Ship Recycling Still Subdued Across the Board

The ship recycling market is ending 2024 in the same lackluster state it began the year. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading global cash buyer of ships, said that “the ship recycling markets across all major destinations continue to face a challenging and subdued environment, each grappling with unique hurdles. India remains stagnant, with both vessel demand and supply notably absent, compounded by the lack of the usual year-end uptick in activity. Bangladesh mirrors this cautious sentiment, where despite a recent price correction, buyers remain unwilling to commit, reflecting a soft and hesitant local market. Pakistan is struggling the most, with consistently low demand, no sales, and external pressures further destabilizing an already weak market. Turkiye, while showing a slight improvement on the import side, still sees no meaningful change in local conditions. As the year draws to a close, the market across all regions paints a uniform picture of sluggishness, with the anticipated December revival failing to materialize”.

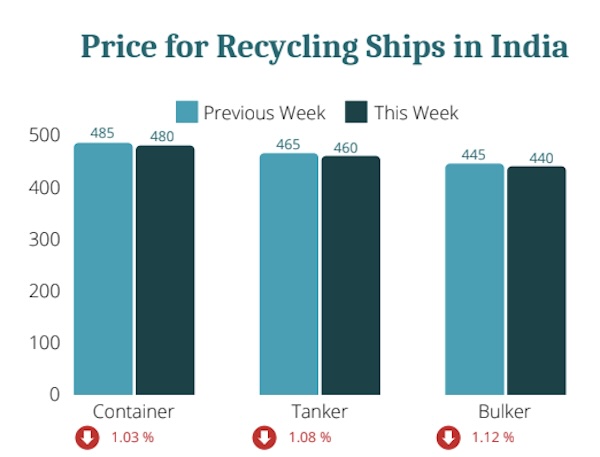

Source: Best Oasis

According to Best Oasis, “this prolonged lull underscores the industry’s cautious mood, leaving stakeholders with little optimism for immediate recovery. Fitch Ratings has provided a “neutral” outlook for the global steel sector in 2025. This reflects expectations of a modest recovery following a sluggish 2024. Key factors include a more balanced Chinese steel market, lower costs, and slight improvements in prices and profit margins. Steel consumption is projected to grow in the low single digits, driven by demand from India, stable consumption in China, and recovery in the US and EU markets”.

In a separate report, shipbroker Intermodal commented that “last week, the ship recycling market saw mixed movements influenced by fluctuating steel prices, shifting currency values, and evolving geopolitical dynamics. Rising oil prices driven by OPEC’s production cuts and sanctions on Russia and Iran created tighter tanker supply, reducing recycling candidates as rates moved higher. Simultaneously, global steel prices faced downward pressure from cheaper imports, creating a challenging environment for recyclers. In India, the local steel market remained sluggish due to weak demand for finished products, though prices held steady. Ship recyclers kept offers stable while actively pursuing limited tonnage. Imported scrap prices saw a slight uptick following global trends. Economic prospects hint at potential interest rate cuts in early 2025 to stimulate business activities possibly giving breakers more room to compete . Pakistan’s ship recycling sector remained constrained by financial instability and stagnant steel prices. Inflation and limited USD liquidity kept production costs high, while recyclers continued seeking new deals despite the fact that at the moment, there is no tonnage.

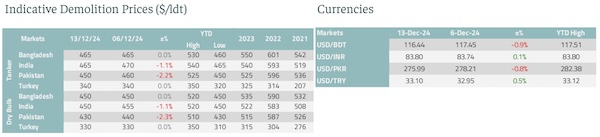

Source: Intermodal

Competition from Iranian imports and delays in IMF support further strained the market. With the HKC compliance deadline looming, yards may face closure unless upgrades are made. In Bangladesh, the steel market reflected mixed signals, with local steel plate prices inching up despite weak demand. Recyclers maintained steady prices but operated cautiously amid limited yard capacity and currency depreciation. Domestic construction projects remained sluggish, hinting at a slow recovery into 2025. Turkey’s ship recycling market faced downward pressure due to declining local steel prices, despite a recent correction in import scrap rates. The Turkish Lira continued to weaken, weighing on recyclers. While ship recycling frameworks are in place, competition from South Asian markets limited Aliaga’s access to tonnage. The global recycling market remains sensitive to broader trade dynamics, economic pressures, and environmental regulations. As the HKC enforcement deadline approaches, compliance upgrades in South Asia become critical. A cautious yet optimistic outlook prevails, with potential improvements expected as global economies stabilize and regulatory frameworks tighten”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide