Shipbuilding Orders on the Rise

Newbuilding ordering activity has been on the rise over the past week. In its latest weekly report, shipbroker Intermodal said that “the shipbuilding market witnessed increased activity this week, with five orders placed in tanker, containership, gas, offshore and cruise ship sectors. In the wet segment, the Belgian group CMB Tech ordered six 26k dwt, ammonia fuelled oil/chemical tankers at the Chinese CMJL, with expected delivery in 2028- 2029. In the containership sector, Jiangsu Lvhang Logistics placed an order for a 1,138 TEU LNG-fuelled vessel, with an option for an additional five units, at Jiangsu Qinfeng Shipyard in China. Deliveries are expected between 2026 and 2027.

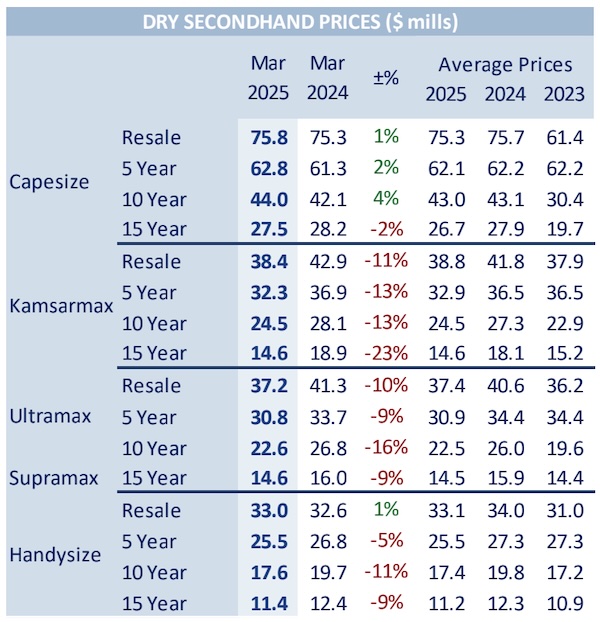

Source: Intermodal

The gas carrier segment saw Singapore-based SFI Energy contract Huangpu Wenchong Shipyard in China for the construction of two 20,000 cbm LNG-fuelled units, with an option for two more, priced at $90 million per vessel. Deliveries are set for 2027- 2028. Beyond the above, two additional orders were reported. More specifically, COSCO Group ordered to GSI of China a semisubmersible heavy lift carrier of 70kdwt, due for delivery in 2027. Finally, in Europe, TUI Cruises signed an agreement with the Italian shipbuilder Fincantieri for the construction of a pair of cruise ships, at a price of $1.08 billion per vessel. Delivery is expected within 2030-2032”, Intermodal said.

Source: Banchero Costa

Meanwhile, in the S&P market, shipbroker Banchero Costa commented that “in the bulk sector, the Capesize CAPE UNITY 180,180 dwt 2007 Imabari built (SS due Nov 2027 and DD due Nov 2025) was reported sold to Chinese interests at high $22 mln ARABELLA 177,000 dwt 2005 Namura built (SS due Sep 2025 and DD due Feb 2026) was sold at $18 mln to undisclosed interests. For comparison, CAPE FRIENDSHIP 185,870 dwt 2005 Kawasaki built was sold at $16 mln in January. In the Panamax segment, Middle Eastern interests were behind the purchase of GRAECIA UNIVERSALIS 73,900 dwt 2005 Namura built (SS and DD due Apr 2025), sold at $8 mln range. In the Supramax segment, Far Eastern interests were behind the purchase of TELERI M 56,300 dwt 2013 Japan Marine built (SS and DD due Oct 2025) reported sold at $16 mln. FORTUNE WING 55,560 dwt 2011 Mitsui Tamano built (SS and DD due Jan 2026) was reported sold at $16 mln to Indonesian interests.

For comparison, JASMINE 56,124 dwt 2012 Mitsui built wassold at $17.50 mln. IZANAGI HARMONY 37,105 dwt 2021 Saiki built (SS and DD due Jan 2026) was reported sold at $24.50 mln to undisclosed interests. In the tanker sector, the VLCC DHT PEONY 320,000 2011 Bohai built (SS and DD due Apr 2026) to Chinese interests at $55 mln. Chinese interests were also behind the purchase of MACEO 319,250 dwt 2005 Hyundai built reported sold at $40 mln. CHEMTRANS POLARIS 72,291 dwt 2005 Hudong built was reported sold at $11.50 mln to undisclosed interest. Chinese interests were behind the purchase of SONGA WINDS 19,900 dwt 2009 Fukuoka built (SS due Jun 2029 and DD due Jul 2027) reported sold at $20.00 mln”.

Source: Xclusiv

In a separate note, shipbroker Xclusiv added that on the dry bulk market, “it seems that the USTR proposal has already started to affect the SnP market. This week, 13 bulk carriers changed ownership, with 10 built in Japan and only 3 in China. On the Newcastlemax Sector, the “Global Commander”- 208K/2010 Universal was sold for region USD 32.5-33 mills to Chinese buyers. Winning International acquired the Capesize “Cape Unity” – 180K/2007 Imabari for USD 22.2 mills. The Kamsarmax “Wangaratta”- 82K/2011 Tsuneishi was sold for USD 17.2 mills to Chinese buyers, with surveys due in June. On the Panamax sector, the “Magic Callisto” – 75K/2012 Sasebo and the “Magic Eclipse”- 75K/2011 Sasebo found new owners for USD 28 mills enbloc. Greek buyers acquired the Ultramax “Servette”- 64K/2020 Nantong Xiangyu for USD 31.7 mills basis 3-year BBHP. On the Supramax sector, the “Teleri M” – 56K/2013 JMU was sold for USD 16.5 mills to clients of Vosco, while the “Fortune Wing”- 56K/2011 Mitsui changed hands for high USD 15 mills”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide