Tanker Market Caught in War and Geopolitics “Fever”

With the threat of the closure of the Hormuz Strait gaining substantial ground after the weekend’s developments, it’s safe to say that any analysis about the tanker market can immediately become obsolete. This is further testament to the volatile nature of today’s shipping markets. In its latest weekly report, shipbroker Gibson said that “while the international community remains fixated on the intensifying conflict between Israel and Iran, the European Union is progressing its 18th package of sanctions on Russia, with the implementation expected to be decided upon next week. Although less immediately dramatic, several of the proposed measures could have significant implications for the tanker market. Chief among them are expanded measures against the shadow fleet, a ban on imports of refined products made from Russian crude, and a proposed reduction in the oil price cap from $60 to $45 per barrel”.

According to Gibson, “sanctioning the dark fleet appears the most straightforward. Around 12% of the global tanker fleet over 25,000 dwt is already under sanctions, with the Aframax/LR2 size group most affected. In this segment, 24% of the fleet is already under sanctions. Reportedly, up to 77 additional vessels could be targeted in the latest package, although some are likely already sanctioned by other jurisdictions. As the pool of sanctioned vessels grows, there has already been an increase in mainstream tonnage re-engaging in Russian trade, in particular Aframaxes and Suezmaxes. This trend will continue if Western pressure on the dark fleet intensifies. A more challenging measure is the proposed import ban on products refined from Russian crude. The refining process significantly alters the chemical composition of crude, whilst refineries also often use blending components to optimize the refining process and product quality. There is no established global mechanism to trace or certify the origin of the crude used for refining. Enforcing this ban would require either the establishment of a robust verification system or a broader restriction on refined product imports from key importers of Russian crude”.

Source: Gibson Shipbrokers

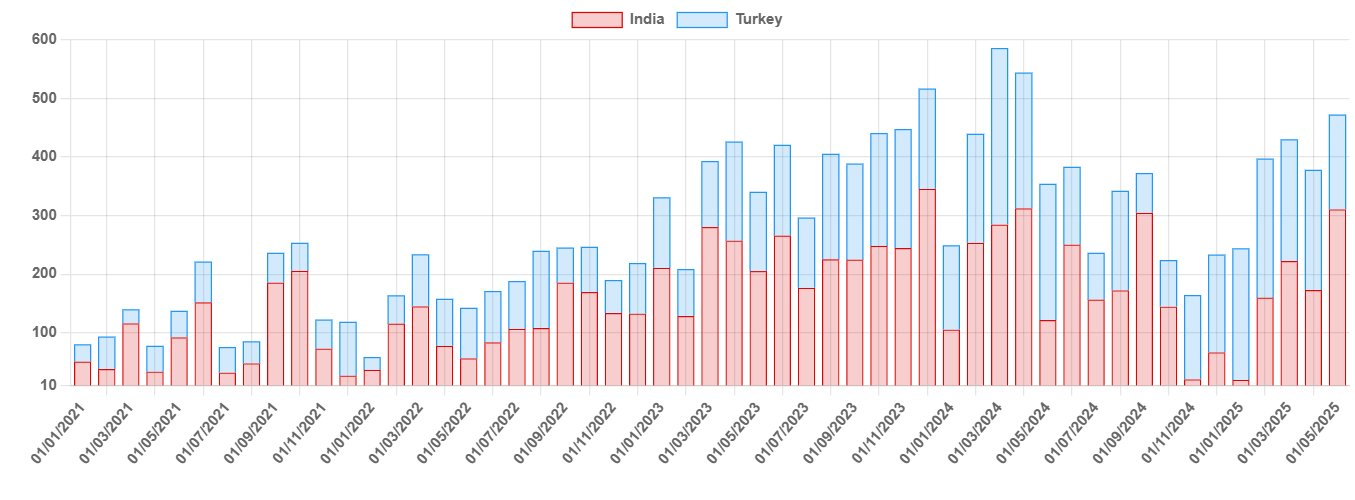

“From a supply perspective, Europe in theory could replace banned volumes with supplies from the US, the Middle East and Asia. India and Turkey, which are significant importers of Russian crude, together exported around 340,000 barrels per day of clean products to EU-27 in 2024, which accounts for just 10% of total regional intake. However, in the current geopolitical climate, with the Middle East already on the edge, this would likely lead to tighter gasoil and jet fuel markets”, the shipbroker said.

Gibson added that “perhaps the most ambitious is a proposal to lower the Russian oil price cap to $45/bbl. The timing of this move is highly problematic, considering escalating hostilities between Israel and Iran, and the upward pressure on oil prices. In the short term, Russian exports could decline as a lower cap could deter mainstream tanker participation in Russian trades, while owners reassess compliance risks. However, much will depend on Russia’s ability to circumvent restrictions and buyers’ willingness to lift cargoes using sanctioned vessels. Another potential consequence is further migration of older mainstream tonnage into the dark fleet; however, this path is much riskier today, considering the increasing EU and the UK appetite to directly sanction vessels. Recently, EU officials privately acknowledged that the recent spike in prices reduces the pressure to lower price cap level. Furthermore, for the measure to be effective, it needs alignment with other oil price coalition countries; yet the Trump administration appears to oppose any further sanctions on Russia at present. Reportedly, G7 members would prefer to delay the decision”.

“Only time will show what final measures are agreed upon. Detail here is also key. Still, targeting the dark fleet is likely, which will continue to support higher engagement of mainstream tonnage in Russian trade. The product import ban will be extremely difficult to execute, but not impossible; however, the proposed price cap reduction is perhaps unrealistic at the moment without US support and favourable market conditions”, Gibson concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide