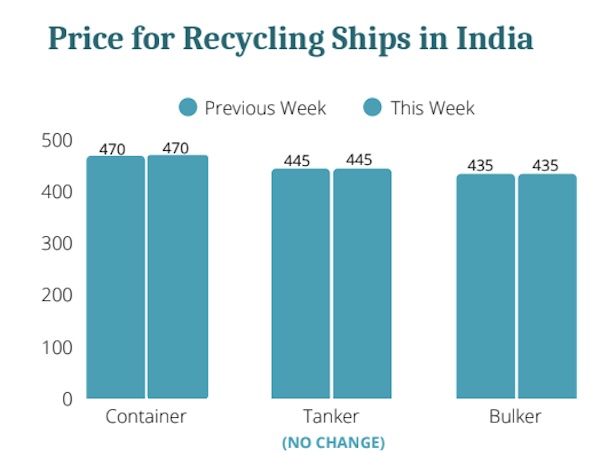

Ship Recycling Activity at a Crossroads

The ship recycling markets are entering a transitionary stage. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “as the clock ticks down to the enforcement of the Hong Kong Convention, the global ship recycling market stands at a crossroads marked by hesitation, minimal activity, and growing regulatory pressure. In India, the pace remains slow with limited interest, but the country could emerge stronger post-HKC, backed by a relatively higher number of compliant yards. Bangladesh continues to face a deadlock, with vessels anchored offshore awaiting NOC approvals and no resolution in sight ahead of Eid and the June deadline. Pakistan has seen a flicker of buying activity driven by timing, but the absence of compliant yards and silence on any extension keeps sentiment fragile. Meanwhile, Türkiye remains subdued, with stable pricing and little indication of renewed momentum, as the broader industry braces for the shifts to come”.

Source: Best Oasis

According to Best Oasis, “recent developments in US-China trade relations have eased immediate tensions, but the overall situation remains uncertain. While some tariffs have been rolled back, a large number are still in place, and no long-term agreement has been reached. Earlier increases in cargo volumes, as companies rushed to ship goods before higher tariffs took effect, have now normalised. Businesses remain cautious, delaying investment and long-term planning due to the lack of policy clarity. For the shipping industry, the impact is significant. Trade routes are still being adjusted, supply chains are under review, and demand across key markets remains unpredictable. Without a stable trade framework, the sector is likely to face continued disruptions and uneven recovery”, the company said in its report.

Meanwhile, in a separate note, shipbroker Intermodal added that “the recycling segment experienced an uptick in activity last week with the sale of 4 LNG units in South Asia, as owners moved to phase out older, less efficient steam turbine units amid persistently subdued market conditions. With almost 60 LNG carriers currently idle, prospects point to a further increase in recycling activity of gas carriers within 2025. Other than that ship recycling markets remained largely subdued, with uncertainty and growing concerns related HKC compliance. Despite the limited recycling activity, market sentiment in India remains positive, particularly looking ahead to the post-HKC era. India enjoys a clear regulatory advantage over regional competitors, with more than 100 HKC-compliant yards already certified. This makes it the most attractive destination for shipowners seeking environmentally compliant recycling solutions. On the macroeconomic front, India recently surpassed Japan to become the world’s fourth-largest economy. The Union Bank of India projects GDP growth could reach 7% in Q4 FY2025”.

Source: Intermodal

The shipbroker added that “in Bangladesh the ship recycling sector is facing mounting challenges as the HKC enforcement date approaches next month. Only 9 yards have been certified so far, while more than 20 remain under inspection, making it unlikely that non-compliant facilities will be approved in time. This regulatory uncertainty has suppressed buying interest, with many market participants adopting a cautious, wait-and-see approach. Difficulties in securing NOCs have led to vessel congestion outside port limits, causing significant delays. In response, the Ship Recycling Association is reportedly considering legal measures to push for vessel approvals. Market sentiment remains further constrained by weak steel demand and the forthcoming onset of monsoon season. Pakistan’s ship recycling industry faces acute regulatory risk, with yards still unprepared, not having initiated the necessary upgrades, being well below than HKC compliance standards and lagging behind its regional competitors. Without upgrades and improved price offerings, the market at Gadani risks continued stagnation and eventually being sidelined from the global recycling market, unless progress accelerates. Currently, the lack of compliant yards and a clear regulatory path forward continues to weigh heavily on market confidence. On a brighter note, the IMF recently disbursed $1 billion to Pakistan under the EFF program, following a favorable review of the country’s reform progress. In Turkey, the market witnessed action from one notable deal: the recycling sale of the Greek ferry Kriti I. Being under EU jurisdiction, the owner had to comply with EUSRR, preventing a sale to Subcontinent at a higher price”, Intermodal concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide