Ship Recycling Subdued Last Week with Prices Retreating

The ship recycling market is still experiencing muted sentiment. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that in India, “the market remained relatively strong during most of the week, though it softened toward the end, reflecting some downward adjustment in prices. Buying appetite is still visible, though prices have come off slightly.

Overall activity remains cautious but steady as participants adjust to recent price movements. In Bangladesh, the market has shown some movement, with buyers displaying keener interest in securing vessels. Although the local market has not improved, stronger buying interest is giving the market better momentum. Sentiment is gradually improving, supported by stronger willingness from the market participants”.

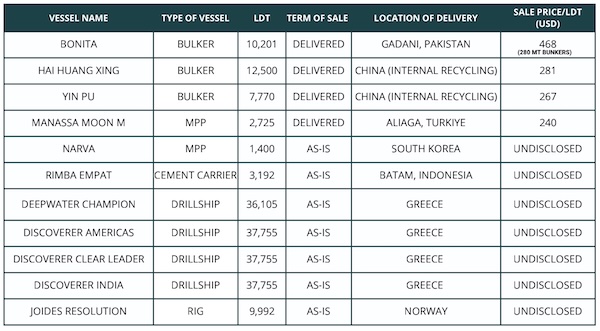

Source: Best Oasis

Best Oasis added that in Pakistan, “there is still good movement from buyers, although momentum has slowed somewhat due to the recent floods. Despite these challenges, buying appetite remains intact, helping to keep the market supported. Overall sentiment is cautiously optimistic, with buyers continuing to show interest even amid disruptions. In Turkiye, import prices dropped by USD 2 this week; however, this decline has not led to any noticeable movement in the local market. Conditions remain stable, with no significant shifts in demand or overall sentiment”, the company’s report concluded.

In a similar note, shipbroker Intermodal noted that “the ship recycling markets were subdued last week, with sentiment muted across key regions. Economic headwinds, currency volatility, and regulatory hurdles kept buyers cautious. Despite a brief boost in sentiment following the arrival of LNG units at Alang, India’s ship demolition sector continues to face significant challenges. The rupee weakened to historic lows against the U.S. dollar, capital outflows intensified, and investor sentiment remained subdued, amplifying the impact of U.S. tariffs and pushing exports to a nine-month low. The steel sector is also struggling with sluggish demand and seasonal monsoon disruptions, further complicating the outlook. Market participants are closely watching ongoing U.S.-India trade talks. Gadani’s ship recycling sector experienced a quiet week, with limited vessel availability as some units were diverted to Subcontinent competitors. Progress on HKC compliance remains slow, and local yards continue to face competitive challenges, partly due to inefficiencies in salvaging non-ferrous metals. The steel market is under pressure, though a recovery is expected once the monsoon subsides.

Source: Intermodal

Meanwhile, the State Bank of Pakistan maintained its benchmark policy rate at 11% to contain inflation, while recent floods have damaged agriculture and increased prices for wheat, rice, and vegetables. The Bangladesh market remains sluggish, constrained by HKC approval delays and weak local demand. Nevertheless, stronger buyer interest is injecting cautious momentum, gradually lifting market sentiment. The steel sector is seeing rising optimism, supported by increased demand. Political uncertainty continues to weigh on broader economic activity, with the interim administration yet to advance key infrastructure projects. Despite these challenges, modest improvements in sentiment point to the potential for recovery in the coming months. Another flat week for the Turkish ship recycling market, with minimal shifts. Weak local steel demand is prompting mills to scale back output. Meanwhile, Lira continues its depreciation against the U.S. Dollar, hitting new lows and adding pressure to market dynamics”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide