Seaborne Coal Trade Retreated So Far in 2025

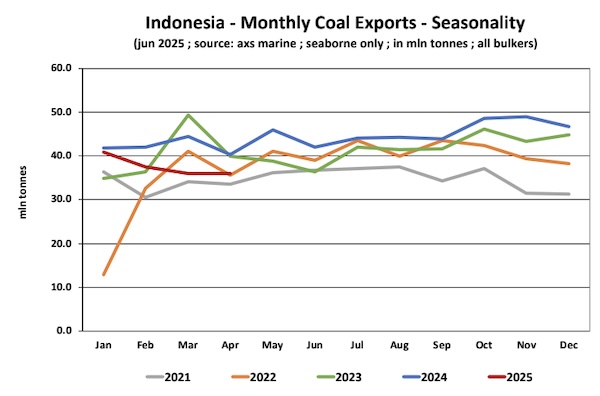

The seaborne coal trade has been falling so far in 2025, with Indonesia, the world’s leading exporter, being no exception to the trend. In its latest weekly report, shipbroker Banchero Costa said that “in Jan-Apr 2025, global seaborne coal loadings declined by -6.4% y-o-y to 408.3 mln t (excluding cabotage), based on vessel tracking data from AXS Marine. In Jan-Apr 2025, exports from Indonesia declined by -10.9% y-o-y to 150.1 mln tonnes, whilst from Australia were down by -7.3% y-o-y to 103.3 mln t. From Russia exports declined by -3.3% y-o-y to 50.7 mln t in Jan-Apr 2025, from the USA declined by -1.3% y-o-y to 27.5 mln t, from South Africa by +7.7% y-o-y to 21.8 mln t. Shipments from Colombia declined by -23.5% y-o-y to 15.3 mln t in JanApr 2025, from Canada up by +1.8% y-o-y to 16.1 mln t, and from Mozambique by +0.2% t-o-y to 6.2 mln t. Seaborne coal imports into Mainland China declined by -7.9% y-o-y to 115.0 mln t in Jan-Apr 2025. Imports to India declined by -7.9% yo-y to 75.9 mln t, to Japan declined by -2.1% y-o-y to 50.7 mln t in JanApr 2025, to South Korea down by -19.9% y-o-y to 30.9 mln t. To the EU imports were up by +5.7% y-o-y to 21.5 mln t in Jan-Apr 2025, whilst to Vietnam volumes increased by +23.2% y-o-y to 22.7 mln t. Imports to Malaysia increased by +2.3% y-o-y to 12.8 mln t, and to Bangladesh by +68.5% y-o-y to 5.6 mln t”.

Source: Banchero Costa

According to Banchero Costa, “Indonesia is the world’s largest seaborne exporter of coal, accounting for 38.8% of the global seaborne coal market in 2024. Export volumes from Indonesia were relatively depressed during 2020 and 2021, due to disruption from Covid19 and from government policies favouring domestic consumption but bounced back to an all-time record high in 2022, and continued to grow further in 2023. Total seaborne coal exports from Indonesia in 2023 reached 494.6 mln tonnes, +10.2% y-o-y, according to AXS Marine vessel tracking data. In 2024, coal exports from Indonesia increased further by +7.7% y-o-y to 532.9 mln tonnes”.

The shipbroker added that “the vast majority of Indonesian coal exports are loaded in East Kalimantan and South Kalimantan (the island of Borneo), with some volumes also shipped from southern Sumatra island. The main coal export terminals in Indonesia are: Taboneo/ Banjarmasin (100.8 mln t loaded in Jan-Dec 2024), Tanjung Bara (41.7 mln t), Muara Berau (40.1 mln t), Balikpapan (39.8 mln t), Muara Banyuasin (39.2 mt), Muara Pantai (37.1 mt), Samarinda (33.7 mt), Bunati (32.4 mt), Adang Bay (20.4 mt), Tanjung Pemancingan (19.4 mt), Senipah Terminal (14.3 mln t), Kaliorang (13.9 mt). The majority (50.3%) of coal volumes from Indonesia in 2024 were loaded on Panamax vessels, with 30.1% on Supramax vessels, 10.4% on PostPanamax, and just 7.2% on Capesize tonnage”.

Source: Banchero Costa

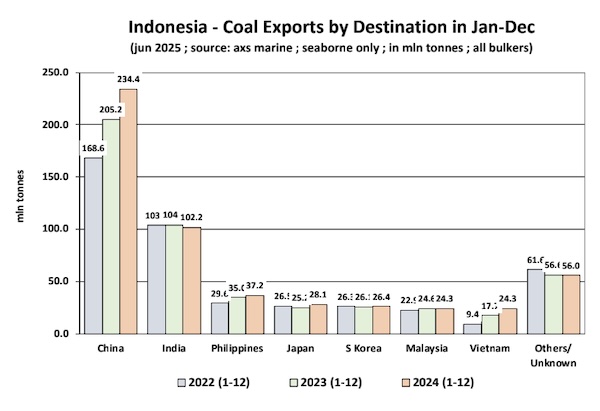

“China continues to be the top importer of Indonesian seaborne coal exports, accounting for 44.0% of shipments in Jan-Dec 2024. In Jan-Dec 2024, shipments from Indonesia to China increased by +14.2% at 234.4 mln tonnes. In Jan-Apr 2025 there was a -20.1% y-o-y correction to 54.4 mln t. About 19.2% of exports, or 102.2 mln tonnes in Jan-Dec 2024, were shipped to India, representing a correction of -1.9% y-o-y. In Jan-Apr 2025 there was a -15.3% y-o-y correction to 33.3 mln t. Shipments to the Philippines have increased by +6.1% y-o-y in Jan-Dec 2024 to 37.2 mln tonnes, with the Philippines accounting for 7.0% of Indonesian exports. Exports from Indonesia to Japan increased by +11.7% y-o-y in Jan-Dec 2024 to 28.1 mln t, with Japan accounting for 5.3%. South Korea imported 26.4 mln t of coal from Indonesia in Jan-Dec 2024, up +0.9% y-o-y. Malaysia received 24.3 mln tonnes, down -1.1% y-o-y. Last but not least, exports to Vietnam surged by +36.8% y-o-y to 24.3 mln t in Jan-Dec 2024”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide