“Global markets seem to be going through quite a disconnect of late as on the one hand, the last couple of months has seen a multitude of directions that stock markets, trading markets, charter rates, financial and FX markets, and even the ship recycling markets have been greeted by versions of unfolding realities that seem to conflict with what’s been transpiring at the bidding tables of late,” says cash buyer GMS.

Various reports have been consistently confirming positive movements in dry / trading markets, oil up and down (with more down expected), financial markets wreaking havoc on the global ship recycling industry, and ship recycling volumes seemingly improving over recent weeks (primarily in India).

“And this week was another roller coaster of confusion.”

The Baltic Exchange Dry Bulk Index fell nearly 7 points on Friday, yet as Capes, Panamax, and Supramax indices all slipped 14, 3, and 4 points respectively. Yet, the overall benchmark reported a net 2.5% positive gain for the entire sector, driven primarily by the strength of Capes that reportedly firmed another 5.5%.

On the flip side, WTI crude slipped 1% down to $65 / barrel as Iraq’s Kurdistan region reportedly resuming crude oil exports after a 2.5-year hiatus, adding a near 190K barrel / day output that is expected to climb to 230K bpd. The restart pushed by U.S. pressure comes as OPEC+ eyes further outputs while risks to Russian supplies linger amidst their war of attrition.

“The net trickledown effect of the above coupled with a quick stop at sanctions stations has seen ship recycling nation currencies unexpectedly take a royal hammering this week as Bangladesh, India and Turkey all reported declines in their currencies once again, while local steel plate prices flatlined across the board, expect in India,” says GMS.

“Dimly lit hopes lie in wait for brighter times ahead for a beleaguered ship recycling industry,” says GMS.

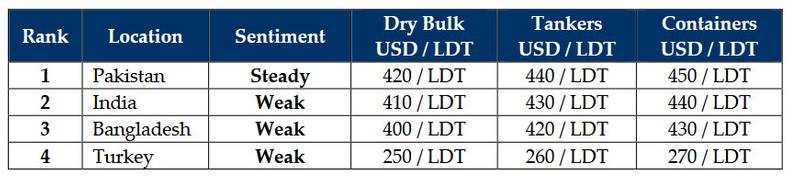

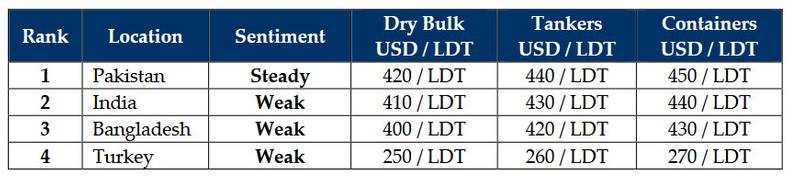

GMS demo rankings / pricing for week 39 of 2025 are: