Seaborne Coal Exports Fall as China Puts a Lid on Imports

China’s coal imports retreated during the first quarter of the year, which in turn took a toll on the global seaborne coal trade. In its latest weekly report, shipbroker Banchero Costa said that “in Jan-Mar 2025, global seaborne coal loadings declined by -6.7% y-o-y to 307.0 mln t (excluding cabotage), based on vessel tracking data from AXS Marine. This represents a reversal from the +3.3% y-o-y growth seen in 1Q 2024. In Jan-Mar 2025, exports from Indonesia declined by -10.7% y-o-y to 114.5 mln tonnes, whilst from Australia were down by -9.4% y-o-y to 76.6 mln t. From Russia exports declined by -3.2% y-o-y to 36.8 mln t in Jan-Mar 2025, from the USA declined by -4.9% y-o-y to 20.8 mln t, from South Africa increased by +10.3% y-o-y to 16.4 mln t. Shipments from Colombia declined by -18.9% y-o-y to 12.5 mln t in JanMar 2025, from Canada up by +0.8% y-o-y to 11.6 mln t, and from Mozambique by +4.6% t-o-y to 4.5 mln t”.

Source: Banchero Costa

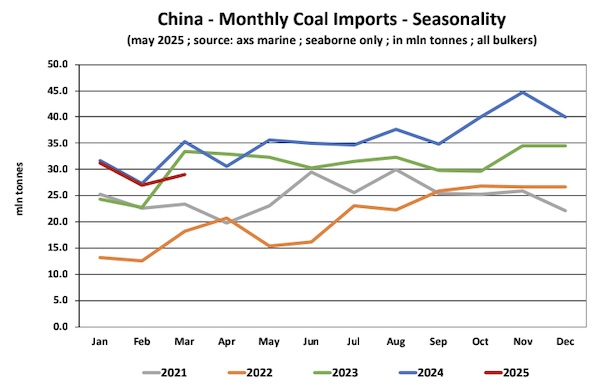

According to Banchero Costa, “seaborne coal imports into Mainland China declined by -7.3% y-o-y to 87.4 mln t in Jan-Mar 2025. Imports to India declined by -10.1% y-o-y to 53.9 mln t, to Japan increased by +0.9% y-o-y to 39.4 mln t in Jan-Mar 2025, to South Korea down by -20.0% y-o-y to 23.8 mln t. To the EU imports were up by +5.5% y-o-y to 16.1 mln tonnes in Jan-Mar 2025, whilst to Vietnam volumes increased by +24.9% y-o-y to 16.6 mln tonnes. Mainland China is currently the world’s largest seaborne importer of coal (including both thermal and coking), accounting for 31.2% of the global seaborne coal market in 2024. It is ahead of India, which accounts for 17.3% of coal trade and Japan with a 11.5% market share. Total seaborne coal imports into China in the 12 months of 2024 reached a record 427.1 mln tonnes, according to Refinitiv vessel tracking. This was up +15.9% y-o-y from the 368.4 mln t of 2023, which in turn was up +48.6% from the 248.0 mln t in 2022. In Jan-Mar 2025, imports into China corrected by -7.3% y-o-y to 87.4 mln t, but were still significantly higher than the 80.6 mln t in 1Q 2023 and the 44.2 mln t in 1Q 2022”.

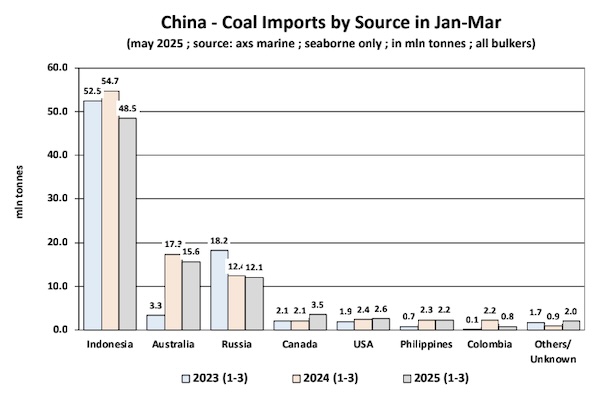

“In Jan-Dec 2024, most coal volumes into China were loaded on Panamax vessels (52.3%), with 23.4% on Supramax and Ultramax vessels, 6.9% on Post-Panamaxes and 14.4% on Capesize tonnage. Top discharge ports for coal imports into China in Jan-Dec 2024 were Machong (24.4 mln tonnes of coal in Jan-Dec 2024), Fangcheng (23.4 mln t), Qinzhou (20.1 mln t), Gaolan (18.2 mln t), Meizhou (17.7 mln t), Caofeidian (16.0 mln t), Shanghai (15.3 mln t), Nanjing (11.1 mln t), Ningbo (11.1 mln t), Guangzhou (11.1 mln t), Tangshan (10.1 mln t), Dongwu (10.1 mln t). Indonesia is still by far the top supplier of coal to China accounting for 55.5% of China’s imports in the first 3 months of 2025. Arrivals from Indonesia to China declined by -11.3% y-o-y to 48.5 mln tonnes in Jan-Mar 2025 compared to 54.7 mln t in Jan-Mar 2024.

Source: Banchero Costa

Australia is now back, and the second largest supplier of coal into China with a share of 17.8%. In Jan-Mar 2025, China imported 15.6 mln tonnes of coal from Australia, down -10.0% y-o-y from 17.3 mln tonnes in 1Q 2024, but very much up from the 3.3 mln t in 1Q 2023 or the 0.1 mln t in 1Q 2022. The third largest supplier of coal to China is Russia, accounting for a 13.8% share of Chinese imports. Coal shipments from Russia to China declined by -2.4% y-o-y to 12.1 mln t in Jan-Mar 2025, well below the 18.2 mln t in 1Q 2023, but well above the 7.4 mln t in 1Q 2022. Most Russian shipments are sourced from the Far East region of the country, with 3.1 mln t imported in Jan-Mar 2025 from the port of Vanino, 2.2 mln t from Vostochny, 2.1 mln t from Nakhodka. Coal volumes from Canada to China have skyrocketed by +68.7% y-o-y in Jan-Mar 2025 to 3.5 mln t.. From the USA they surprisingly increased by +10.0% y-o-y to 2.6 mln tonnes in Jan-Mar 2025”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide