Ship Recycling Activity Under the Hong Kong Convention Influence

The impending enforcement of the Hong Kong Convention is bringing some turbulence in the ship recycling market, as compliance is a key factor. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “as the Hong Kong Convention enforcement approaches, the global ship recycling market remains quiet with activity restrained by regulatory developments and weak sentiment. In India, local conditions stay soft with minimal interest. A new directive now mandates IHM certification for new vessels from 26 June 2025, while existing ships must comply before recycling or by mid-2030. Only HKC-compliant yards are permitted for recycling, with provisions for converting existing Statements of Compliance to IHM Certificates. In Bangladesh, uncertainty continues with no clear direction on NOC approvals for nonHKC yards. Even certified facilities are cautious, offering significantly below recent price levels, and overall activity remains limited. Pakistan has seen a rise in buying interest as the HKC deadline nears, driven by timing rather than a shift in sentiment. A new port directive now requires full IHM documentation for all recycling candidates, though no yard has yet been officially confirmed as compliant. Türkiye remains flat and unchanged from the previous week, reflecting its usual market consistency”.

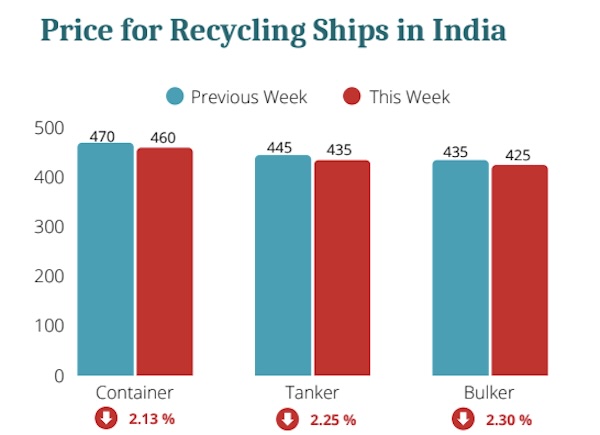

Source: Best Oasis

In its analysis, Best Oasis commented that “as attention shifts toward EU SRR-compliant ship recycling, new yards are being developed under a framework that appears structured, visible, and progressive. It presents a powerful image of responsibility. But is responsibility only about how it looks on paper? Many HKC-compliant yards have spent years improving infrastructure, aligning with global standards, and anchoring livelihoods for thousands. Their work may not carry the same polish, but does that make it any less credible or valuable? With more capacity coming in, it becomes harder to ignore the realities of a cyclical industry. When activity slows, will all these yards remain active? Will the communities that have grown around long-standing facilities still have a place in this changing landscape? It’s not just about choosing one standard over another. The question may be whether the pursuit of progress is being matched by a clear understanding of what sustainability really means for the environment, for the industry, and for the people behind it”, it said.

In a separate note, shipbroker Intemodal said this week that “all eyes remain on the compliance front across the Indian subcontinent, as ship recycling yards intensify their efforts to catch up with HKC requirements. Moreover, President Trump’s announcement for doubling tariffs on steel and aluminum to 50% is raising concerns for impacts on steel demand and prices. In Pakistan, approximately 7 ship recycling yards are currently undergoing infrastructure and procedural upgrades to achieve HKC certification. Of these, only two are expected to be certified before the enforcement deadline of 26 June 2025, with the remaining yards likely to follow thereafter. While this progress is encouraging, uncertainty still clouds the sector’s future postHKC implementation. In the meantime, a slight increase in buyer interest has been observed. However, this appears to be driven more by opportunistic acquisitions of vessels that can be beached at Gadani before the deadline, rather than any fundamental improvement in market conditions. In this context, a price premium may emerge for end-of-life vessels deliverable prior to the regulatory cutoff. Bangladesh continues to make tangible strides toward HKC compliance.

Source: Intermodal

Up to 14 yards are expected to be certified by next month, signaling solid progress. In comparison to Pakistan, Bangladesh is performing better in aligning its facilities with HKC standards. However, a key issue remains unresolved: the lack of clear government guidance on the issuance of NOCs for non-compliant facilities. This regulatory uncertainty has led to hesitation among buyers, thereby dampening market sentiment. Adding to the difficulties is a struggling steel market, affected by a slow economy and fewer construction projects In India, ship recycling activity remains subdued. The onset of the monsoon season has further impacted sentiment. Strong winds and heavy rainfall during this period disrupt yard operations, complicate logistics, and slow construction activity, which in turn weakens demand for steel. On the regulatory side, the Directorate General of Shipping has issued a new circular defining the local implementation of the HKC. Effective from 26 June 2025, all new ships must carry an IHM indicating the location of dangerous materials onboard, along with the corresponding International Certificate. Existing ships are required to comply by the earlier of either their recycling date or 26 June 2030. Furthermore, only HKC-compliant recycling yards holding a valid DASR will be authorized for ship recycling. The Turkish market was on a standstill last week with not much to report. Steel sector softened, due to an influx of cheap Chinese imports, which are pushing prices lower. Meanwhile, the Turkish lira continued to weaken against the US dollar amid heightened investor uncertainty, driven by ongoing political unrest. This follows the issuance of arrest warrants for opposition party members, shaking investor confidence”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide