With crude oil flows patterns still very much fluid, tanker market participants are closely monitoring oil demand and supply fundamentals. In a recent weekly report, shipbroker Xclusiv said that “Russian seaborne crude exports in August reached 3.40 million b/d, inching higher from July’s 3.35 million b/d but remaining below the 3.5–3.6 million b/d levels seen between March and May. The marginal month-on-month rise masks important shifts in trade flows: shipments to India plunged by 21% to 1.30 million b/d, their lowest since January, while China’s intake rose 12% to 1.11 million b/d, a fresh high for the year. The dynamic between India and China is once again at the heart of Russia’s seaborne trade patterns, with the two Asian giants absorbing more than 70% of total flows. The monthly table underscores the structural changes underway. Indian imports peaked at 1.76 million b/d in March before gradually retreating, with August volumes falling nearly 0.5 million b/d from that high.

Source: Xclusiv

“Chinese imports, by contrast, have remained relatively steady throughout 2025, fluctuating around the 1.0 million b/d mark, before accelerating in August. Elsewhere, Europe’s imports, though still marginal, surged to 0.35 million b/d in August from negligible levels earlier this year, highlighting persistent leakage despite EU restrictions. Africa also re-emerged as a modest outlet at 0.20 million b/d. These shifts illustrate Russia’s flexibility in redirecting barrels in response to sanctions, discounts, and shifting arbitrage opportunities. India’s sharp pullback coincided with Washington’s Aug. 27 announcement of 25% “secondary tariffs” on Indian imports of Russian crude. Discounts on Urals widened further at the start of September to more than $11.50/b versus dated Brent, suggesting that Russia may be forced to concede even deeper price cuts to maintain flows”, Xclusiv said.

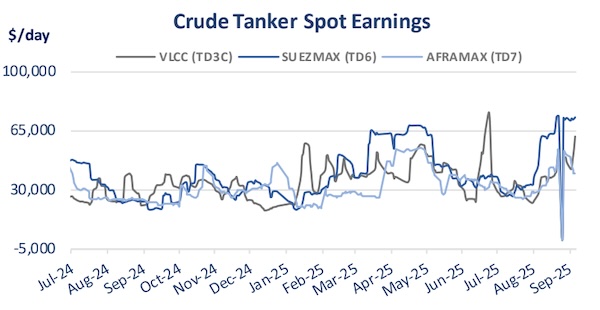

Meanwhile, according to the shipbroker, “for India, the choice is politically fraught: discounted barrels help its refiners, yet its exports to the United States are far more valuable than the savings on cheap crude. This delicate balance could see Indian refiners hedge their exposure, diversifying toward Middle Eastern or West African grades. For shipowners, the picture is mixed. A reduced Indian appetite may shorten ton-mile demand, as flows from Baltic or Black Sea ports to India are among the longest voyages in Russia’s crude trade. Conversely, incremental barrels to China often move via the Pacific, which involves shorter distances. However, the uptick in European and African flows—albeit from a low base—adds fresh tonne-mile opportunities. Every rerouting away from India toward smaller, more scattered buyers tends to fragment trade and increase the number of liftings, which can be positive for the S&P market by tightening effective vessel supply”.

Source: Xclusiv

“Overlaying these shifts is the looming OPEC+ meeting on Sept. 7, where eight core members including Russia must decide whether to pause the unwinding of production cuts. Since April, the group has been steadily adding back 2.2 million b/d, betting on robust summer demand. With seasonal demand now fading and US tariffs reshaping Russian flows, the alliance faces pressure to prevent a fourth-quarter supply glut. Forecasts already point to global liquids supply of 108.3 million b/d in December against demand of just 105.3 million b/d, implying a sizeable surplus that could push Brent below $60/b. For the SnP market, the confluence of discounted Russian crude, shifting trade routes, and uncertain OPEC+ policy injects both risk and opportunity. Older tankers in the so-called shadow fleet remain heavily employed in Russia-linked trades, but any widening of discounts and diversification of buyers could stretch the available fleet further. At the same time, mainstream owners remain cautious, aware that if OPEC+ mismanages supply, a sharp drop in oil prices could ripple into freight markets”, Xclusiv concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide