Ship Recycling Moving Ahead with the Hong Kong Convention Deadline Affecting Activity

Ship recycling activity remained lacklustre last week, with markets across key recycling destinations closed during the holiday period. Best Oasis (www.best-oasis.com), a leading cash buyer of ships, said in its weekly report that “as operations now begin to resume, early market signals are beginning to emerge. The global ship recycling market faced a broadly weaker trend this week, shaped by holidays, price corrections, and continued regulatory anticipation. In India, prices declined further under local pressure, and sentiment remains subdued. Bangladesh remained inactive due to Eid holidays, with the market expected to reopen mid-June. Pakistan also saw minimal activity, with a few buyers active ahead of the Hong Kong Convention deadline, but overall momentum stayed limited. Yard compliance efforts continue, though clarity remains lacking. In Türkiye, both import and domestic prices fell amid weak demand and post-holiday slowdown”.

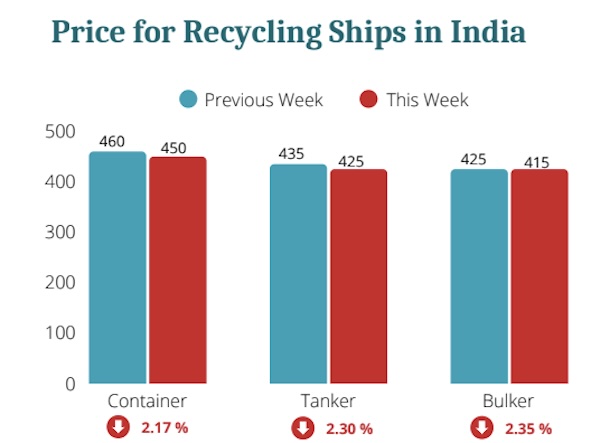

Source: Best Oasis

Meanwhile, “as the 26 June HKC enforcement date nears, attention across all markets is shifting toward compliance readiness and post-holiday direction. Global trade tensions are heating up again as sweeping U.S. tariffs introduced under President Trump begin to take effect, rattling confidence in supply chains and triggering concerns about growth. The move has already led to a downgrade in global economic forecasts, with the OECD warning of broad consequences if the situation escalates. Against this backdrop, senior officials from the U.S. and China are meeting in London this week for a new round of trade talks. While expectations are cautious, the stakes are high. From critical mineral exports to tariff rollbacks, the outcomes of these discussions could either open a path toward de-escalation or push markets further into uncertainty. What unfolds in London may well set the tone for global trade in the months ahead”, Best Oasis concluded.

In a separate weekly note, shipbroker Intermodal said that “the ship recycling markets experienced a subdued week, primarily due to ongoing religious holidays and growing concerns over the impending HKC compliance deadline. In India the ship recycling market remains quiet, amid weakening sentiment, while the government is considering plans for expansion of the ship recycling sector near Alang. The local steel market is also feeling the pinch from poor demand for finished steel products. On the economic front, however, there’s positive news: inflation has dropped to 3.1%, the government is supporting local industries through tax savings, and foreign reserves are robust, nearing $700 billion, close to all-time high figure. Religious holidays through mid-June have left both the ship recycling and steel markets in Bangladesh lethargic. Once markets reactivate, the government’s focus will shift to regulatory matters and HKC compliance, guiding recycling facilities into the post-HKC era. Currently, only 9 out of 35 ship recycling facilities are HKC-approved, significantly impacting local demand”.

Source: Intermodal

“As for the national economy, the interim government’s national budget has revealed decreased expenditures and measures to increase tax revenues, seeking to achieve to reduce fiscal deficits. Market participants worry that new tax schemes will affect end -of-life vessel prices, potentially dampening market sentiment. Like Bangladesh, Pakistan’s ship recycling market has been sluggish. Pakistan lags behind its subcontinent neighbours in regulatory progress, with fewer than 10 yards estimated to have submitted HKC compliance plans and limited infrastructure updates. This situation is prompting some buyers to offer higher prices now to secure tonnage before the HKC enforcement limits their purchasing ability. Overall, significant uncertainty surrounds the market’s outlook once the HKC takes effect. The Turkish market experienced constrained activity, primarily stemming from subdued buying interest and religious holidays. On a positive note, inflation showed encouraging signs in May, easing to 35.41%, its lowest level since November 2021”, Intermodal concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide