Ship recycling is exhibiting signs of divergence across the major markets. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships, said that “the Indian market remains very weak, with prices declining daily and no signs of recovery. Overall demand in local markets has dropped sharply, partly due to the government’s continued restriction on reusing ship-recycled scrap for cold rolling. Even with the onset of winter, recyclers see no relief, indicating ongoing market

pressure. The Indian ship recycling industry welcomed a recent ruling by the Customs, Excise and Service Tax Appellate Tribunal, classifying used lead-acid batteries from ship recycling as goods rather than waste or scrap, removing excise duty and enhancing cost efficiency, regulatory clarity, and sustainability. In Bangladesh, “buyers remain active, focusing mainly on tankers and bulkers in the 7,000–10,000 LDT range. Local market sentiment continues to soften due to limited tonnage availability, though prices remain relatively firm compared to India and Pakistan. This situation is expected to stabilize once the yards secure sufficient vessels, bringing prices more in line with regional markets”.

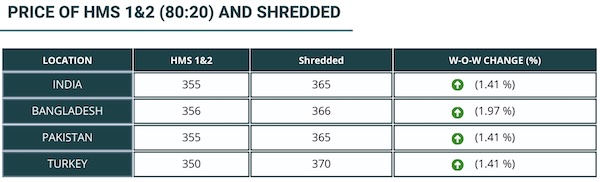

Source: Best Oasis

Meanwhile, in Pakistan, “the market remains relatively better than India, but uncertainty over the pending IMF tranche has led sellers to adopt a wait-and-see approach as meetings continue. No new vessel deliveries have been reported since the IMF tension emerged, reflecting cautious sentiment and concerns over USD availability. Until there is clarity on the IMF outcome, sellers may consider diverting to Bangladesh or India, with India offering comparatively greater stability. Finally, in Turkiye, import prices have improved by around USD 5 this week, while local prices remain unchanged. The market continues to follow its usual pattern, showing no notable changes. As is typically the case, activity and sentiment remain exactly the same as in previous weeks. Recent data shows that around 30 percent of the global container fleet, measured by capacity, is on order and scheduled for delivery over the next few years. This wave of newbuilds could offer a glimmer of hope for recyclers as newer vessels gradually replace older ones”, Best Oasis concluded.

In a separate note this week, shipbroker Intermodal said that “ship recycling markets displayed divergent conditions last week, with activity levels and sentiment varying across destinations. The Indian ship recycling market saw declined activity last week, marked by a notable gap between sellers’ pricing expectations and buyers’ purchasing power. Sanctioned vessels continue to arrive at discounted prices, distorting competition. The ongoing weakening of the rupee has further constrained recyclers’ buying capacity, while government restrictions on using shiprecycled scrap for cold-rolled steel have dampened local demand. On the international front, discussions with the U.S. continue, though India’s purchases of Russian oil to supply its expanding refining sector remain a point of contention. Market sentiment in Pakistan remains subdued amid ongoing escalation of armed conflicts with Afghanistan, stalled IMF funding, and broader economic pressures, including rising poverty and inflation.

Source: Intermodal

These challenges have prompted market participants to maintain a holding pattern. Adding to the uncertainty, no shipyards have yet attained full HKC compliance, although activity continues under provisional DASR approvals. The steel sector is also under pressure, constrained by weak construction activity, with domestic mills operating at roughly one-third of capacity. Bangladesh’s ship recycling industry is showing signs of recovery following a period of constrained activity with sector’s focus on HKC upgrades. The market has witnessed renewed interest, with buying activity concentrated on dry and wet units in the 7,000-10,000 LDT range. Arrival costs for end-of-life vessels will increase from mid-October due to higher disbursement expenses, which has somewhat tempered sentiment. Meanwhile, the local steel market remains balanced, amid expectations of further strengthening once the monsoon season concludes. In Turkey, the market remains largely unchanged from the previous week, though there is a steady inflow of vessels and the steel market shows signs of improvement as demand strengthens. Meanwhile, the Turkish lira continues to weaken, weighing on market sentiment”, the shipbroker cnocluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide