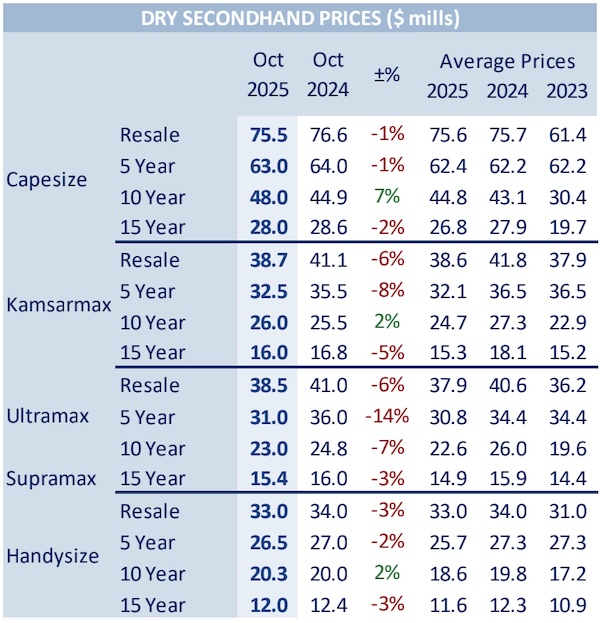

The second hand ship market has seen many new deals over the past week. In its latest weekly report, shipbroker Banchero Costa said that “in the bulk sector, the Panamax NAVIOS HELIOS 77,000 dwt 2005 Namura built was reported sold to Hong Kong interests at $8.25 mln. TASIK SAKURA 76,000 dwt 2011 Oshima built was reported sold to Omicron at region $15 mln. In the Ultramax segment, IMABARI QUEEN 60,000 dwt 2016 Sanoyas built was reported sold to British Bulkers at $23.5 mln. In the Supramax segment, Chinese interests were behind the purchase of STONEWELL PIONEER 56,000 dwt 2014 Taizhou built at $14.7 mln. In the Handysize segment, TBC PRIME 38,000 dwt 2011 Minaminippon built was reported sold to Vietnamese interests at $14 mln. Additionally, TBC PASSION 38,000 dwt 2011 Imabari built was also reported sold to Vietnamese interests at $14.4 mln. In the tanker sector, the VLCC LANDBRIDGE FORTUNE 308,000 dwt 2016 Dalian built was reported sold enbloc with sistership LANDBRIDGE PROSPERITY (2016) at $171.60m. Additionally, sister LANDBRIDGE HORIZON (2019) was reported sold at $103 mln. All three vessels are scrubber-fitted and were reported sold to Trafigura. In the Suezmax segment, ECO BEVERLY HILLS 157,000 dwt 2019 Hyundai Samho built was reported sold enbloc with sister ECO BEL AIR (2019) to Performance Shipping at $76.5 mln each. In the Aframax segment, Pakistan National Shipping was behind the purchase of NAFSIKA 112,000 dwt 2022 Sumitomo Heavy Marine built and LORAX 110,000 dwt 2022 Sumitomo built at $75 mln each. In the LR1 segment, PGC COMPANION 73,000 dwt 2005 Hudong-Zhonghua built was reported sold at $10.3 mln to undisclosed interests”.

Source: Banchero Costa

In a separate note, shipbroker Xclusiv said that “buying momentum continued in the dry sector this week, spanning from Capesize down to Handysize units. In the Capesize sector, the “Hebei No. 1” – 182K/2009 Dalian was sold for USD 25 mills. In the Panamax sector, the “Nara I” – 77K/2007 Jiangnan changed hands at USD 8.5 mills, while in the Ultramax sector Greek buyers acquired the Scrubber fitted Japanese-built “Imabari Queen” – 60K/2016 Sanoyas for USD 23.5 mills. The “Athena” – 62K/2011 Oshima was sold for USD 17.75 mills, basis TC attached at USD 14,750/day until end-2025. Chinese buyers were active in the Supramax segment, acquiring the Electronic M/E “Stonewell Pioneer” – 57K/2014 Taizhou Sanfu for USD 14.7 mills. Meanwhile, the “Aquavita Bay” – 56K/2014 JMU with electronic M/E fetched USD 20.25 mills, highlighting premiums for Tier II Japanese tonnage. The Philippines-built “Forever SW” – 58K/2010 Tsuneishi Cebu was sold for USD 15.2 mills. A major en-bloc deal saw Brave Maritime acquiring three Japanese-built Handy bulkers – the “African Heron”, “African Merlin”, and “African Goshawk” – 34K/2016 Namura for USD 17.5 mills each, marking one of the most notable Handysize moves of the week. Elsewhere, the “Dogan” – 39K/2013 SPP changed hands for USD 14.8 mills, while the older “St Theresa” – 33K/2006 Kanda fetched USD 7.2 mills. Finally, the Ice Class 1C Handy “Irma” – 35K/2000 Mitsui was sold for high USD 4 mills”.

Similarly, “the tanker market remained highly active this week, led by strong appetite for modern tonnage across the VLCC and Aframax/LR2 segments. Trafigura acquired the modern VLCC “Landbridge Horizon” – 308K/2019 Dalian for USD 103 mills. Performance Shipping expanded further in the crude sector, purchasing en bloc the Suezmax sisters “Eco Bel Air” and “Eco Beverly Hills” – 157K/2019 Hyundai Samho for USD 75.438 mills each. In the same size range, the vintage “Konya” – 164K/2005 HHI found new owners for USD 28.4 mills, showing firm values for older, well-maintained Korean-built units. Chinese buyers were active as well, acquiring the “Oceanus” – 150K/2008 Universal for USD 38 mills. On the Aframax side, Pakistan National Shipping Corporation returned to the market acquiring two nearly-new Japanese-built vessels, the “Nafsika” – 112K/2022 Sumitomo and the “Lorax” – 110K/2022 Sumitomo, for about USD 75 mills apiece. A trio of Korean-built sisters, the “Kmarin Renown”, “Kmarin Respect”, and “Kmarin Reliance” – 110K/2016 STX, were sold to undisclosed buyers for USD 46 mills each. Older Aframax tonnage continued to see movement, with the “Hydra” – 106K/2004 Sumitomo changing hands at USD 20.75 mills, while the Ice Class Aframaxes “Minerva Lisa” and “Minerva Iris” – 104K/2004 Samsung were reportedly committed in the low USD 20s. Product tanker activity was also notable, as the MR2 “Stavanger Poseidon”- 49K/2020 Hyundai Vietnam was sold for USD 44.15 mills to Pakistan National Shipping, while the “San Sebastian” – 37K/2007 HMD fetched USD 13.5 mills”, Xclusiv concluded.

Source: Xclusiv

Meanwhile, in the newbuilding market, Banchero Costa said that “in the tanker sector, Greek company Dynacom placed an order of 4 x 306,000 dwt VLCCs to Chinese yard Hengli H.I. The price for each vessel is estimated to be between $116-$118 mln, and deliveries will span from mid-2026 to 2027. Turkey’s Densay Shipping placed an order of 2 x 50,000 dwt product carriersto Chinese builder Wuhu. The MR2 duo is set to be delivered mid and late 2028. In the Chemical segment, Chinese yard Jiangsu New Jiangzhou SB secured an order of 3 x 33,000 dwt stainless steel Chemical carriers from DM Shipping in Korea. Each vessel will have dual-fuel methanol propulsion and is priced at $56 mln. Deliveries will start late in 2028 and finish Q4 2029. In the Container sector, China’s Jiangsu Ocean Shipping placed an order of 2 x 1,900 TEU carriers to Chinese yard Huangpu Wenchong. Both are scheduled for delivery Q4 2029”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide