Ship Recycling Still Looking for Solid Ground

The ship recycling market has remained largely unchanged and lackluster over the past week. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “in India the local market has remained weak this week, continuing the downward momentum that began last week. Demand from the end sales market has been very poor, resulting in limited movement and subdued activity. Buyer interest remains low, and overall sentiment continues to be negative, reflecting cautious market behavior”.

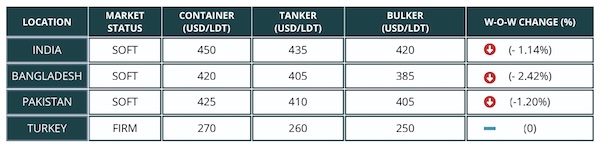

Source: Best Oasis

In Bangladesh, “the local recycled steel market remains under significant pressure, with small vessel prices being quoted at USD 330–340 levels. This highlights prevailing market discouragement, as smaller vessels typically yield higher volumes of recycled steel and contain fewer steel plates. The steel plate market has also softened, though the decline has been relatively moderate compared to the pronounced weakness observed in the recycled steel segment. Overall sentiment remains cautious amid subdued demand and limited pricing support. In Pakistan, the number of HKC-compliant yards is increasing, enhancing the country’s recycling capacity. However, the recent flooding in Punjab, a key region for steel production, has significantly slowed down overall market activity. Local buyers remain interested but are quoting prices with a cautious approach amid subdued demand and regional disruptions. Finally, in Turkey, the market situation remains largely the same as last week, with no notable changes in sentiment or activity levels. Despite expectations for improvement, overall market conditions continue to remain muted”, Best Oasis concluded.

In a separate report this week, shipbroker Intermodal added that “activity in subcontinent remained limited this week, as many ship recycling yards continue to face HKC-compliance related hurdles. A clear example of these challenges is Bangladesh’s ship recycling sector, which remains under significant strain as activity stalls amid a sluggish domestic steel market and subdued buying interest. Yard operations continue to be constrained by pending HKC compliance issues, while poor market conditions discourage fresh investment. Although 18 yards have successfully achieved HKC certification, only 3 additional facilities have declared intentions to pursue compliance, bringing the total to 21. This represents a notable decline from the pre-HKC era of around 35, highlighting the contraction of Bangladesh’s recycling capacity. Last week’s optimism along Alang’s coastline has faded, giving way to a subdued market. Stakeholders remain on hold, closely monitoring developments in India-U.S. trade relations and tariffs. While India’s strong domestic consumption is expected to cushion GDP impacts due to the economy’s limited reliance on exports, prolonged trade measures could reduce projected fiscal -year growth by around 0.5% from 6.5%. These factors have dampened activity, leaving few buyers willing to commit.

Source: Intermodal

Overall, the market remains cautious amid ongoing trade headwinds. Pakistan’s Gadani ship recycling market is in a comparatively favorable position across the subcontinent, with growing momentum in HKC compliance and government’s intentions for the sector’s shift towards more eco-friendly practices. The $40 million plan to upgrade 31 yards into eco-compliant facilities by 2026 has bolstered market sentiment. On the compliance front, 9 facilities currently hold provisional DASR, pending full HKC approval. Recent floods have dampened economic activity, affecting steel and ship recycling markets while also causing significant damage to infrastructure and agriculture. The Turkish market remains stagnant, showing little movement compared to last week. Meanwhile, the local steel market is steady, and demand may improve. The Turkish lira continues to weaken against the U.S. dollar, tempering market dynamics”, Intermodal concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide