Shipping Caught in the US-China Trade Tensions

The shipping market has been at the forefront of the latest round of the US-China trade war. In its latest weekly report, shipbroker Xclusiv said that “the US-China trade front is once again testing shipping markets, with Washington’s planned port fees on Chinese-linked tonnage due to come into effect on October 14. The measures are steep: vessels owned or operated by Chinese entities will be hit with a flat $80 per net ton fee per voyage, while non-Chinese operators of Chinese-built ships will face either $23 per net ton or $154 per teu capacity, capped at five calls per year. Alphaliner estimates that COSCO, including its OOCL fleet, could shoulder as much as $1.53 billion annually if the fees hold, nearly half of the $3.2 billion impact projected for the top 10 carriers. Beijing has already fired back, with Premier Li Qiang signing a decree pledging countermeasures against any discriminatory measures on Chinese ships or crews. While some observers believe the October 14 deadline may be extended—or even scrapped—as part of broader negotiations, the uncertainty has already unsettled carriers, adding another layer of geopolitical risk to fleet deployment strategies”.

Source: Xclusiv

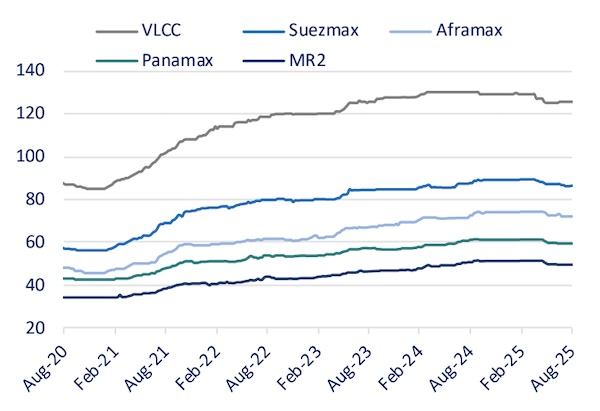

“In parallel, Russia has managed to push crude exports higher despite facing mounting international headwinds and repeated Ukrainian drone attacks on refining capacity. Seaborne crude liftings reached 3.88 million b/d in September, the strongest since April 2024. India, now Russia’s most crucial outlet, lifted 1.73 million b/d, a near 30% increase from August, while Turkey also boosted intake. China, however, cut volumes by 12% to 1.12 million b/d, underscoring shifting dynamics in Moscow’s crude flows. The rise comes even as the G7 tightened its oil price cap to $47.60/b and vowed to maximize pressure on Russian exports. Drone strikes have shuttered nearly 1.9 million b/d of refining capacity, forcing Moscow to extend bans on gasoline and diesel exports. Urals discounts have narrowed to around $11.50/b versus Dated Brent, well below the $21.50/b average seen post-invasion, signaling that buyers are still securing barrels but at terms more favorable to Moscow than before. The strain on Russia’s downstream sector—refineries offline, product exports down 15% month on month, and even retail fuel shortages in southern regions—shows that upstream crude flows remain resilient, but not without severe domestic costs”, Xclusiv said.

According to the shipbroker, “against this backdrop, Asian buyers are recalibrating sourcing strategies. Both Thai and Japanese refiners are stepping up imports of US crude, taking advantage of competitive WTI Midland and West Texas Light pricing, while reducing reliance on Middle Eastern suppliers amid regional instability. Thailand’s PTT has gone as far as creating a “War Room” to oversee its diversification, lifting US imports to nearly 147,000 b/d in August, up almost 45% year on year. Over January-August, US crude made up 16% of Thai crude intake. Japan, too, has leaned into American barrels, importing 85,000 b/d in the same period—up 43% from last year—as WTI Midland consistently trades at a discount to Murban and other Middle Eastern grades. The Brent-Dubai spread turning negative in late August only deepened the appeal of Atlantic Basin sweet crudes. Beyond economics, these flows carry a political dimension: Bangkok used its record US crude purchases to secure a cut in reciprocal tariffs from 36% to 19%, while Tokyo is leveraging intake volumes as part of its broader trade negotiations with Washington”.

Source: Xclusiv

“For tankers, these moves highlight diverging trade lanes at play. While Russian barrels continue to move east, sustaining long-haul voyages to India and Turkey, Japan and Thailand’s pivot to US crude adds fresh ton-mile demand across the Pacific. The uncertainty surrounding US-China port fees, the fragility of Russian product exports, and Asia’s evolving crude diet all underline the same theme: geopolitical and trade maneuvering are increasingly dictating tanker employment and shaping S&P sentiment”, Xclusiv concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide