Ship Recycling Market Remains Quiet

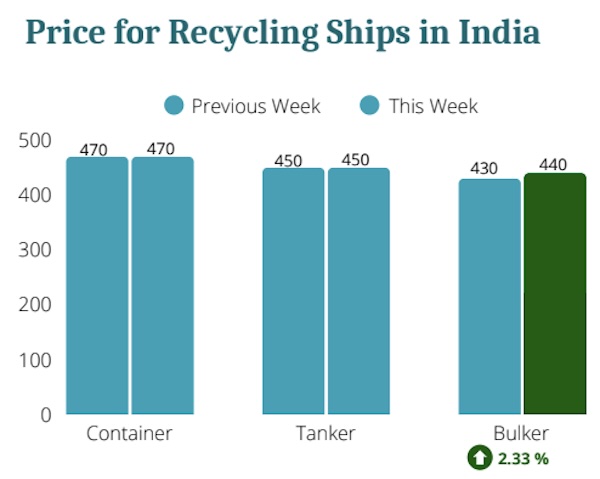

Things have remained unchanged in the ship recycling market. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “the ship recycling market remained relatively quiet this week, with activity slowing down in several key destinations due to holidays. India showed slight improvement, supported by local demand and a more stable tone, further backed by recent GST clarity on domestic vessels. In Bangladesh, the market was mostly inactive during Eid, though prices edged higher in line with international trends. Most yards are currently occupied, and concerns have grown over newly imposed US tariffs, which could affect export sentiment going forward. Pakistan maintained steady demand within its usual vessel size range, but continued to face challenges in competing on price and securing financing due to tighter banking scrutiny. Meanwhile, Türkiye remained inactive throughout the week due to national holidays, with no changes reported”.

Source: Best Oasis

Best Oasis added that “overall, despite some movement in select areas, the global ship recycling market remained largely muted, awaiting a clearer direction once normal activity resumes. As highlighted in recent weeks, the evolving global trade landscape continues to weigh on market sentiment, with the latest U.S. tariff policy introducing fresh uncertainty. While officials initially presented the sweeping duties as firm and non-negotiable, President Trump has since indicated a willingness to engage in talks if other countries offer “something phenomenal.” This conflicting messaging, paired with steep tariff hikes on key trading partners, has unsettled financial markets and raised concerns over broader trade flows. For the ship recycling industry, such macroeconomic shifts are increasingly important, as they influence steel demand, vessel supply, and overall market dynamics. With several destinations already in a quieter phase due to holidays, the added pressure from global policy developments could shape sentiment in the weeks ahead”, the report concluded.

Meanwhile, in a separate note, shipbroker Intermodal said this week that “the ship demolition markets experienced a slowdown last week, due to Eid holidays in Bangladesh, Pakistan and Turkey, amid concerns over the new US tariffs. In India the market players are assessing the potential impacts of Trump’s tariffs, since the country presents high sensitivity to such trade policy shifts with global impact. The Indian government has indicated it will refrain from implementing retaliatory measures, instead focusing diplomatic efforts on negotiations with US to secure tariff reductions. In ship recycling there is a demand uptick, however the available tonnage supply remains limited. Bangladesh ship recycling market remained inactive last week, due to the Eid holidays. There are concerns among the shipyards regarding the approaching deadline for facility upgrades to meet the HKC standards, hoping for government-granted extension. Moreover, the potential impacts of the 37% tariffs imposed by US have intensified market uncertainty. On a positive economic note, the country recorded unprecedented remittance inflows exceeding $3 billion, providing support to national foreign exchange reserves.

Source: Intermodal

Pakistan similarly experienced a subdued market week amid Eid festivities. Buyer interest appears concentrated on vessels ranging between 5,000 and 10,000 tons. Increased due diligence requirements from financial institutions are hindering buyers’ ability to obtain LCs. On the macroeconomic front, inflation rate declined for the fifth consecutive month, reaching a record low of 0.7% y-o-y. However, the implementation of 30% tariffs by the US has heightened concerns regarding potential trade deficit expansion, as the United States represents Pakistan’s largest export market. Turkish steel and ship recycling markets remained stagnant, with activity expected to resume after Eid. Inflation continued to ease in March, nevertheless, the persistent weakening of the local currency against the US Dollar could potentially reverse this trajectory in coming months. Market sentiment appears less severely affected by US tariff announcements, as Turkish exports to the US are subject only to the 10% baseline duty rate”, Intermodal concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide