Shipping in the midst of the ongoing trade wars

The escalation of tariffs and trade wars is spilling over to the shipping industry, especially if US’ proposal to target Chinese-built ships moves ahead. In its latest weekly report, shipbroker Xclusiv said that “the U.S. Trade Representative’s (USTR) proposal targeting Chinese maritime interests, particularly Chinese-built ships, port fees, and related sanctions, represents a significant escalation in the ongoing trade tensions between the U.S. and China. The proposal, if implemented, could have far-reaching consequences for both the global shipping industry and U.S. trade dynamics. However, the dominant position of Chinese shipyards in the global market, combined with the ongoing international demand for Chinese-built vessels, suggests that such measures may not be as effective as intended.

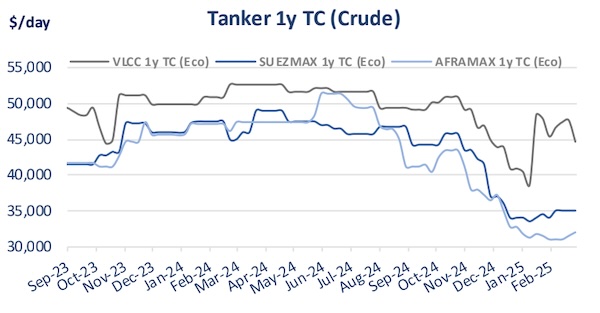

Source: Xclusiv

The Chinese shipbuilding industry holds a dominant position in the global market, accounting for a substantial share of the order book in key shipping segments. According to our data, Chinese yards make up around 70% of the orderbook for bulk carriers and tankers over 10,000 DWT, 75% of the container orderbook over 5,000 dwt and 37% of the gas carrier orderbook over 3,000 DWT. Additionally, Chinese shipyards control a large portion of the gas carrier orderbook, further consolidating their dominance. In 2026, it is projected that Chinese shipyards will deliver 65% of new vessels across these categories. This robust market share is driven by a combination of factors, including competitive pricing, efficient production processes, and technological advancements in shipbuilding”.

According to Xclusiv, “despite the USTR’s proposal to impose port fees on Chinese vessels, the reality is that most shipowners already own Chinese-built vessels or are in the process of constructing new ones in Chinese yards. Chinese-built vessels currently make up 43% of the bulk carriers over 10,000 dwt, 23% of tankers over 10,000 dwt, 35% of container carriers over 5,000 dwt, and 15% of gas carriers over 3,000 dwt in the active fleet. If we focus on vessels aged 0-10 years, Chinese-built vessels represent 54%, 33%, 59%, and 21% in these segments, respectively. The total fleet of vessels under 10 years old has a 45% share of Chinese-built ships. This market dominance is unlikely to be significantly disrupted by the imposition of port fees or other regulatory pressures. The Chinese shipyards have made significant investments in expanding their production capacity, ensuring that they are well-positioned to meet the increasing demand for fleet renewal driven by environmental regulations and the need for more fuel-efficient ships. Furthermore, some Japanese and South Korean shipyards have even partnered with Chinese yards, sharing designs and technical know-how to improve construction processes and maintain competitiveness in the market. If the USTR’s proposal moves forward, it is likely to create significant disruptions in the global shipping market, particularly in the tanker and container vessel segments, by leading to higher freight rates, which could fuel inflation and raise logistical costs for U.S. businesses. Moreover, many shipowners may avoid U.S. ports altogether to bypass the added costs, potentially leading to an imbalance in vessel supply and demand. This could strain global shipping capacity and result in higher costs for U.S. trade, undermining the U.S. government’s goals of boosting domestic production and strengthening exports”.

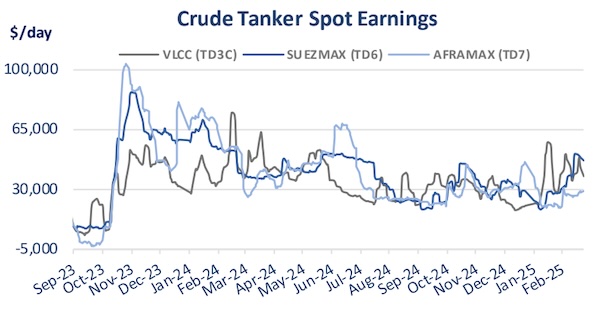

Source: Xclusiv

“This disruption could have long-term implications for global supply chains. The Chinese shipbuilding industry is a critical component of the global logistics infrastructure, and any disruption to the flow of Chinese-built vessels could have cascading effects on supply chains, leading to less efficient global trade. This could ultimately hurt U.S. businesses, which rely on affordable and efficient shipping to remain competitive in the global marketplace”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide