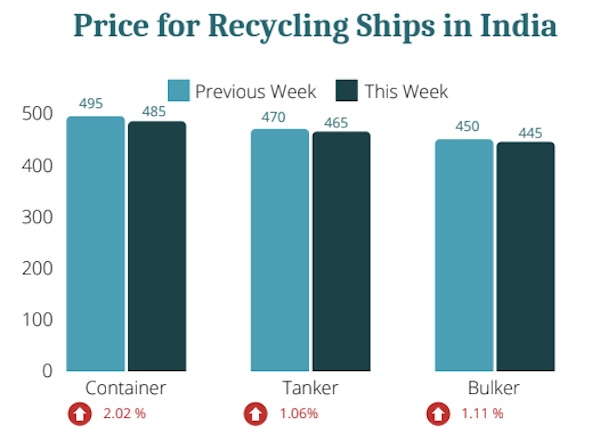

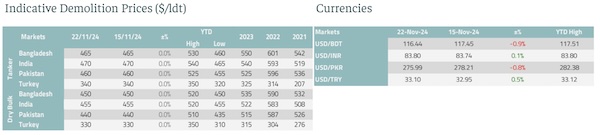

The ship recycling market remained in a downtrend over the past week. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “this week, the ship recycling markets across South Asia and Türkiye remained subdued, continuing the cautious tone seen in recent weeks. In India, the market saw no significant change as both demand and tonnage remained notably low. Ship-recycled steel continued to struggle against the appeal of hotrolled coil plates, which, despite being priced slightly higher, are preferred for their superior quality and consistency. This, combined with ample domestic production and steady imports, further weighed on the market. Bangladesh mirrored this sluggish trend, with negligible activity and no significant developments, despite fleeting hopes of a year-end boost or support from the interim government. Pakistan continued its prolonged stagnation due to constrained financial access and difficulties in opening letters of credit, leaving the market directionless. Türkiye experienced a USD 10 drop in import prices, but local market conditions showed little response, reflecting persistent weak sentiment and demand.”

Source: Best Oasis

According to Best Oasis, “we can say that the markets largely remained cautious and stagnant, weighed down by low demand, financial constraints, and competitive pressures from alternative steel sources, with no immediate signs of recovery on the horizon. Global steel production in October 2024 grew by 0.4% year-on-year and 5.3% month-on-month, reflecting recovery driven by steady outputs in China and India and strong gains in Germany and Brazil, despite declines in South Korea and Russia. With demand projected to rise 1.7% in 2024 to 1.793 billion metric tons, fueled by infrastructure and industrial expansion in developing regions, the industry faces a delicate balancing act. If production outpaces demand, overcapacity could become a looming challenge, potentially weighing down prices and margins. The question now is whether producers can strike the right balance to ensure sustainable growth”, the company’s report concluded.

In a separate note this week, shipbroker Intermodal stated that “the ship recycling market continues to face subdued activity, driven by weak steel demand, imports of lower cost Chinese steel and environmental concerns among industry players regarding compliance with green recycling regulations Furthermore, with the Christmas period approaching, some shipowners are delaying recycling decisions, hoping for more favourable post-holidays market dynamics. In India, the market has experienced a quiet week, with low demand driven by a combination of factors, including ample domestic steel production and the influx of cheaper steel from China. The prices for ship recycling have declined by $5-$10/ldt, reflecting broader market conditions. In the economic front, GDP growth forecasts for India have been revised down to 6.8%, due to reduced government spending, high interest rates, and inflationary pressures. In Pakistan, the ship recycling sector has seen limited developments last week, as the economy continues to grapple with ongoing economic challenges. Negotiations with the IMF over the $7 billion bailout remain underway together with ongoing investigations for the misuse of $440 million funds. The difficulties in opening LCs and securing funds persist and further hinder operations within the recycling industry. Local steel plates dropped by $4/ton, facing competition from lower-cost Chinese steel. Ship recycling prices have remained stable amidst weak steel demand.

Source: Intermodal

The sentiment of the market is pessimistic, with no signs of immediate improvement. In Bangladesh, despite muted steel demand due to the lack of new infrastructure projects, the steel plate prices have increased by $3/ton on the back of inadequate supply. Stagnant conditions persist in the recycling market, with the scrap prices remaining at the same level as of the previous week. Although demand for tonnage recycling exists, it is constrained by government policies requesting by the scrapyards to demonstrate proof of substantial progress in complying with the upcoming HKC regulations. These restrictions are likely to impede any near -term improvements in market fundamentals. In Turkey, the market is significantly impacted by the broader economic environment, including high inflation, low productivity growth, and declining foreign investments. The government is attempting to decrease inflation rate through restrictive monetary policies. However, weak demand in the steel market and poor export performance continue to dampen market prospects. The Turkish Lira remains near a historic low of 34.5 against the US Dollar, further adding to the challenges”, Intermodal concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide