. In Jan-Nov 2024, Saudi Arabia shipped 67.5 mln tonnes of crude to Mainland China, which represents a -8.5% y-o-y decline from 73.7 mln tonnes in JanNov 2023. Saudi Arabia also shipped 44.9 mln tonnes this year to Japan, which is a drop of -9.8% y-o-y from 49.7 mln t. The third top destination was South Korea, with 41.6 mln t, down -1.3% yo-y from 42.2 mln t in Jan-Nov 2023. Shipments from Saudi to ASEAN declined by -18.2% y-o-y to in Jan-Nov 2024 to 30.0 mln tonnes. Volumes to India declined by -9.7% yo-y in Jan-Nov 2024 to 28.1 mln t. Direct shipments to the EU declined by -66.2% y-o-y in Jan-Nov 2024 to 1.9 mln t, from 5.8 mln t last year”, Banchero Costa concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide