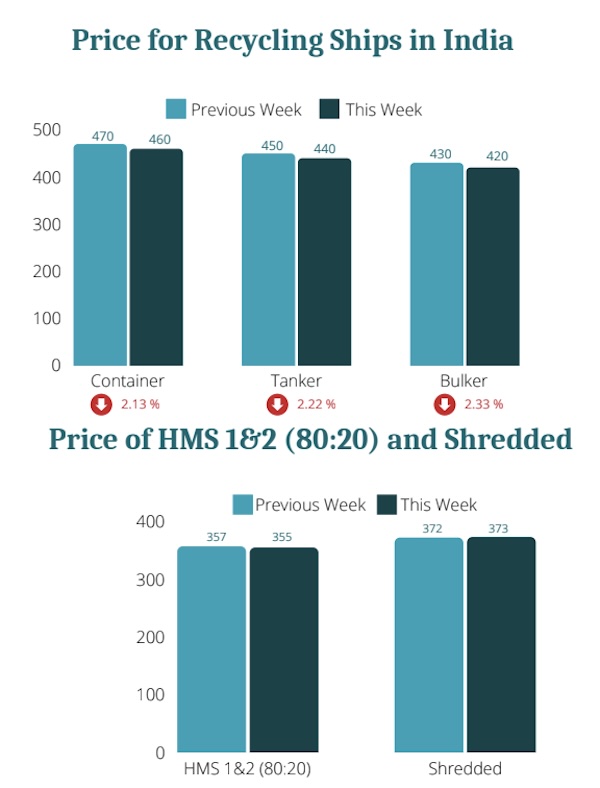

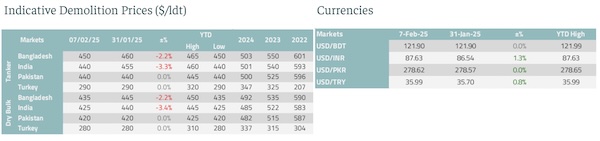

The ship recycling market is still quite slow and uncertain. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “this week, the ship recycling market remained slow and uncertain, with all four major destinations—India, Bangladesh, Pakistan, and Türkiye—struggling to gain momentum. In India, recyclers had pinned their hopes on the Union Budget 2025-26, but with no action against cheap steel imports, domestic scrap prices stayed under pressure. Tonnage availability was low, and the rising dollar made transactions more challenging, dampening market confidence. Bangladesh saw recyclers pushing for lower prices, but sellers held firm, unwilling to meet these levels. This price standoff kept the market subdued, with no clear direction. Pakistan remained mostly unchanged, though recyclers expect an increase in available tonnage in the coming months, which could push prices lower. Some sales took place, but concerns over price stability and competition from Iranian imports kept the market cautious. Türkiye, meanwhile, continued to face weak demand and little movement, leaving recyclers waiting for signs of improvement”.

Source: Best Oasis

According to Best Oasis, “across all major destinations, the market remains in a state of caution and uncertainty. Buyers are hesitant, sellers are holding their ground, and external pressures continue to weigh on sentiment. For now, the industry is in a wait-and-watch mode, hoping for a shift but bracing for further challenges. The U.S. tariffs on Mexico, Canada, and China set off a ripple effect, with trade partners hitting back with their own tariffs. Businesses relying on steel, aluminum, and international supply chains saw costs climb, forcing them to raise prices, cut production, or find new suppliers. Industries like automotive, construction, and technology felt the strain as trade routes shifted and supply chains grew more complicated. With rising uncertainty, companies held back on investments, and economic growth started to slow. If these trade tensions drag on, they won’t just shake up global commerce; rather, they’ll force industries to rethink how they operate, adapt to new realities, or risk falling behind in a rapidly changing world”.

Meanwhile, in a separate report, shipbroker Intermodal added that “the ship recycling market remained sluggish, weighed down by uncertainty related to U.S. trade policy, tariffs, and the increasing likelihood of a new trade war. In Bangladesh the political uncertainty is escalating following a speech by the exiled PM triggered violent riots. This unrest is further straining the economy, delaying infrastructure projects and dampening steel demand, all of which impacting ship recycling activity. Fewer ship recyclers are seeking tonnage, with their offers falling shot of sellers’ expectations. On the regulatory front, the Ministry of Industries granted a two-month extension for shipyards to obtain NOCs, now due by March 31, 2025, provided they achieve full HKC compliance by June 2025. In India, market participants were somehow disappointed by the Union Budget announcement, as the measures prioritized development of shipbuilding and related infrastructure rather than support for the ship recycling sector or measures to curb cheap steel imports from China. This has fuelled a cautious market sentiment, compounded by a weakening rupee, limited activity, and limited supply of candidate vessels.

Source: Intermodal

On the economic front, the Reserve Bank of India’s 0.25% cut in its key rate, aimed at countering slowing economic growth, has provided some relief to businesses by easing borrowing costs. In Pakistan, the market has shown some movement, with Gadani buyers actively bidding for candidate vessels. However, the ship recycling sector is impacted by local steel market dynamics, as steel plate prices remain stable amid uncertainty over a potential increased influx of cheap Chinese steel, because of the US tariffs to China. Moreover, despite buyers’ interest in acquiring tonnage, the required infrastructure upgrades for HKC compliance, are hindering Gadani yards’ competitiveness compared to their subcontinent neighbors. Meanwhile, the country remains in financial distress, burdened by high debt obligations and pending international aid, while the IMF investigates allegations of fund mismanagement and corruption. The Turkish market remains subdued, with little change from the previous week aside from the introduction of some fresh tonnage. While the steel market conditions remain unchanged, rising raw material costs have pushed up steel product prices. Looking ahead, a potential uptick in construction activity in the coming weeks could strengthen demand and offer some support to the market”, Intermodal concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide