Shipping Re-Routing to Gain Traction as Tariff War Seeks Resolution

The shipping industry, as one of the leading parts of the global supply chain, is expected to face adjustments ahead, as a result of the ongoing tariff uncertainties. In its latest weekly report, shipbroker Intermodal said that “following Donald Trump’s recent announcement unveiling new tariffs, various interpretations have emerged regarding the motivations behind this protectionist stance. One perspective, ground-ed in economic policy, views these measures as part of the US administration efforts to lower fiscal deficits. Alternatively, other interpretations place these tariffs within a broader strategy to rebalance global economic power dynamics with major impacts for world economies, drawing a parallel to US President Nixon’s decision in 1971 to abandon the gold standard and Bretton Woods System, highlighting how a major economic policy shift can fuel uncertainty and inflation”.

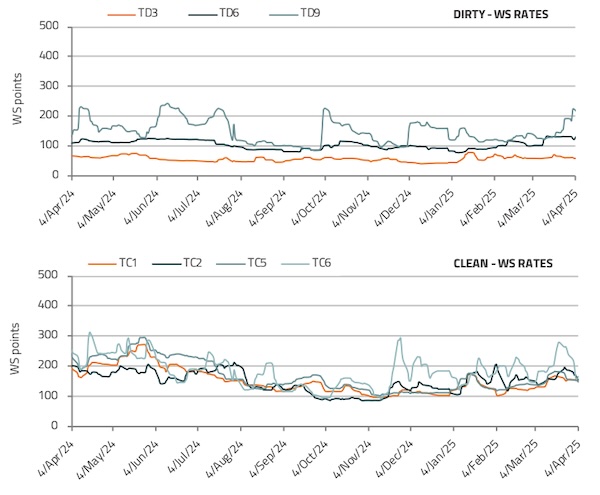

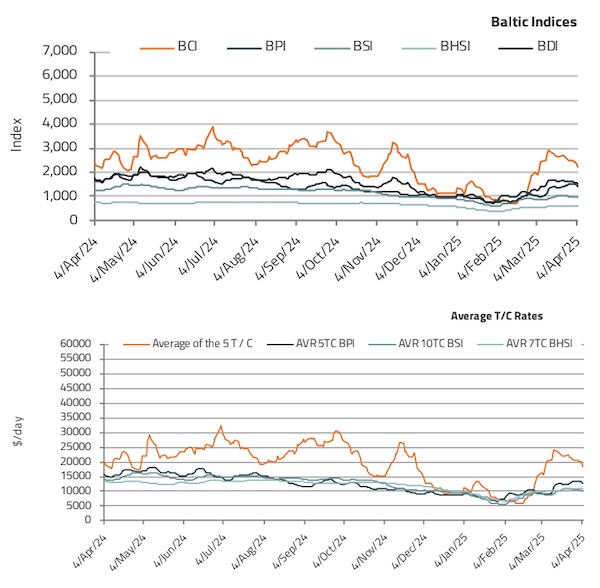

Source: Intermodal

“Additionally, the newly announced tariffs have raised concerns about the unfolding of the situation with the potential retaliatory actions (already China responded with new tariffs on US imports), pending decisions on the USTR proposed port fees to Chinese vessels and the effects on global trade and shipping. Given that these tariffs target leading exporters of finished products, like China and Japan, the containership sector is likely to be the ship-ping sector most affected, as these goods are predominantly carried via box ships”, the shipbroker said.

genvo_beauty_dry_bulkb

genvo_beauty_dry_bulkb

According to Intermodal’s Senior Analyst, Mr. Nikos Tagoulis, “these potential impacts should be assessed within the current landscape of the containership market, summarized as follows: The ongoing disruption in the Red Sea region continues to support the containership market by increasing demand for ton-miles while constraining active supply. Given persistent geopolitical tensions, this disruption is projected to continue into 2025. After a strong 2024, with container trade expanding by approximately 6%, growth is anticipated to slow. Rising protectionism and geopolitical uncertainties are likely to dampen trade expansion, with projected growth of 2.7% in 2026 and 2.3% in 2027. The tonnage supply outlook remains robust, with the orderbook -to-fleet ratio exceeding 28%. Projections indicate an increase in tonnage supply by 6.2% in 2025, followed by a moderation to 3.3% in 2026. Demolition activity remains subdued, with only three units recycled in Q1 2025. In the S&P market, buyer interest is shifting towards non-Chinese vessels, reflecting concerns over potential USTR port tariffs”.

He added that “regarding the freight market, time charter rates are trending upward, especially in smaller vessel segments, driven by increased demand amid limited availability of larger units. The spot market has shown signs of recovery, firming for a second consecutive week after earlier declines, supported by increased traffic to US ports and frontloading ahead of tariffs. Nonetheless, rates remain weak, down by 20% and 44% compared to average figures of 2025 (up to date) and 2024 respectively. Overall, the containership sector faces a complex outlook marked by uncertainty, given the combination of moderated demand, concerns over tariffs, ample tonnage supply, and continued reliance on Red Sea disruptions. The sector’s high sensitivity to trade policy changes and consumer demand elasticity renders it particularly vulnerable to escalating trade tensions. Current estimates indicate that more than 10% of global container trade will be impacted by these tariffs”.

Source: Intermodal

Intermodal’s analyst concluded that “in the short term, we anticipate shifts in trade patterns and re-routing, as liner companies reconfigure supply chains, adjust ser-vices or renegotiate contracts with shippers to mitigate the im-pacts of tariffs. In a more medium-term horizon, freight rates may experience volatility alongside impacts on trade volumes and tonnage demand, prompting shipping operators to adjust fleet deployment strategies. Moreover, the broader threat of a global recession stemming from escalating trade barriers remains a downside risk. Nevertheless, amid these challenges, the reshaping of trade flows and the initiation of new partnerships may unlock fresh opportunities for the containership market”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide