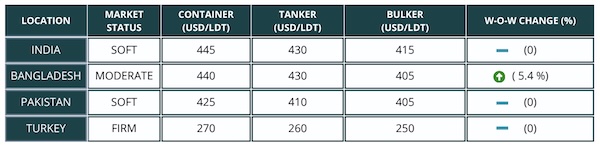

The ship recycling markets remained a mixed bag during the previous week. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships, said that “in India, the market remained negative throughout the week, with no signs of recovery in sentiment. Buyers are no longer keen to purchase vessels at any pricing level and have stepped back from active negotiations. Industry participants are pushing for the Directorate General (DG) government to release the DASR numbers for the yards, which are becoming mandatory. In Bangladesh, signs of recovery are visible in the local market, largely driven by the lack of available tonnage. The shortage of units has pushed buyers to act aggressively, securing tonnage at levels that often exceed economic logic. Despite this uptick in activity, the overall economy remains weak, casting doubt on the durability of the recovery trend”.

Source: Best Oasis

In Pakistan, Best Oasis added that “good progress is being made toward compliance with the Hong Kong Convention (HKC), with many yards investing to upgrade facilities. It is estimated that 12–14 yards will soon be ready with HKC certification, making this a market to closely watch. After the devastating floods, the market is gradually stabilising, providing a more balanced outlook for the weeks ahead. In Turkiye, import prices declined last week as reported, but this week no further change has been observed. The earlier drop has still not reflected in the market, with no shift in sentiment, demand, or overall activity. Conditions remain stagnant, with participants continuing to hold back amid a lack of fresh triggers”, Best Oasis concluded.

Meanwhile, in a separate report this week, shipbroker Intermodal said that “ship recycling activity remained subdued last week, with buyers’ preference shifting toward larger units. India’s ship dismantling sector endured another difficult week amid weakening market conditions. Vessel breaking facilities are struggling with a lack of candidates, while buyers seem unwilling at the moment to commit to new deals. The steel industry remains under strain from subdued demand, impacting prices for finished steel products. A small uptick in the rupee’s value versus the dollar offers some encouragement, though meaningful recovery depends on positive trade developments, specifically whether Washington might roll back import duties to 25% from current elevated rates. In Gadani, the market continues to experience limited activity as the country addresses widespread flood damage across multiple provinces, affecting communities, agriculture, and infrastructure. With no HKC-certified facilities currently operational, local yards depend on DASR certificates for vessel imports, though compliance upgrades are progressing.

Source: Intermodal

This regulatory environment has led recyclers to pursue larger vessels with higher steel content rather than smaller units. On a glimpse of hope, approximately 12-14 facilities are nearing HKC certification. A more favorable outlook is anticipated for the upcoming period once monsoon season draws to a close. In Bangladesh, scarcity of candidates has strengthened market conditions as buyers compete for the limited available units. However, like Pakistan, interest in smaller tonnage remains minimal due to reduced profit margins amid HKC requirements. Consequently, recyclers are focusing on larger vessels, seeking higher returns. The domestic steel market continues to face headwinds from insufficient public infrastructure investment and persistent economic headwinds, though inflationary pressures have moderated slightly. Another muted week for the Turkey, with market participants adopting a wait and see stance. Despite an influx of candidates, buyers seem reluctant. The steel market remains flat, as economic uncertainty weighs on stockpiling decisions”, Intermodal concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide