Tanker Market Improved During April

The tanker market showed renewed growth during April, OPEC said in its latest monthly report. Dirty tanker spot freight rates broadly improved m-o-m in April, with VLCC rates supported by expected higher tonnage demand out of the Middle East. VLCC spot freight rates on the Middle East-to-East route and West Africa-to-East route rose 2% each, m-o-m, while rates on the Middle East-to-West route fell 3%, m-o-m, amid a drop in flows to the US. Suezmax spot freight rates gained 15%, m-o-m, on the West Africa-to-USGC route, supported by higher activities in the Atlantic basin. In the Aframax market, a tighter balance boosted cross-Med spot freight rates by 30%, m-o-m. In the clean tanker market, spot freight rates were broadly lower, weighed down by refinery maintenance and ample tonnage availability. East of Suez rates fell 13%, m-o-m, while West of Suez rates declined by 14%, m-o-m.

Dirty tanker freight rates

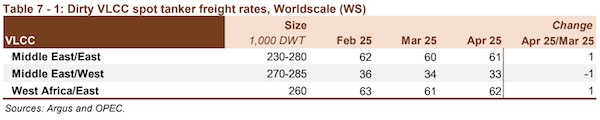

Very large crude carriers (VLCC)

VLCC spot freight rates showed mixed movements in April, strengthening East of Suez amid higher flows out of the Middle East, but softer West of Suez due to lower volumes headed to the US. On average, VLCC spot freight rates rose 2%, m-o-m, but were still down 5% compared with the same month last year. On the Middle East-to-East route, rates averaged WS61 in April, representing a gain of 2% compared to the previous month. Rates were 2% lower, y-o-y. Spot freight rates on the Middle East-to-West route declined by 3%, m-o-m, to average WS33. Compared with the same month in 2024, rates were down 21%. Spot freight rates on the West Africa-to-East route rose 2%, m-o-m, to average WS62 in April. Compared with the same month in 2024, rates were down by 2%.

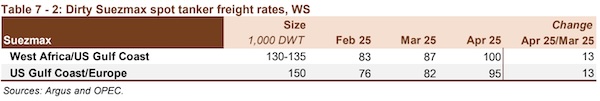

Suezmax

Spot freight rates for Suezmax vessels strengthened in April, up 15% on average, m-o-m, but remained slightly below last year’s levels, down 1%. On the West Africa-to-USGC route, spot freight rates in April averaged WS100, representing a gain of 15%, m-o-m. Spot rates were 6% lower on the route compared with the same month in 2024. Rates on the USGCto-Europe route increased by 16% to average WS95. Compared with the same month in 2024, rates were up by 4%.

Aframax

Aframax spot freight rates rose, m-o-m, on all monitored routes in April, especially in the Atlantic Basin. Aframax rates increased 30%, m-o-m, and were 2% higher, y-o-y.

Rates on the Indonesia-to-East route gained 4%, m-o-m, to an average of WS136 in April. Y-o-y, rates on the route were down 14%.

The Caribbean-to-USEC spot freight rates jumped 54%, m-o-m, to average WS211, amid a sharp rise in tonnage demand. Compared with the same month last year, rates were up 24%. Rates on the Med-to-Northwest Europe (NWE) route was up 30%, m-o-m, to average WS172, amid higher activity in the region. Compared with the same month in 2024, rates were down 2%. Similarly, cross-Med spot freight rates increased 30%, m-o-m, to average WS178. Y-o-y, spot rates on the route were still down 3%.

Clean tanker freight rates

Clean spot freight rates fell across the board in April, weighed down by ample tonnage availability. East of Suez rates dropped 13% on average, while West of Suez rates were down 14%. Compared to the previous year, East of Suez rates were down 37%, while West of Suez rates declined 25%.

Rates on the Middle East-to-East route fell by 10%, m-o-m, to average WS142, amid lower flows to South Korea. Compared with the same month in 2024, rates were 37% lower. Clean spot freight rates on the Singapore-to-East route decreased by 15%, m-o-m, to average WS156 in April. This represents a 38% decline compared with the same month in 2024. In the Atlantic basin, clean rates on the NWE-to-USEC route averaged WS146.

This was a loss of 10%, m-o-m, and 19%, y-o-y. Inter-Med rates averaged WS179, down 15%, m-o-m, and 28%, y-o-y. On the Med-to-NWE route spot rates averaged WS189, down 14%, m-o-m and 27%, y-o-y.

Nikos Roussanoglou, Hellenic Shipping News Worldwide