Ship Recycling Market Facing Headwinds

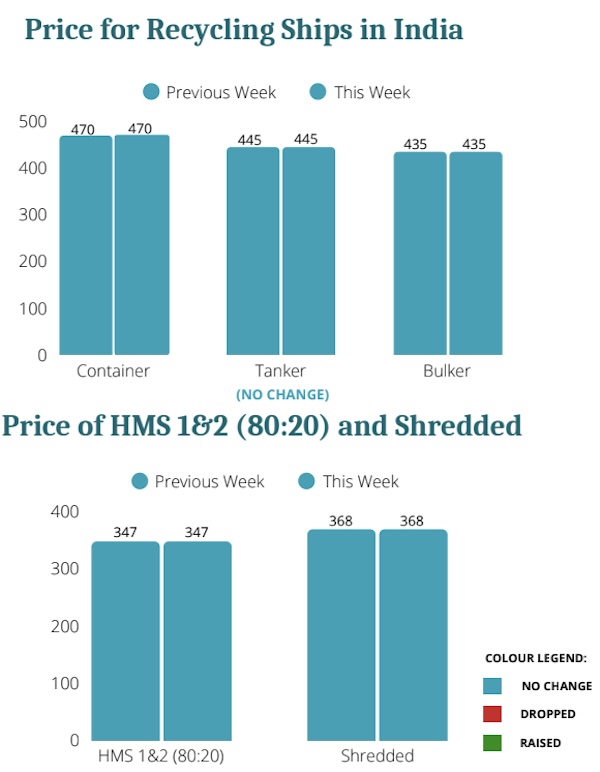

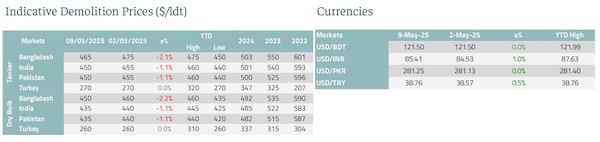

With India’s and Pakistan’s clash casting a dark shadow over the region, the ship recycling market has continued to face headwinds. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “the global ship recycling market continued to face headwinds, with limited momentum across key destinations. In India, the week began with marginal positivity, hinting at a potential uptick in sentiment. However, trading activity soon lost steam, constrained by ongoing financial tightness that continues to limit liquidity and participation in the domestic market. Bangladesh remains under the spotlight as the industry edges closer to upcoming regulatory milestones. Despite some movement on compliance, broader market sentiment remains cautious, influenced by uneven yard preparedness and restricted approval flows. Pakistan offered little in terms of activity, with buying interest staying muted and pricing remaining unaligned with regional benchmarks. This disconnect continues to suppress transactions and keep market conditions stagnant. In Türkiye, local prices showed no significant movement, even as import costs edged upward, indicating a cautious stance from buyers amid broader market uncertainty”.

Source: Best Oasis

According to Best Oasis, “tensions between India and Pakistan have intensified in recent days, with increased military activity and strained bilateral relations raising concerns across the region. As two of South Asia’s key economic players and home to major ship recycling operations—the current instability adds an additional layer of uncertainty to the broader landscape. It is hoped that both nations can move toward de-escalation to ensure regional stability and continuity in cross-border engagement. Global economic growth is projected to slow to 2.3 percent in 2025, falling below the recession threshold, warns UNCTAD. The slowdown is driven by rising tariff tensions, especially US tariffs on Chinese goods, reduced global trade, declining investor confidence, and capital outflows from developing countries due to higher interest rates. UNCTAD calls for urgent policy action to restore stability and support development”, it concluded.

Meanwhile, in a separate note, shipbroker Intermodal commented that “last week, the spotlight in the ship recycling markets remained on the escalating conflict between India and Pakistan. The announcement of a ceasefire was welcomed by market participants, but broader sentiment remains cautious. Regulatory pressures continue to mount, especially in Pakistan and Bangladesh, where only a limited number of yards are currently HKCcompliant. With the June 26 deadline approaching, recyclers in both countries are intensifying their efforts to upgrade facilities and meet compliance standards. The Bangladeshi ship recycling sector is navigating regulatory complexity as HKC enforcement looms. Only yards that have completed between 50% and 70% of the necessary upgrades have secured the required approvals, while facilities with minimal progress remain largely inactive. Currently, just seven yards are fully HKC-compliant and therefore eligible to acquire tonnage post-enforcement. The uncertainty around whether additional facilities will meet compliance in time is creating concerns over the industry’s regulatory adaptability. Market activity remains subdued, with delays in NOC issuance further limiting buyer engagement. India’s ship recycling market showed modest signs of improvement but faces challenges related to constrained liquidity and limited capital flow. Demand in the steel sector remained subdued last week, as buyers adopted a wait-and-see approach amid the armed conflict with Pakistan, in the Kashmir region. On a positive note, most Indian yards are already aligned with HKC regulations, positioning the country advantageously in the postHKC environment. In Pakistan the market was, largely distracted by its military conflict with India. The aftermath of India’s most significant attacks in the past fifty years may weigh heavily on sentiment”.

Source: Intermodal

“On the regulatory front, Pakistan trails its regional counterparts, with only a handful of yards nearing HKC compliance. Uncertainty regarding post-HKC procedures is discouraging fresh tonnage acquisitions. The domestic steel market remains sluggish, marked by weak demand and flat pricing. Economically, a potential $1.3 billion IMF tranche may provide some relief, but approval delays are possible. Combined, geopolitical tensions, economic fragility, and regulatory pressure contribute to a clouded and pessimistic market outlook. It was a relatively quiet week for Turkey’s ship recycling market. Buyer interest was limited but present, particularly for smaller, regionally positioned vessels. The domestic steel market showed slight improvement in sentiment, however underlying demand remains soft and finished steel prices were largely unchanged. On the economic front, inflation has eased, dropping below 38% in March, though it still remains well above the Central Bank’s year-end target of 24%”, Intermodal concluded

Nikos Roussanoglou, Hellenic Shipping News Worldwide