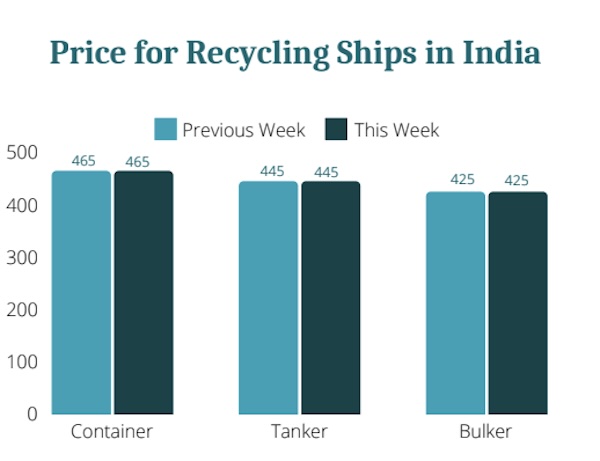

Ship Recycling Market Still in Decline

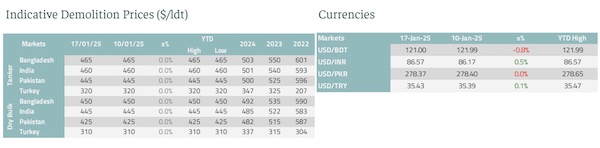

The ship recycling market has continued its lackluster mode over the past week. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “this week in ship recycling, the markets across all major destinations followed their ongoing trends, some more predictably than others. India saw no improvements—if anything, the market dipped slightly further. However, with Makar Sankranti celebrations in Gujarat, a pause in activity was expected, and there’s hope that things will pick up in the coming week. Bangladesh remains in its usual cycle of brief steel price upticks followed by corrections. The bigger concern, however, is the ongoing struggle to secure bank LC approvals, as strict regulations and a persistent dollar shortage continue to limit buying activity.

Source: Best Oasis

Best Oasis added that “Pakistan, meanwhile, remains in deep freeze. For yet another week, there has been no meaningful shift, no improvements, and no surprises—just the same stagnant conditions. Lastly, Türkiye, after weeks of the same market conditions, finally saw movement, but unfortunately in the wrong direction. Prices dropped by 10 to 12 USD both locally and for imports, leaving little room for optimism. With January halfway through, the industry is watching closely for any signs of a turnaround in the coming weeks. The latest U.S. sanctions on Russia’s oil sector are reshaping global shipping, creating ripple effects across the industry. With over 180 oil tankers blacklisted, the availability of vessels to transport Russian crude has dropped, leading to rising shipping costs. Meanwhile, major buyers like China and India are shifting to other suppliers, forcing oil shipments onto longer and more expensive routes. Shipowners now face tighter compliance rules, adding new risks and complexities to their operations. As the shipping industry navigates these disruptions, it will be crucial to watch how these shifts influence the ship recycling market in the months ahead”, Best Oasis concluded.

In a separate report, shipbroker Intermodal said in its weekly note that “the ship recycling market remains constrained, characterized by limited activity, weakened steel market fundamentals, and ongoing depreciation of local currencies against the US dollar. Despite the presence of fresh tonnage in the market, discrepancies in pricing between buyers and sellers have hindered some successful transactions. In India, there was no significant activity reported this week. The Indian Rupee’s depreciation to record low levels against the US dollar has further eroded buyers’ purchasing power. Local steel demand remains sluggish, exacerbated by the influx of cheaper Chinese imports, which continue to challenge domestic steel producers. These factors, coupled with the weak currency, have added uncertainty to the market. However, on a positive note, India’s economic outlook remains stronger than its subcontinent neighbours and Alang shipyards maintain a leading position in shipyard compliance with HKC regulations. Bangladesh meanwhile, continues to grapple with financial distress, inflationary pressures, and political instability, while the GDP growth projections for 2025 indicate a slowdown at 4.1%, versus 5% growth in 2024. The recycling sector is impacted by the depreciation of the Bangladeshi Taka against the US dollar, compounded by a shortage of foreign exchange and difficulties in the issuance of LCs. Additionally, weak steel demand continues to pose challenges to recyclers.

Source: Intermodal

While an increase in available candidate vessels has been noted, discrepancies in pricing between buyers and sellers have led to only a limited number of finalized transactions. In Pakistan, the market remains at a standstill, with no notable developments since the previous week. Although there were minor fluctuations in the local steel market, these were short-lived, as price increases were followed by declines due to the influx of cheaper imports. Despite ongoing economic challenges (such as a high burden of debt servicing, inflation, and widespread poverty) the country’s GDP is projected to show modest growth in 2025, rising to 2.8% from 2.5% in 2023. Government efforts to broaden the tax base and improve revenue collection are expected to gradually increase fiscal revenues. A positive development includes Pakistan’s agreement with the World Bank for $20 billion in funding under the Country Partnership Framework, which will support the country’s economic recovery and long-term growth, starting in 2026. In Turkey, the weak fundamentals of steel market, with downwards pressure on prices and declined demand, have impacted the local ship recyclers, who have had to adjust their offering prices accordingly. The continued depreciation of the Turkish Lira against the US dollar further weighs on market sentiment”, Intermodal concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide