Ship Recycling Market Entering a New Era

With the Hong Kong Convention entering into force, the global ship recycling industry is officially entering a new era. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “June 26, 2025, marks a key regulatory moment in the ship recycling landscape, with the Hong Kong Convention (HKC) officially entering into force. On the same day, the UAE has implemented its own Ship Recycling Regulation (UAE SRR), which aligns with the HKC but introduces distinct national requirements, including the prohibition of beaching and the use of only dry docks or equivalent facilities. Given the UAE’s geographic position as a major transit and bunkering hub for vessels heading toward recycling yards in South Asia, the new regulation carries wider implications. Even vessels not recycling in the UAE may be subject to increased scrutiny during port calls or transits, effectively turning the UAE into a soft enforcement point along key recycling routes. These developments are expected to prompt a reassessment of compliance strategies, potentially adding pressure on older tonnage and reshaping routing decisions in the near term. The market is now watching closely to see how these new frameworks play out in practice”.

Source: Best Oasis

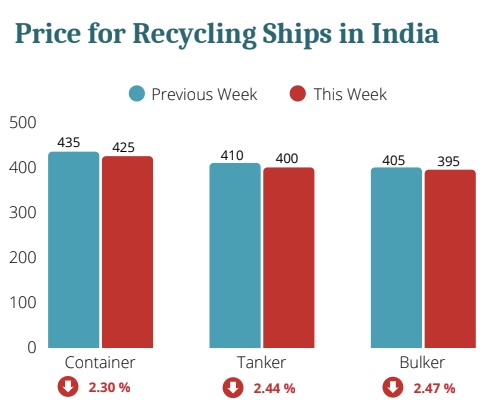

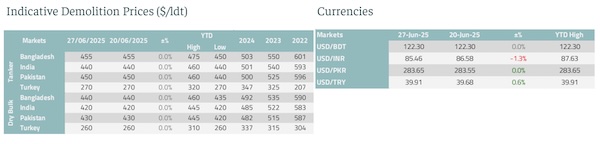

Best Oasis added that “the ship recycling market remained quiet this week, with all major destinations showing subdued activity. In India, prices continued to decline with the onset of the monsoon and weakening demand from the construction and steel sectors. Bangladesh also saw limited momentum, with only a few HKCcompliant yards active and buying interest staying low. Pakistan experienced some demand due to reduced Iranian steel exports, but uncertainty around compliance and regulation kept overall sentiment cautious. Türkiye remained largely inactive, with low mill output and weak domestic steel demand discouraging fresh purchases. Overall, the market across all major recycling destinations remains under pressure, with seasonal factors, regulatory changes, and weak steel fundamentals contributing to a cautious and slow-moving environment”, the company’s report concluded.

Meanwhile, in a separate note, shipbroker Intermodal commented that “last Friday marked a significant milestone for the global ship recycling industry, as the Hong Kong Convention (HKC) officially came into force. The convention introduces standards aimed at ensuring environmentally sound and safe ship recycling practices. Overall, market activity remained subdued last week, influenced by the seasonal monsoon across the Indian Subcontinent and a wait-and-see approach adopted by stakeholders, particularly in Bangladesh and Pakistan, as they observe post HKC market developments. In India the monsoon season and the slowdown of construction activity (main driver of domestic steel demand) continue taking their tolls on ship recycling prices. Consequently, the local steel market is subdued as well, with steel plate prices following a downward trend for the past six weeks, reflecting weak demand. On the macroeconomic front, the central bank plans to tighten its monetary policy by withdrawing ca. $1.32bn of liquidity, out of the market. However, due to excess reserves of $2.6bn already held by commercial banks at the central bank, the measure is not expected to significantly dampen market sentiment. In Bangladesh, a key concern among market participants is the limited number of ship recyclers currently cleared to import vessels for dismantling.

Source: Intermodal

This uncertainty, especially regarding the future role of non-HKC-compliant yards, continues to weigh on sentiment. Buying interest remains low, further impacted by the ongoing monsoon season. On the economic side, the government continues to align with IMF-driven reforms, with the IMF recently approving additional funding between USD 0.9 billion and USD 1.3 billion, likely intended to bolster the country’s foreign currency reserves. In Pakistan, market conditions remain largely unchanged from the previous week. A general holding pattern prevails, as stakeholders navigate the uncertainty brought on by the lack of compliant yards, following HKC entry into force. It is anticipated that the government may issue temporary authorizations to yards that have formally submitted compliance plans. Nonetheless, shipowners are hesitant, given the unclear environment. As in Bangladesh, the market is in observation mode, awaiting further developments. The sector faces the risk of losing competitiveness if it cannot keep pace with rising international environmental and safety standards. The steel market continues to be stagnant, with no major changes since last week, with government assessing whether to maintain or not the anti-dumping tariff on Chinese steel billets, initially implemented in 2017. In Turkey, the ship recycling market continues to be at a standstill, affected by weak steel demand and sluggish steel sales. No notable changes have been observed, and the market remains in a low-activity phase”, Intermodal concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide