Strong Momentum in the S&P Market Continues

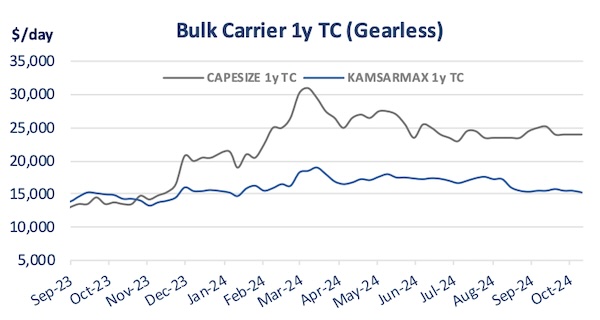

Demand for second hand ships, most notably bulkers, continued throughout the past week. In its latest weekly report, shipbroker Banchero Costa said that “during the week the Nord Virgo 82,000 dwt built 2014 JMU (SS due 2029 ME Scrubber fitted) was sold at $26.1 mln, which is in line with the last sale, the Martha 82,000 dwt built 2014 Tadotsu at $26 mln a couple of weeks ago. In the Panamax segment the Glory 76,000 dwt built 2005 Tsuneishi (SS/DD due Mar 2025 BWTS fitted) was reported at $11.1 mln, back in July the Navios Taurus 2005 Imabari built was done at $12 mln. In the Supra segment the Leon Oekter 58,000 dwt built 2008 Tsuneishi Cebu (SS due 2028 BWTS fitted) was reported sold at $15.35 mln to Chinese buyers.

Source: Banchero Costa

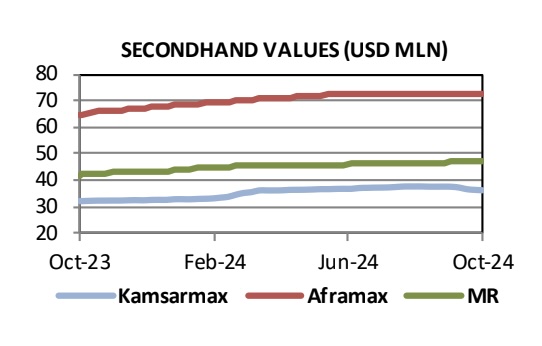

Greek buyers were behind the purchase of the Blue Dragon 38,000 dwt built 2011 Imabari (SS/DD due Jan 2025) at $15.2 mln, during the summer the Sea Smile 2012 Watanabe built was done at $17 mln. In the tanker market the PS Genova 108,000 dwt built 2010 Hudong (LR2 / dpp trader) was reported committed in excess of $40 mln to Turkish buyers. Few MRs changed hands during the week with the White Peach 53,000 dwt built 2007 Guangzhou (ice class 1A BWTS ) was sold at $22 mln, the Alithini II 49,000 dwt built 2008 STX ( SS due 2028 BWTS fitted) was done at $27 mln to UAE buyers and the Butterfly 46,000 dwt built 2004 STX (SS/DD passed this year) was sold at $18 mln to Hong Kong buyers”.

In a separate report, shipbroker Xclusiv added that “on the Capesize sector, the “SG Express”- 180K/2009 Dalian was sold for USD 27 mills, while the 4-year-older “Lila Cochin” – 174K/2005 SWS was sold for USD 18 mills to Chinese buyers. Moving down the sizes, Greek buyers acquired the Post-Panamax “Lowlands Energy” – 96K/2013 Imabari for USD 23 mills. The Electronic M/E Kamsarmax “Nord Pluto”- 82K/2014 was sold for USD 24 mills to Greek buyers, while the Electronic M/E and Scrubber fitted “Nord Virgo” – 81K/2014 JMU found new owners for USD 26 mills. Moreover, on the same sector, German buyers acquired the “Bulk Portugal” – 82K/2012 Tsuneishi for USD 22.5 mills basis 5-year BBHP. On the Ultramax sector, the “Theresa Pride” – 63K/2021 Oshima was sold for 39 mills to Middle eastern buyers. 2x Supramax vessels, the “Lascombes” – 57K/2011 Qingshan and the “Gruaud Larose” – 57K/2011 Qingshan found new owners for USD 12.8 each. Finally, the Ice Class 1C Handysize “Kujawy”- 39K/2005 Tianjin Xingang was sold for a shade below USD 8 mills”.

Source: Xclusiv

Meanwhile, “on the VLCC sector, the “Gesi” – 306K/2007 Daewoo was sold for USD 43.25 mills. On the MR2 sector, Italian buyers have exercised their purchase option on the “High Navigator” – 50K/2018 JMU for USD 34.4 mills, while the “Butterfly” – 46K/2004 STX was sold for USD 18 mills to Chinese buyers. Shell International finalized an agreement with Guangzhou Shipyard for 10 x 50,000 dwt MR2 (scrubber fitted). The price was reported at $48 mln per vessel, with deliveries scheduled between December 2027 and 2030. The Chinese giant Evergreen placed an order for 8 x 16,000 teu at Imabari. The Japanese yard can offer earlier deliveries compared to the already congested Chinese and Korean yards, deliveries are set between April 2027 and April 2028”, Xclusiv concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide