Ship Recycling Market Waiting for Catalyst

The ship recycling market is looking for a catalyst, which will move it forward. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “the ship recycling markets across India, Bangladesh, Pakistan, and Türkiye continue to see limited movement and cautious sentiment. In India, buying interest has slightly improved due to potential import duty tariffs on steel, but uncertainty keeps larger deals on hold. In Bangladesh, demand remains steady, though Eid preparations have slowed activity. The publication of the Merchant Shipping Bill in the Hong Kong Government Gazette marks progress in aligning with international recycling standards. In Pakistan, market conditions remain quiet as Ramadan nears its end, while discussions with the IMF on a 1 billion USD tranche and a climate-related loan progress, though their market impact remains uncertain. In Türkiye, the market remains unchanged, with recyclers cautious amid economic and political concerns”.

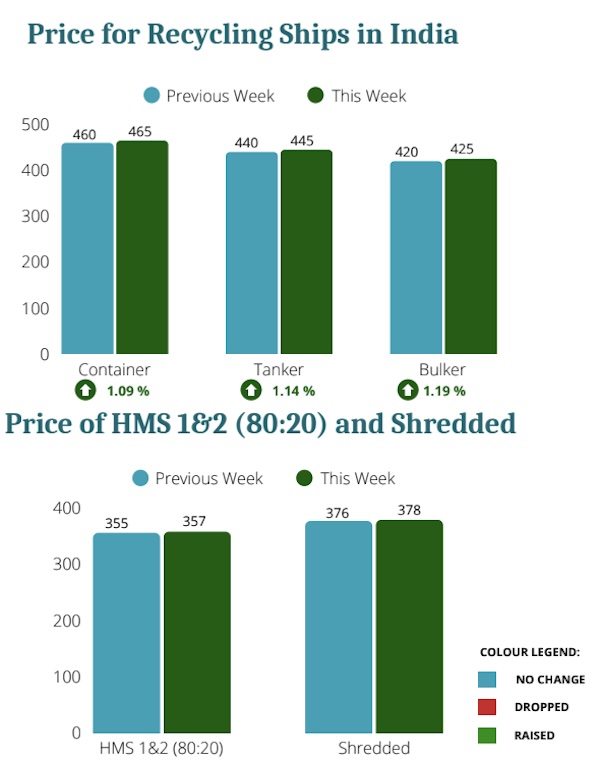

Source: Best Oasis

“Overall, activity remains subdued, with external factors likely to influence future momentum. The global steel dispute has intensified with the European Union delaying its planned retaliatory tariffs on U.S. goods to mid-April, following the U.S. reinstatement of a 25% steel import tariff aimed at protecting domestic producers. The EU’s move allows time for further negotiations and to assess potential U.S. actions. While this offers temporary relief, uncertainty lingers for steel-exporting nations and related industries.

The situation may stem from growing concerns over global overcapacity and trade imbalances, and might signal a shift toward more protectionist trade dynamics. If tensions escalate, this could lead to further trade restrictions, affecting global steel prices, supply chains, and industrial sectors dependent on stable steel flows. Conversely, diplomatic resolutions could ease volatility, but a long-term trend toward localized production and tighter trade controls may reshape the global steel market”, Best Oasis concluded.

Source: Banchero Costa

In a separate report this week, shipbroker Banchero Costa said that “across the Indian Sub Continent regions demand remains firm with both local markets in Alang and Chittagong keen to acquire tonnage but starved of Vessels of any real weight. Aside from a vintage Aframax committed into Bangladesh for a not yet reported price, the usual trickle of small LDT, often 1980’s blt continue to find their way up the beach. Bangladesh remains the go to market however local steel plate prices along with sentiment has been creeping up in India. Where we may not see a major shift in demand and prices over next week due to financial year end but there is some hope for an improved local steel market in terms of demand and prices as we enter into April and Q2, As yards across the Sub Continent start to align with the Hong Kong Convention, the Hong Kong Government proposes to enact legislation to implement HKC by a bill called “The Merchant Shipping (Safe and Environmentally Sound recycling of Ships)”. The bill which will be introduced into the Legislative Council on March 26th and it proposes to ensure that all the requirements of HKC are included in its legislation”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide