Ship Demolition Still Stagnant | Hellenic Shipping News Worldwide

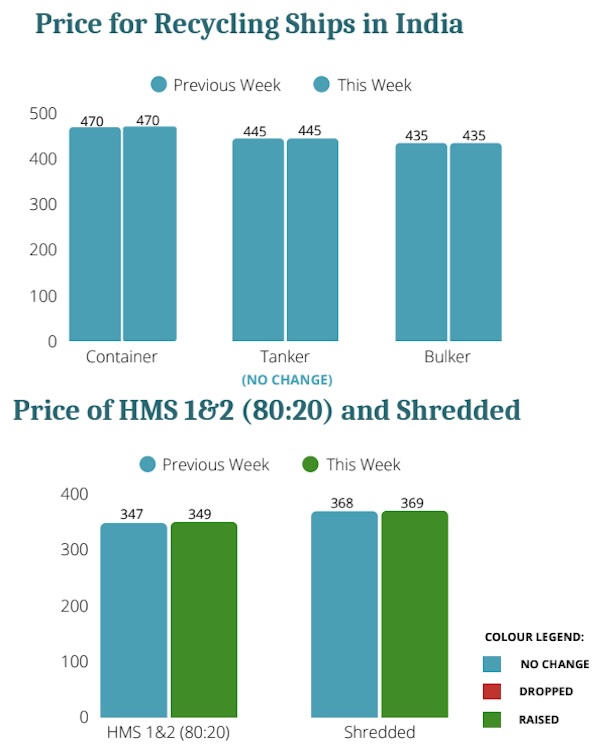

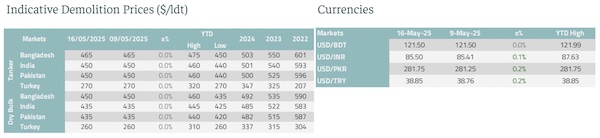

The ship recycling market has remained stagnant over the past week. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships, said that “the global ship recycling market remained largely stagnant this week, with limited activity across key regions. In India, conditions were unchanged, with persistent liquidity issues and weak steel demand keeping sentiment subdued. Bangladesh also saw little movement, as buying interest stayed low amid rising regulatory uncertainty. Several vessels await clearance, but the lack of NOCs for non-HKC-compliant yards has stalled progress ahead of the convention’s enforcement. Pakistan continued to remain inactive, with no improvement in demand. However, focus is slowly shifting to how the market will respond to upcoming compliance requirements. In Türkiye, prices held steady despite a soft market, though slight adjustments may emerge in the coming week. Since last week’s heightened tensions between India and Pakistan, the situation has eased following the announcement of a ceasefire. The de-escalation is a welcome development, aligning with hopes for regional stability and continuity in cross-border engagement. The reduced military activity brings a measure of relief to the broader South Asian landscape, particularly in light of both nations’ economic significance. In a new development, Germany has approved its first ship recycling yard, aligning with international standards and expanding Europe’s regulated dismantling capacity”, Best Oasis said.

Source: Best Oasis

In a separate note, shipbroker Intermodal commented that “the ship recycling market remained generally subdued this week, characterized by low demand and a limited supply of fresh tonnage. While a recent ceasefire between India and Pakistan offered a degree of respite, underlying market fragilities and the approaching enforcement of the HKC continue to foster uncertainty among participants. Discussions at the prior week’s Responsible Ship Recycling Forum in London underscored the imperative of harmonizing the HKC with the Basel Convention to avert future legal ambiguities concerning the management of end-of-life vessels. India’s ship recycling landscape exhibited little change from the previous week, with limited activity stemming from a constrained supply of end-of-life vessels and no immediate prospect of recovery. Market sentiment remained cautious, influenced by weak demand, tight liquidity, and a scarcity of new candidates for dismantling.

The domestic steel market also persisted in its sluggish trajectory, impacted by low demand and reduced governmental expenditure on infrastructure projects. On the trade front, ongoing discussions with USA aim to establish a mutually beneficial agreement. In Bangladesh, the recycling market remained stagnant, hampered by regulatory uncertainties and restrictions on vessel imports due to non-issuance of NOCs for yards not yet HKC-compliant. This situation is stifling market momentum, with limited interest in new acquisitions prevailing amidst these constraints. Progress on the issuance of provisional HKC certificates remains stalled as the convention’s implementation draws nearer. Economically, Bangladesh faces significant headwinds, including liquidity constraints and a slowing GDP growth.

Source: Intermodal

The IMF recently extended $1.3 billion in financial support, with the government requesting an additional $762 million to address these challenges. In Pakistan, the market conditions are mirroring the subdued regional trend. The ship recycling market is largely at a standstill, with the primary focus centered on the progress of shipyards in achieving HKC compliance ahead of the June enforcement headline. The domestic steel market is quiet, with market participants adopting a cautious stance due to limited available funds and weak demand. Anticipation is building for the national budget announcement on June 2nd, with market expectations of potential increases in infrastructure investment. In Turkey, the ship recycling market maintained the status quo of the previous week. Nevertheless, a consistent influx of fresh candidate vessels offers an encouraging prospect for a potential market upturn in the near future. The central bank’s recent decision to increase the costs associated with banks holding foreign currency assets (non-lira) suggests a deliberate policy measure aimed at moderating the domestic demand for foreign exchange”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide