Ship Recyclers Face Unpredictable Steel Plate Prices

In ship recycling, where even a day can make an incredible difference (the summer of circa 2006 when India lost about USD 100/Ton overnight due to a collapse in steel prices, for example), a week can certainly make a dramatic difference, says cash buyer GMS, especially given the turbulent nature of current times that global markets are enduring.

“Going through the checklist of key economic factors affecting the state of global ship recycling today, while the world awaits inflation reports from India and the U.S. (where the government is currently shut down), the Baltic Exchange Dry Index reported a marginal increase as it climbed a mere 13 points by close of Friday on the back of Capesize and Panamax indices both reporting a 13 and 34 point bump in their values, as the small vessel index fell to its lowest level since late August, resulting in the overall index still reporting a near 2% climb this week. Moreover, despite the rising trade rates, oil continues to take a hammering closing at a lowly USD 59.81 / barrel, a number that today stands 18% lower than the same time last year.”

Both Indian and Bangladeshi waterfronts suddenly saw tonnage emerge at their respective anchorage horizons this week.

Eroding fundamentals in the form of declining steel plate prices continue to see weekly disagreements as levels in some locations continue to devolve without end, while others display false hopes via marginal weekly improvements that disappear in subsequent ones, says GMS. “Turkey at the far end remains fashionably late with no progress in volumes, other than the occasional private fixture making the rounds. As week 41 of 2025 / week 2 of October passes, a spook and a whoa later, the market remains just as devolved and unpredictable as ever.”

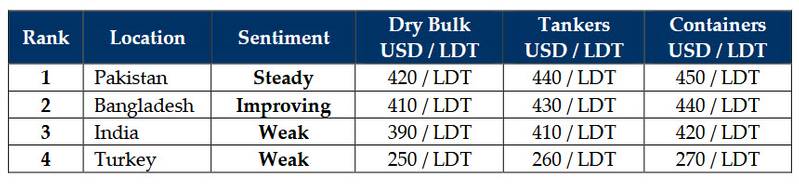

GMS demo rankings / pricing for week 41 of 2025 are: