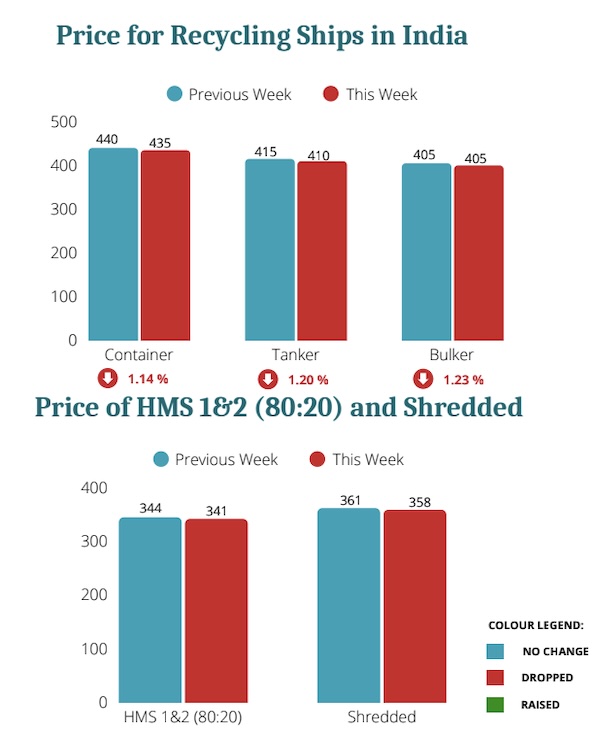

Ship Recycling Market Subdued Again

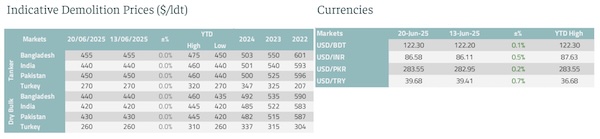

The ship recycling market is trying to find a renewed sense of footing, as the transition towards HKC-compliance is underway, while geopolitical tensions flared once more, negatively impacting the market. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships, said that “this week offered little change across key ship recycling markets, with conditions remaining largely flat and sentiment subdued. Seasonal pressures in India continued to weigh on activity, as the advancing monsoon dampens steel demand, keeping end users on the sidelines. No improvement in market tone has been observed, and outlooks remain pessimistic in the short term. Bangladesh remains inactive as buyers wait for the 26th June enforcement of the Hong Kong Convention.

Source: Best Oasis

Only a limited number of HKC-compliant yards are available, and all are currently occupied with previous tonnage. With no capacity to take new vessels, the market is expected to stay quiet until the second half of next month. In Pakistan, activity remains limited as recyclers take a wait-andwatch approach despite temporary regulatory allowances for non-HKC-compliant transactions. The broader transition toward compliance continues, with all yards expected to meet HKC standards by the end of the year. Türkiye continues to reflect its usual pattern of prolonged stasis. The market shows no meaningful shifts from previous weeks, with both activity and sentiment stuck in neutral. Geopolitical risk has returned to the spotlight as concerns over the Israel–Iran conflict ripple through global markets. With oil prices already reacting to the uncertainty, attention has shifted to how any prolonged tension could impact trade routes, inflation, and capital flows. While no major economic shock has materialized yet, the underlying risk sentiment has clearly shifted, adding another layer of caution to an already fragile global environment”, Best Oasis concluded.

In a separate note, shipbroker Intermodal added that “geopolitical developments and the imminent implementation of the Hong Kong Convention were the primary focus for the ship recycling market last week. In Bangladesh, preparations are in full swing ahead of HKC enforcement, with 10 yards already certified and 25 carrying out the necessary upgrades to meet HKC requirements. The steel market remains subdued, hampered by heavy monsoon rains that have curtailed activity and demand. Incoming recycling prospects are weak as buyers await clarity on the post-HKC environment, resulting in a cautious holding pattern. Economically, Bangladesh has secured loan approvals totalling $15bn from the Asian Development Bank ADB and World Bank, providing crucial financial support amid ongoing market uncertainties. India’s ship recycling sector remains under pressure, impacted by the monsoon season, which has slowed construction activity, a key driver of steel demand, leading to weak buying interest and no immediate recovery expected. Geopolitical tensions in the Middle East, particularly the Iran-Israel conflict, have further weakened the Indian Rupee, compounded by the country’s reliance on imported oil.

Source: Intermodal

Additionally, revised Ministry of Steel guidelines now require imported steel raw materials to comply with Bureau of Indian Standards (BIS) specifications, a certification process that takes 6–9 months. This shift is expected to increase demand for domestic raw materials as mills turn to local sourcing. In Pakistan, ship recycling activity remains limited as buyers adopt a similarly cautious stance to Bangladesh, awaiting developments in the sector following HKC enforcement amid a scarcity of certified facilities. This caution may suppress prices. Meanwhile, the ongoing Middle East conflict remains closely monitored due to Pakistan’s heavy reliance on Iranian oil and the potential economic impact of a Hormuz Strait closure. To alleviate pressure on foreign reserves, Pakistan secured a $1 billion, five-year loan facility to finance oil imports. Despite the sluggish market, there are emerging signs of stabilization and modest demand recovery in the steel sector. In Turkey, the market remains largely stagnant, with growing uncertainty fueled by concerns over escalating Middle East tensions. The Turkish Lira weakened by 0.7% w-o-w against the U.S. Dollar, reflecting the broader regional instability”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide