Ship Recycling Market: Lack of Movement the Norm

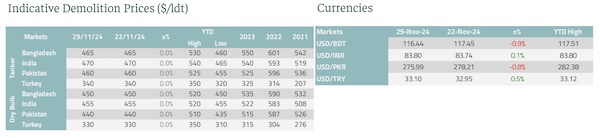

The ship recycling market has kept on being lackluster throughout the course of the past week. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships, said that “the week in ship recycling saw a consistent lack of movement across the board, with no major surprises or shifts. India stayed steady at its low levels from last week. Better weather and construction activity could provide a slight boost, but for now, the market slumbers on. Imports from freezing regions might slow down due to logistics, though this is more theory than reality. Bangladesh saw little action, with only one vessel sale scheduled for January. Political uncertainty around elections has paralyzed decision-making, leaving businesses in limbo. While a hot deal could nudge prices up slightly, the market remains as lethargic as ever. Pakistan continued its lackluster trend, with activity down drastically compared to last year. Anti-government protests shut down cities, with shipping containers doubling as roadblocks instead of recyclables. Stability feels like a distant dream here, and the market reflects that. In Türkiye, the market slowed further, but prices held firm due to limited ship supply”, the report said.

Source: Best Oasis

Best Oasis added that “at least here, stability has a slightly positive ring, even if it’s built on scarcity rather than strength. To wrap it up it was a uniformly dull week. Protectionist trade policies are once again in focus, particularly with the possibility of their increased use by the U.S., raising concerns about their broader economic impact. Globally, such measures could decrease trade volumes, disrupt markets, and trigger retaliatory actions from other nations, potentially leading to escalating trade conflicts. Trade-dependent economies, particularly in Asia, could face notable challenges. A shift away from global cooperation might also undermine efforts to sustain economic stability. These outcomes remain potential scenarios—highlighting that in the dynamic world of trade and politics, unpredictability is the only constant”.

In a separate note this week, shipbroker Intermodal commented that “the markets witnessed another quiet week. Indian Economy’s GDP increased by 5.4% in second fiscal quarter of 2024, below market estimations at 6.5%, attributed to weaker consumption and decreased government spending. Nevertheless, positive signals are provided by the agricultural sector, with production expected to be robust, favoured by strong monsoons. Increased agricultural production could help ease inflation in food prices. The recycling market didn’t see much action since last week, with subdued activity and scrap steel prices maintaining same levels. The Indian Rupee continued to depreciate against US Dollar last week, closing at 84.57. Bangladesh is confronting several economic and political challenges, amid anticipation for the timeline of the elections. The banking system is encountering issues of trust, as the head of Central Bank is accusing financial institutions and large companies for scheming to move funds out of the country”.

Source: Intermodal

According to Intermodal, “the recycling market was lethargic this week, presenting reduced demand and manufacturing contraction. Prices offered for recycling and steel plate prices retreated comparing to last week. While there is some demand for acquisition of tonnage for demolition, this is restricted by policies imposed by the government regarding evidencing progress to meet HKC regulations. No major developments were reported to the Pakistani market this week. The country is on the edge of political instability with the confrontation between the current government and supporters of the former PM, reaching a boiling point. Recycling market is on a standstill, with around 60% reduced activity comparing to last year. The price of local steel prices recorded loss, facing also competition from Iranian cheaper imports. Gadani recyclers are trying to secure a good deal, by checking prices with potential buyers. The lack of tonnage for recycling is setting pressure to recyclers, since they will need to cover fixed costs and on top of that incur some capital expenditure to upgrade the facilities according to HKC regulations. Turkey appears to be close to entering a recession, as the country’s GDP contracted by 0.2% in Q3 2024, marking the second consecutive quarter of decline. While inflation eased compared to October, it remained above market expectations. The Turkish Lira weakened against the U.S. Dollar, dropping to 34.70. Despite the sluggish market conditions, ship recycling prices have remained stable, likely due to the limited availability of ships for recycling”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide