A week of confusing fundamentals saw nearly all markets reacting as bizarrely as on “Liberation Day” tariffs from back in April, says cash buyer GMS.

The tariffs, finally being levied on key destinations (including India) this week, saw turmoil across the board as the week ended. At the onset, oil futures declined 5% and closed the week out at $63.90/barrel. The tariffs announced on Friday included Russia (rather surprisingly) and China, says GMS.

“While the oil futures drop to the tune of 5% was certainly noteworthy, the Baltic Exchange’s dry index advance for a third Friday with an over 2% increase certainly left an optimistic air for ship owners of aging assets, especially for the perennially popular cape index that contributed 4.3% to the overall increase, while supras added a marginal 0.2% to the mix.”

The U.S. Dollar gained ground against India, Pakistan, and Turkey, while declining against both Bangladesh and China this week. “Local steel plate prices at the various ship recycling destinations also reciprocated their share of confusion, as despite their own differing movements through the week, a majority ended right back where they started.”

Trickling down to the recycling markets, the crazy monsoons of 2025 continue to hammer key locations (especially Bangladesh) as ship recyclers, cash buyers and shipowners collectively come to grips with the new governing realities of the Hong Kong Convention that is now a compelling force in the Indian sub-continent ship recycling markets today – given all of the changing / additional documentation and inward formalities now mandated.

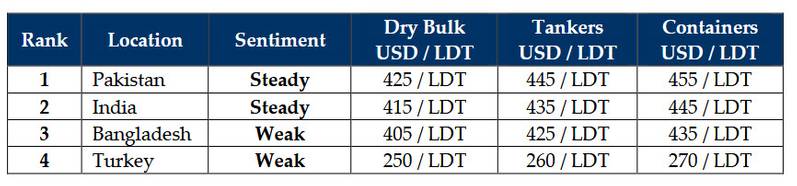

An overall shortage of candidates (compared to recent years) has also left the industry in a state of virtual stasis, although all locations reported at least one fresh arrival for the week. Prices have and continue to endure a turbulent time, with ongoing tariff dramas and even sanction threats that has left a specter of uncertainty looming over key nations including the ship recycling countries, and this has seen levels decline by at least $60/LDT since the peaks seen earlier this year.

Along with a shortage of candidates and apart from some large LDT LNG and bulk carriers that have greeted the various anchorages across recent weeks / months, it has been a comparatively busier time than expected in the Indian sub-continent, especially in India where, conflictingly, sanctions drama also continues as a vessel was reportedly arrested at Alang.

GMS demo rankings / pricing for week 32 of 2025 are: