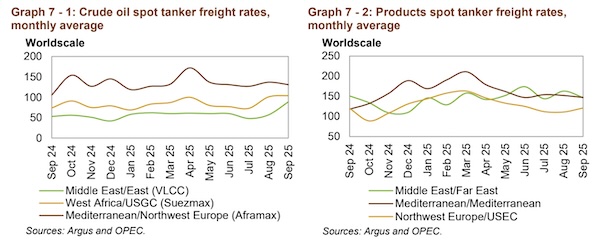

The tanker market showed mixed results during the past month, OPEC said in its latest monthly report. Dirty tanker spot freight rates showed mixed movement in September. VLCC spot freight rates surged as increasing outflows from the Middle East worked through available tonnage lists. Spot freight rates on the Middle East-to-East route jumped 56%, m-o-m, and similar gains were seen on rates on the Middle Eastto-West route.

Activities were more muted in the Suezmax market, although balanced tonnage kept the market firm. Rates on the West Africa-to-US Gulf Coast (USGC) route edged up 3%. Aframax spot freight rates saw mixed movement as disruptions limited tonnage demand in the Mediterranean. Cross-Med spot freight rates fell 6%, m-o-m. In contrast, rates on the Indonesia-to-East route rose 16%, m-o-m.

In the clean tanker market, spot freight rates were also mixed. Some improvement was seen in short-haul rates, while refinery maintenance limited Middle East clean tonnage demand. Rates on the Middle East-toEast route declined by 10%, m-o-m, while rates on the Singapore-to-East route increased by 5%, m-o-m.

Dirty tanker freight rates

Very large crude carriers (VLCC)

VLCC spot freight rates exhibited a strong performance in September, as a steady stream of cargoes drew down tanker availability. On average, VLCC spot freight rates increased 55%, m-o-m, and were up 58% compared with the same month last year. On the Middle East-to-East route, rates averaged WS89 in September, representing a jump of 56% from the previous month. Rates were 68% higher, y-o-y. Similarly, spot freight rates on the Middle East-to-West route increased 56%, m-o-m, to average WS53. Rates also jumped 56% compared with the same month in 2024. On the West Africa-to-East route, spot freight rates also rose 48%, m-o-m, to average WS86. Compared with the same month in 2024, rates were 51% higher.

Suezmax

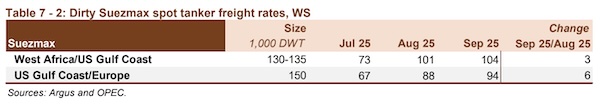

Spot freight rates for Suezmax vessels showed a more muted performance on average in September following last month’s surge, gaining 5%, m-o-m. Compared with the same month last year, average rates for the vessel class were 43% higher.

On the West Africa-to-USGC route, spot freight rates in September averaged WS104, representing an increase of 3%, m-o-m. Compared with the same month in 2024, spot rates on the route were up by 41%. Rates on the USGC-to-Europe route rose 7%, m-o-m, to average WS94. Compared with the same month in 2024, rates were 47% higher.

Aframax

Aframax spot freight rates registered the only decline in September among the monitored classes, weighed down by a weak performance around the Mediterranean and Atlantic. On average, Aframax rates dipped by 1%, m-o-m. Compared with the same month last year, rates for the vessel class were up 23% on average. The Indonesia-to-East route registered a positive performance, m-o-m, rising 16% to WS126. However, y-o-y, rates on the route were down 7%.

Spot freight rates on the Caribbean-to-US East Coast (USEC) route fell 4%, m-o-m, to average WS154. Compared with the same month last year, rates were still 66% higher. Spot freight rates around the Mediterranean also declined. Cross-Med rates fell 6%, m-o-m, to average WS136. Y-o-y, spot rates on the route were up 23%. Rates on the Med-to-Northwest Europe (NWE) route dropped by 4%, m-o-m, to average WS131. Compared with the same month in 2024, rates were 24% higher.

Clean tanker freight rates

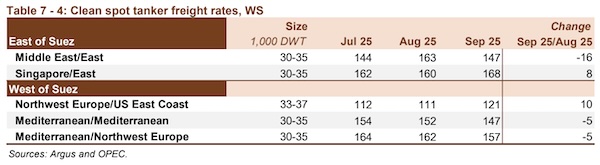

Clean spot freight rates showed a mixed performance across the regions, although trending lower on average, m-o-m. East of Suez rates fell 2% on average, m-o-m, while West of Suez rates were broadly flat. Compared to the previous year, East of Suez rates increased by 5% and West of Suez rates by 16% on average.

Rates on the Middle East-to-East route saw the strongest m-o-m decline, falling 10% to average WS147. Compared with September 2024, rates were 3% lower. In contrast, clean spot freight rates on the shorter haul Singapore-to-East route rose 5%, m-o-m, to average WS168. Y-o-y, rates on the route gained 14%.

In the Atlantic Basin, clean rates on the NWE-to-USEC route averaged WS121, representing gains of 9%, m-o-m, and 1%, y-o-y. Cross-Med rates edged lower, averaging WS147, representing a drop of 3%, m-o-m. Rates on the Med-to-NWE route averaged WS157, also representing a 3% decline. Y-o-y, spot freight rates on both routes were both around 24% higher.

Nikos Roussanoglou, Hellenic Shipping News Worldwide