Tanker Market Declined During November

The tanker market show weakness during the month of November, OPEC said in its latest monthly report. Dirty spot freight rates declined across all monitored routes in November, as rising vessel availability outpaced limited tonnage demand. On the Middle East-to-East route, VLCC spot freight rates decreased 9%, m-o-m, in November, while rates on the West Africa-to-East route dropped 10% over the same period. In the Suezmax market, rates on the US Gulf Coast-to-Europe route reversed the previous month’s gains, down 25%, m-o-m. Aframax spot rates on the Caribbean-to-US East Coast route fell 34%, retreating after a strong surge the month before. In the clean market, East of Suez rates declined 15% on average while West of Suez rates jumped 19%.

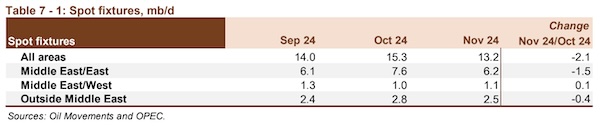

Spot fixtures

Global spot fixtures declined m-o-m in November, averaging 13.20 mb/d for the month, representing a drop of 2.1 mb/d, or about 14%, m-o-m. Compared with November 2023, global spot fixtures were 0.8 mb/d, or 6%, higher. Middle East-to-East fixtures fell by 1.5 mb/d, or 19%, m-o-m, to average 6.2 mb/d. Y-o-y, fixtures on the Middle Eastto-East route were 0.6 mb/d, or 10%, higher. Spot fixtures on the Middle East-to-West route registered the only m-o-m gains seen in November. The route saw an increase of 0.1 mb/d, or 12%, m-o-m, to average 1.1 mb/d. Compared with the same month last year, fixtures were broadly unchanged. Spot fixtures on ‘Outside Middle East’ routes returned most of the previous month’s gains, declining 0.4 mb/d, or almost 14%, m-o-m, to average 2.5 mb/d. Compared with the same month in 2023, fixtures were down by 0.3 mb/d, or 12%.

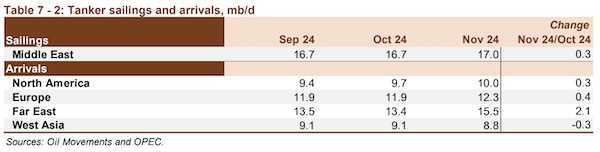

Sailings and arrivals

Middle East sailings also increased, up 0.3 mb/d or about 2%, m-o-m, to average just under 17 mb/d. Y-o-y, sailings from the region were 0.6 mb/d, or 4%, higher. Crude arrivals were generally stronger, with gains on all monitored routes except West Asia. North American arrivals increased by about 0.3 mb/d, or about 3%, to average just under 10 mb/d. Compared with November 2023, they were 1.5 mb/d higher, or up about 18%. Arrivals to Europe rose by 0.4 mb/d, or over 3%, m-o-m, to average 12.3 mb/d. Compared with the same month in 2023, they were 0.4 mb/d, or 3%, higher.

Far East arrivals averaged 15.5 mb/d in November, representing a gain of 2.1 mb/d, or almost 16%. Y-o-y, arrivals in the region were 1.0 mb/d, or over 7%, higher. Arrivals in West Asia saw the only m-o-m declines on monitored routes, falling 0.3 mb/d, or 3%, to average 8.8 mb/d. Compared with the same month last year, however, arrivals in the region were up 0.6 mb/d, or 8%.

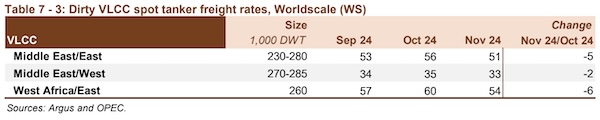

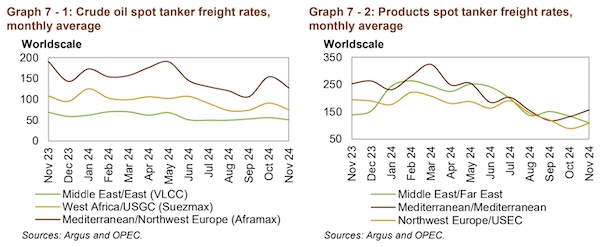

Dirty tanker freight rates

Very large crude carriers (VLCC)

Spot freight rates for VLCCs declined on all monitored routes in November, as a build-up of tonnage availability softened rates. On average, VLCC spot freight rates decreased by 8%, m-o-m, and they were down 22% compared with the same month in 2023. On the Middle East-to-East route, rates averaged WS51 in November, down 9% compared to the previous month. Y-o-y rates were 26% lower. The Middle East-to-West route also registered a loss in November, falling 6%, m-o-m, to average WS33. Compared with the same month in 2023, rates on the route fell by 18%. Spot freight rates on the West Africa-to-East route also declined, falling 10%, m-o-m, to average WS54 in November. Compared with the same month in 2023, rates were down 22%.

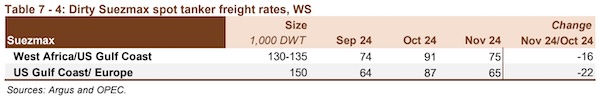

Suezmax

Suezmax spot rates dropped on average by 21%, m-o-m, in November and were down 22% compared with the same month last year. On the West Africa-to-USGC route, spot freight rates in November averaged WS75, representing a decline of 18%, m-o-m. Spot rates were 31% lower than the same month in 2023. Rates on the USGC-to-Europe route showed a larger decline, following a strong performance the month before. Spot freight rates fell 25%, m-o-m, to average WS65. Compared with the same month in 2023, rates were down 40%.

Aframax

Aframax spot freight rates retreated from the strong performance seen the month before. On average, Aframax rates declined by 20%, m-o-m, while spot rates were 36% below the levels seen in November 2023. Rates on the Indonesia-to-East route decreased by 12%, m-o-m, to average WS134 in November. Y-o-y, spot rates on the route were down 18% compared to the same month last year.

Spot rates on the Caribbean-to-USEC route fell 34%, m-o-m, to average WS111 in November. Rates were 52% below the same month last year. Cross-Med spot freight rates declined by 18%, m-o-m, to average WS128. Compared with the same month last year, spot rates on the route were down 36%. Similarly, rates on the Med-to-Northwest Europe (NWE) route averaged WS127, representing a drop of 18%, m-o-m. Compared with the same month in 2023, rates were down 34%.

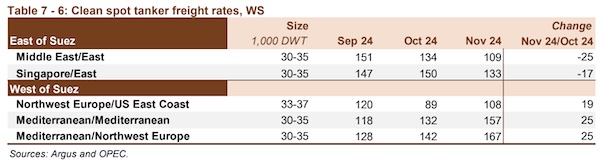

Clean tanker freight rates

Clean spot freight rates saw mixed movements, m-o-m, in November. East of Suez rates registered declines, falling 15% on average, while West of Suez rates strengthened, gaining 19%. Compared to the previous year, East of Suez rates were down 17% and West of Suez rates were 39% lower.

Rates on the Middle East-to-East route fell 19%, m-o-m, to average WS109 in November. Compared with the same month in 2023, rates were 21% lower. In contrast, clean spot freight rates on the Singapore-to-East route dropped 11%, m-o-m. Rates on the route averaged WS133, representing a 13% decline compared with the same month in 2023. In contrast, spot freight rates on the NWE-to-USEC route rose 21%, m-o-m.

Rates averaged WS108, which represents a 44% drop compared with November 2023. Rates around the Mediterranean showed similar gains, m-o-m. Rates on the Cross-Med route were up 19%, m-o-m, to average WS157 but were 38% lower, y-o-y. Rates on the Med-to-NWE route increased 18%, m-o-m, but 37%, y-o-y, to average WS167.

Nikos Roussanoglou, Hellenic Shipping News Worldwide