Shipowners Boost Investments in Dry Bulkers

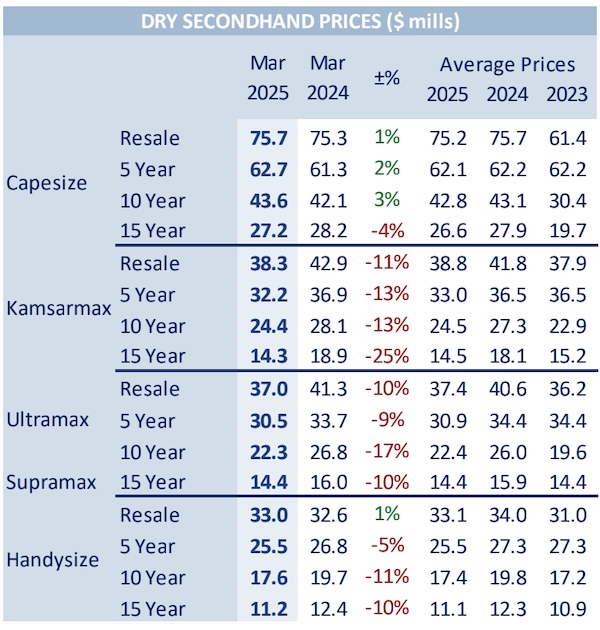

Shipowners have increased their investments in the secondhand dry bulk market. In its latest weekly report, shipbroker Banchero Costa commented that “in the dry segment, the cape BULK PROVIDENCE 180,000 dwt 2010 STX Shipbuilding built (SS due 2026 BWTS fitted) was sold at $28 mln to Chinese owners. Undisclosed buyers were behind the enbloc purchase of the 4 Kamsarmax owned by ArcelorMittal AM BUCHANAN & AM KRAKOW both 81,000 dwt 2013 NewTimes built (SS due 2028 BWTS fitted ) + AM ZENICA & AM ANNABA both 76,000 dwt 2014 Hudong built (SS due 2028 BWTS fitted ) were reported sold at $60 mln. In the Supra segment IVS GLENEAGLES 58,000 dwt 2016 Shin Kurushima Toyohashi built (SS due 2017) reported sold to for $23 mln. NEW VENTURE 53,000 dwt 2009 Chengxi Shipyard Jiangyin built was sold at $10 mln. In February EVROPI, same vessel but Xiamen built wassold at $7,5mln. After offers were invited last week the handy LION 32,000 dwt built 2007 Kanda Kawajiri built (SS due 2027 BWTS fitted) reported sold for $10 mln. Two weeks ago sistership PNOI, two years younger was purchased almost $1,2 mln more. Last relevant sale reported is NIMBLE NICKY 31,000 dwt 2010 Hakodate built (SS due 2025 BWTS fitted) reported sold at low $11 mln”.

Source: Banchero Costa

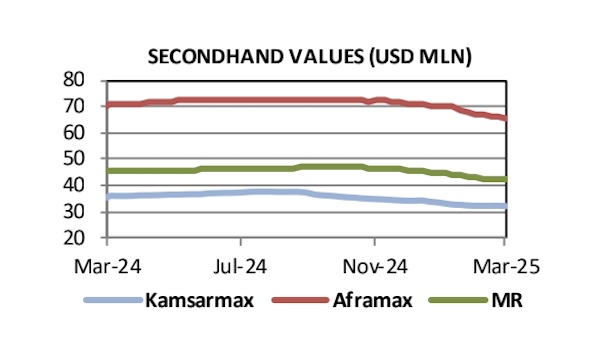

The shipbroker added that “in the tanker market, the sale of the VLCC AUSTRALIS 299,000 dwt 2003 Universal built was reported sold at hight $20 mln, In January a similar vessel ROLIN 308,000 dwt 2005 Samsung built wassold for $31 mln. SEACROSS 149,000 dwt 2006 Hyundai Samho Built (SS due 2026 BWTS fitted) wassold at $33 mln, In the MR2 sector EDEN 50,000 dwt Hyundai built was sold for $41,5 mln (SS due 2025 BWTS fitted). SIRINA 50,000 DWT 2001 Mitsui built was sold for $ 6,85 mln. CHALLENGE PROCYON 45,000 dwt 2011 Shin Kurushima built was sold at high $19 mln (SS due 2025). Sister vessel CHIBA four years older wassold in January at $17mln”, Banchero Costa concluded.

In a similar note, shipbroker Xclusiv added that in the dry bulk market, “it was a very active week, with 16 vessels finding new owners. On the Capesize sector, the “Bulk Providence” – 180K/2011 STX was sold for USD 28 mills to Chinese buyers, while the 2-year-older “Braverus”- 171K/2009 Sungdong found new owners for USD 22 mills. On the Supramax “IVS Gleneagles” – 58K/2016 Shin Kurushima changed hands for USD 23 mills, while the Scrubber fitted “CS Sonoma”- 57K/2010 Jiangsu Hantong was sold for USD 11.3 mills to South East Asian buyers, while the “Jin Shun” – 53K/2007 Shanghai Shipyard was sold for USD 8.26 mills to clients of Yuhe Shipping basis delivery end April/May 2025. Last but not least, the Handysize “Izanagi Harmony”- 37K/2021 Saiki changed hands for high USD 24 mills, whilst the 5-year-older OHBS “Atlantic Brave” – 33K/2016 Shin Kurushima was sold for USD 17.8 mills basis forward delivery with 15th October cancelling. The tanker S&P activity was subdued this week, with only 2 sales to report. The MR2 “Eden” – 50K/2020 HMD was sold for excess USD 40 mills to clients of Ditas Shipping. On the Small Tanker/Chemical sector, Chinese buyers acquired the Scrubber fitted, stainless steel “Songa Winds” – 20K/2009 Fukuoka for USD 20.5 mills”, Xclusiv said.

Source: Xclusiv

Meanwhile, in the newbuilding market, Banchero Costa said that “in the tanker sector, Capital Maritime placed an order of 2 x 320,000 dwt vessels at south Korean builder Hanwha Ocean. The price for each vessel is reported to be $125 mln and deliveries are set to start in late 2027 and finish around Q2 2028. The Chinese builder Jingjiang Nanyang secured an order from Chinese financial company Yangzijiang Financial Holding of 4 x 50,000 dwt MR vessels, with the intention of dispose of them before or on delivery. The price for each vessel was not reported, but deliveries are set to start in Q1 2026 and to continue with a pace of one vessel for every quarterly. The vessels are going to be IMO III compliant and scrubber fitted. In the dry sector, Japanese builder Naikai secured an order of 2 x 39,000 dwt from Taiwanese company Wisdom Marine Lines. The price for each vessel is reported to be $35.37 mln and deliveries are set for mid and late 2028. Hong Kong based company Seacon Shipmanagement placed an order of 4 x 17,500 dwt multipurpose vessels to Chinese shipyard Sumec Dayang. The price was not disclosed, but deliveries are set through all 2027”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide