Tanker Market Fragmented With Performance Varying

The tanker market is fragmented with each class showing varying performance, as a direct result of changing trade flows. In a recent weekly report, shipbroker Xclusiv said that “the oil market is once again caught between contrasting narratives, with the International Energy Agency (IEA) warning of an “ever more bloated market” while OPEC projects a far more optimistic outlook. The IEA has cut its demand growth forecasts for 2025 and 2026 to 680,000 b/d and 700,000 b/d, citing weak OECD consumption and softer-than-expected emerging market demand. China remains central: demand rose 230,000 b/d in June year-on-year, the first such gain since February, yet growth is expected to slow to just 90,000 b/d in 2025 and 160,000 b/d in 2026. OPEC, in contrast, sees 2026 demand growth at 1.4 million b/d and has raised its “call” on OPEC+ crude to 43.1 million b/d. The group highlights persistently low OECD stocks—still 92 million barrels below the five-year average—arguing that demand resilience and tight inventories will allow voluntary cuts to be phased out without hurting prices. Brent has reflected this tug-of-war, dropping to $61/b in May, rebounding above $80/b during the Israel-Iran flare-up, and now hovering near $68/b”.

Source: Xclusiv

According to Xclusiv, “China’s import behaviour adds to the uncertainty. Crude inflows hit a 22-month high in June but slowed in July, with further easing likely unless the state boosts strategic reserves. Independent refiners face tighter quotas, while state-owned refiners sit on nearly one billion barrels of commercial stocks. Without new SPR buying, imports could fall to 11.05 million b/d, though talk of a 100-million-barrel SPR build may sustain current levels. Chinese refiners are also cautious on Russian Urals ahead of US-Russia talks, shifting instead toward discounted Iranian and ESPO grades”.

Source: Xclusiv

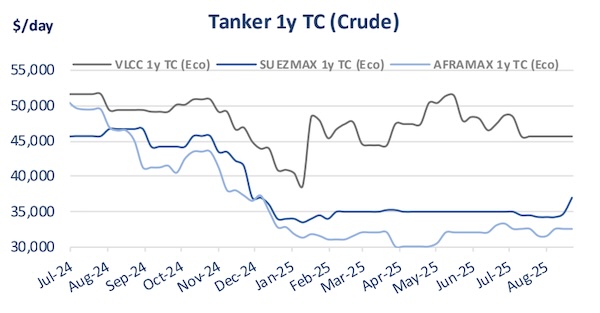

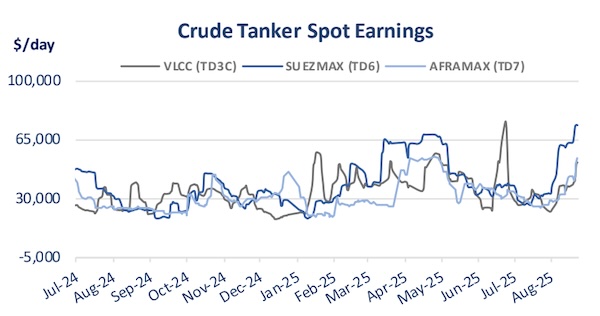

Xclusiv noted that “these shifting fundamentals have been mirrored in tanker earnings across July and August. Aframax rates slid through most of July, bottoming near USD 23,200/day on July 23, before rebounding above USD 35,000/day by mid-August as Atlantic basin activity picked up. Suezmaxes followed an even sharper trajectory, rising from USD 27,500/day in early July to above USD 62,000/day by August 22, as Kazakhstan diverts crude exports from the BTC pipeline to the CPC terminal at Novorossiysk, where capacity constraints have shifted liftings to suezmaxes over aframaxes. VLCC earnings, meanwhile, moved from the low USD 30,000s/day in July to over USD 47,000/day in August 22, supported by longer-haul demand from India and China’s stockpiling talk. MR performance was more uneven: while the Atlantic basket climbed from USD 19,000/day mid-July to over USD 36,000/day in mid-August, the Pacific basket remained subdued, hovering mostly in the low USD 20,000s/day”.

“The divergence across segments reflects the interplay between macro supply-demand balances and regional trade distortions. Suezmaxes and Aframaxes, closer to Atlantic and Med disruptions, have surged, while VLCCs benefit from India’s diversification and potential SPR flows. MRs, more reliant on product demand and shorter-haul trades, have struggled to keep momentum”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide