Ship Recycling Market Still Struggling

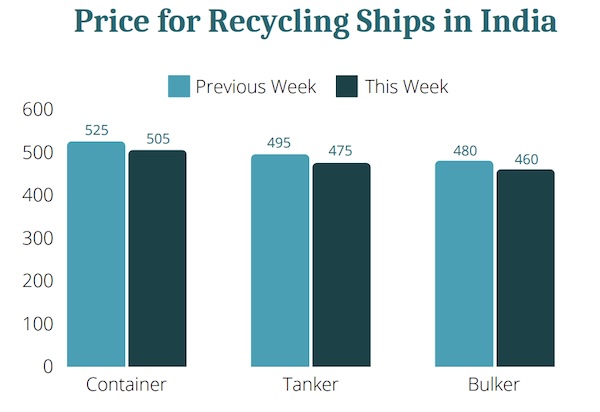

The ship recycling market has remained in “struggle” mode over the past week. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “ship recycling activities across all major destinations continue to struggle, with market sentiment largely negative. In India, the market has been down for months with no signs of recovery, and hopes for improvement are fading. Bangladesh faces a regressive market with daily declines, while compliance measures have become stricter. Pakistan’s market remains stagnant, showing no noticeable improvements or momentum. Similarly, in Türkiye, there are no new developments in imports or local activity. Recycling volumes are primarily driven by bulk carriers, containerships, and the offshore and general cargo segments, while tankers have not reached recycling beaches for a long time, reflecting the ongoing challenges in the ship recycling market”.

Source: Best Oasis

Best Oasis added that “China’s weakened steel demand is driving down global steel prices, as excess supply floods international markets. While lower prices may benefit sectors like real estate and infrastructure, they risk creating trade imbalances and pressuring domestic steel producers worldwide. With China’s tight financing restrictions and no clear rebound in infrastructure projects, low prices are expected to persist, impacting global markets. The U.S. construction industry remains cautiously optimistic, though high Federal Reserve interest rates have dampened new projects and sidelined developers for over a year. Markets are facing increasing downward pressure, with oil prices expected to weaken further. Investors are advised to reduce oil exposure as declining global demand forecasts point to continued price declines over the next six to nine months. Key organizations, including the IEA, EIA, and OPEC, have revised down their oil consumption projections for 2024 and 2025. Major banks have also lowered their Brent crude price targets, reflecting the shifting market sentiment”, Best Oasis concluded.

In a separate report, shipbroker Intermodal added that “the ship demolition market has faced significant challenges this week, with weak demand and falling prices for both steel and scrap continuing in key destinations. In India, the market remains sluggish with steel prices falling sharply due to low demand and the continued influx of cheaper Chinese steel. Indian recyclers are reluctant to make new purchases as ship plate prices continue to fall. Government regulations are likely to increase the amount of scrap available in the future, with carmakers required to recycle 8% of steel from cars by 2026 and 18% by 2036. In addition, the long-awaited increase in construction activity has yet to materialize, putting further pressure on scrap demand. Bangladesh is facing similar difficulties, with the market under pressure from political turmoil, economic challenges and the ongoing monsoon season. Stricter compliance measures, such as approved IHM on board, are causing delays in recycling operations, while prices remain stagnant. Monsoons have disrupted logistics, exacerbating the shortage of available tonnage and hampering recyclers’ operations.

Source: Intermodal

The country is seeking a $5 billion loan from the IMF, as well as better terms on existing loans from Russia and India. In Pakistan, the market continues to show no signs of improvement. Local recyclers are struggling with falling steel prices, exacerbated by an influx of cheaper Chinese steel imports. Although the recent interest rate cut by the central bank offers a glimmer of hope, its impact on the ship recycling industry has yet to be felt. Recyclers remain cautious, especially for larger vessels. The Turkish market remains largely unchanged, with little activity in either local recycling or imports. Prices have remained flat, but there is growing concern about the impact of increasing Chinese steel imports. Recyclers expect further price falls as demand remains weak. Overall, the ship recycling market remains under significant downward pressure, with little sign of immediate recovery in any of the major destinations”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide