The tanker market is again facing a reshaping of its trade routes. In its latest weekly report, shipbroker Gibson said that “this week sanctions pressure on Russia was dialled up a notch. On Thursday, the first major US sanctions against Russia under the Trump administration were implemented, marking a step change in the administration’s approach. On Friday morning, the EU followed suit, implementing their 19th sanctions package. A week prior, the UK implemented a fresh batch of sanctions”.

According to Gibson, “the UK struck first, designating Rosneft and Lukoil, as well as a few small port companies in Shandong and Yulong Petrochemical (400kbd). The UK also sanctioned Nayara Energy, which been sanctioned previously by the EU in its 18th sanctions package. A list of 44 tankers of various size was also named. The US also designated Rosneft and Lukoil on Wednesday night, prohibiting price cap compliant trade. Consequently, Indian refiners reportedly will make large cuts to their crude imports from Russia. If confirmed, the degree to which Indian refiners reduce their imports will be a crucial factor to watch. Reports are also circulating that China state oil majors will suspend purchases of Russian oil due to these new sanctions.

“The 19th sanctions package was more complex and wide ranging, with various entities and individuals designated, as well as 114 tankers added to the list. Notably, the EU designated Liaoyang Petrochemical (200kbd) and joined the UK in sanctioning Yulong Petrochemical, and now also prohibits price cap compliant trade with Rosneft and Gazprom Neft. Several traders, false flag registries, as well as a Russian shipbuilder were also on the list. Further, the EU ban on products refined from Russian oil was clarified, with rules now stating that if Russian crude oil can be segregated and processed separately by a refinery, then import into the EU is allowed”, the shipbroker said.

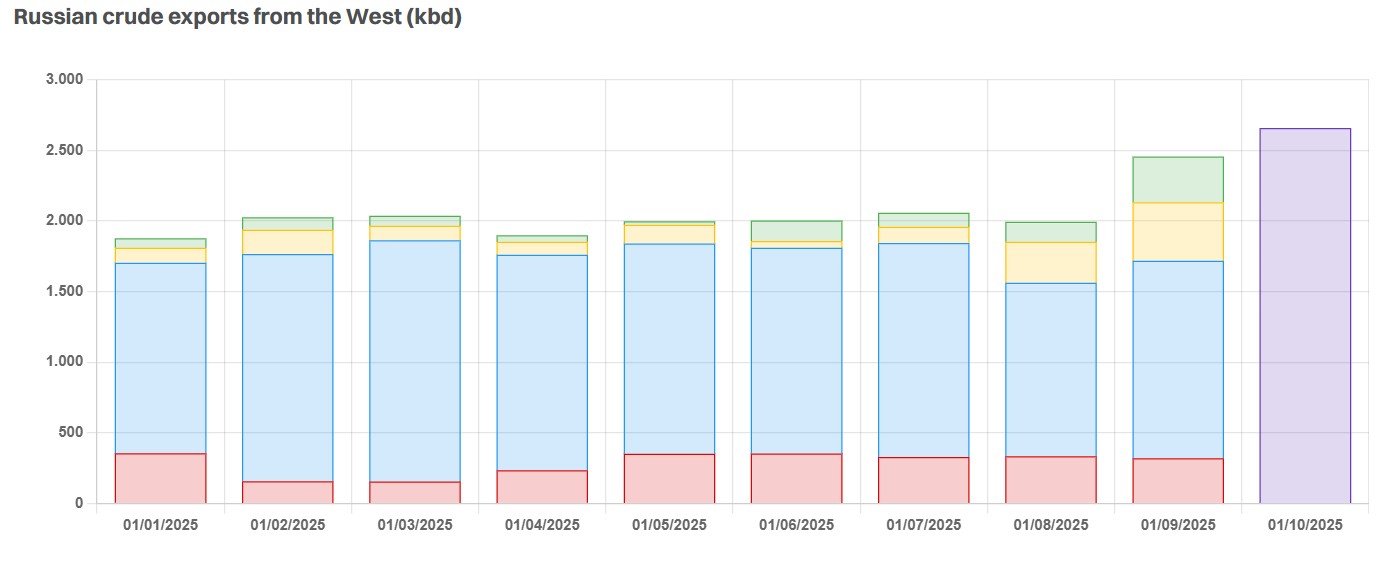

Source: Gibson Shipbrokers

Gibson added that “oil prices reacted strongly especially to news of the US sanctions, possibly pricing in supply disruption. The implications for tankers of this coordinated wave of sanctions could be far reaching. Increased demand for non-sanctioned barrels from India is likely, with cargoes sourced from the Middle East and the Atlantic. Mainstream tankers, and especially VLCCs stand to benefit here, particularly if cargoes are sourced long haul from West of Suez. However, greater volumes of Russian barrels may be diverted into sanctioned and/or independent refineries in China, and these increases into China could be met with a reduction from other sources, negatively impacting freight markets. Further, mainstream Aframaxes and Suezmaxes currently engaged in trade with Rosneft/Lukoil are likely to think twice now, with a return to conventional markets made more likely. The designation of the Yulong refinery has reportedly seen suppliers cancel AG and TMX barrels destined for the refinery. So far, the refinery has mostly imported Russian crude, this dependency might be strengthened going forward. Overall, a total of 1.25mbd of Chinese refining capacity has been sanctioned this year, of which Liaoyang is the only non-independent refinery”.

“Indian and Turkish refiners were soon going to have to reduce their intake of Russian crude to continue selling refined products to Europe, and this process might be accelerated by this latest wave of sanctions. If Turkey reduces its intake of Russian crude, regional sources could make up the difference (e.g. Ceyhan, Libya). Aframaxes would be the main beneficiary, followed by Suezmaxes. On the clean side, naphtha markets may tighten, with the East/West spread moving higher. Taiwan imported over 100kbd of Russian naphtha so far this year, and over half of Indian seaborne naphtha imports come from Russian sources. Alternative naphtha supply will likely have to come from Middle Eastern suppliers, with possible additions from the USG and Med. Similarly to crude, China may increase its imports of surplus Russian naphtha if India reduces its intake. Further, tighter Russian product supply into Latin America and Africa could strengthen arbs, especially from the USG, benefitting MRs”, Gibson noted.

The shipbroker concluded that “news is moving fast, and the overall impact is currently difficult to assess. Short term volatility remains likely. We have seen several times this year how quickly supply chains can adjust to a new reality, though in many cases greater inefficiency is introduced to the market”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide