Ship Demolition Market: Weakness Still the Main Theme

The ship demolition market has still been weak over the past few days. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “the ship recycling market remained weak across all major destinations, with limited movement and sentiment largely unchanged. In India, the downward trend continued as safeguard measures failed to revive demand, and financial stress weighed heavily on both mills and buyers. Bangladesh stayed stagnant, with the market awaiting the long-anticipated NOC decision expected to be announced soon. Pakistan saw minimal activity, with buyers focusing only on smaller vessels and quoting unworkable prices for larger ones, while progress toward HKC compliance remained uncertain. In Türkiye, the market stayed depressed, with no shift in pricing and buyers cautious amid widening trade deficits and persistent inflation. As India accelerates its efforts to scale up maritime infrastructure and global standing, Maharashtra has approved a policy focused on shipbuilding, repair, and recycling.

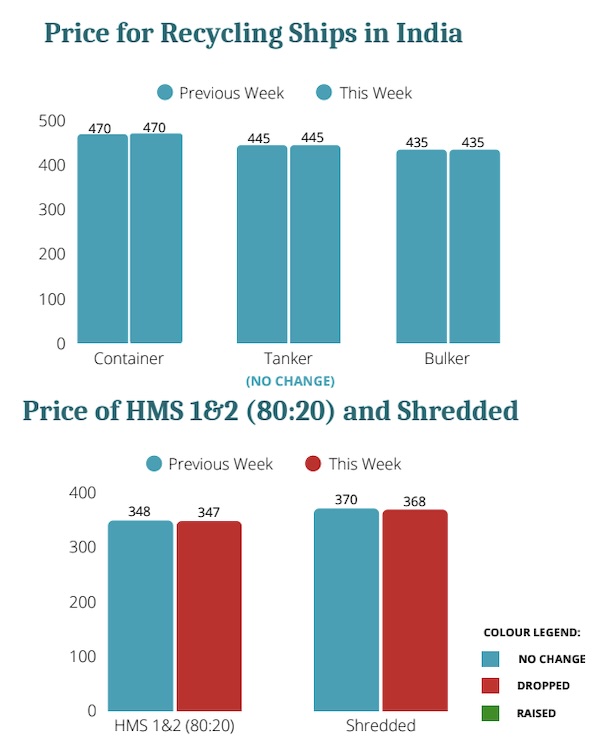

Source: Best Oasis

The move aligns with the Maritime India Vision 2030 and supports the country’s goal of becoming a top-five shipbuilding nation and a global leader in ship recycling by 2047. As global economic uncertainty grows, concerns over inflation, weaker growth, and disrupted trade continue to build. S&P Global has warned that the effect of ongoing US tariffs could now lead to a sharper slowdown, with sectors like technology, telecoms, retail, and automotive facing rising costs and supply chain stress. Insights from GlobalData also highlight how companies are struggling with pricing pressure and sourcing instability. While fossil fuels remain largely unaffected, wider trade imbalances are forming. These shifts could begin to reshape global shipping dynamics, adding further unpredictability to trade flows in the months ahead”, Best Oasis noted.

In a separate report, shipbroker Intermodal added that “with the June deadline for the implementation of HKC approaching, attention is increasingly focused on compliance preparations, while market participants closely monitor escalating tensions between India and Pakistan. In India, the ship recycling market remained subdued this week marked by a scarcity of end-of-life units and limited transactional activity. The steel sector also softened, with declining prices in both steel plates and finished products. Despite the implementation of safeguard duties, overall market sentiment remains fragile. However, the broader economy seems to hold steady, supported by improved consumer demand and domestic spending. Moreover, progress in trade negotiations with the United States offers a note of optimism. This development could position India among the first countries to finalize such an agreement, offering some insulation from global economic turbulence. In Bangladesh, the recycling market remains stalled due to the limited availability of candidate vessels, as several shipyards continue to face challenges in securing NOCs.

Source: Intermodal

The import approval process remains cumbersome, with authorities reviewing applications individually, thereby complicating and delaying deliveries to recycling yards. Developments regarding HKC compliance and the possibility of an extension for NOC certificates are drawing significant industry attention, with non-compliant yards working intensively to upgrade their facilities to meet HKC standards and hoping for a two-month extension. In Pakistan the demand for recycling candidates is low and mainly focused on smaller-sized units. Concerns persist over the industry’s ability to comply with HKC regulations in time. While the national economy is showing signs of improvement, highlighted by a 0.28% year-on-year easing of inflation in April, geopolitical tensions with India seem to rise. Pakistan has criticized India’s recent efforts to influence the IMF to reassess its financial support, a move Islamabad considers in breach of international norms. If successful, this could block the expected $1.3 billion IMF loan scheduled for review on May 9th, restricting Pakistan’s liquidity and further straining the ship recycling sector. In Turkey the market remains under pressure with minimal activity and limited tonnage supply. Market participants have adopted a cautious stance, keeping a close watch on macroeconomic developments. Although inflation eased to 37.86% in April, marking the 11th consecutive month of decline, the Central Bank has opted to pursue a contractionary monetary policy. A 3.5% hike in the benchmark interest rate was implemented to stabilize prices and safeguard the economy amid rising global protectionist risks”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide