Recycling Market Eases

Despite a frantic start to 2025 that saw a marked return of recycling tonnage at the bidding tables, sale and purchase activity across the global ship recycling spectrum eased further this week as Chinese New Year holidays descended upon the world, says cash buyer GMS.

“It is the Year of the Snake, and it is indeed expected to be a far busier one than the preceding years, with record low volumes of supply and an ensuing inertia that eventually led to the shuttering of yards across the major global ship recycling destinations in 2024.”

Should supply become unsustainable, this may apply even further pressure on recycling markets and eventually affect ship owners down the line, who will then have no choice but to bite the bullet of chasing falling prices in markets, says GMS.

So far, India and Bangladesh have shouldered the increasing number of vessels since October 2024, when Pakistani recyclers all but disappeared from the bidding tables on the back of an unfolding domestic financial crises. However, Gadani recyclers are now looking to get back into the game once again, at a time when locally favored dry bulk (Panamax and handy bulkers) vessels and LNG tankers have been much of the ongoing flavor of recycling sales so far this year.

Container ships are expected in the future given the recent easing of traffic in the Red Sea shipping lanes.

“Week 6 is likely setting itself up to be the pivotal point of global Tariff Wars of 2025. This also seems to be affecting the performance of the U.S. Dollar, which although seems to have made minor improvements against most of the major ship recycling nation currencies by the end of the week, actually started to decline across the board early in the week with the uncertainty of the upcoming tariffs, which even resulted in flattening steel plate prices at all ship recycling nations, except India where expectedly, they declined.”

Tariffs on Chinese steel stand to be of key concern to the sub-continent ship recycling markets and when China starts dumping their surplus post-tariff steel, it will be a critical factor in demand and vessel pricing for much of this year.

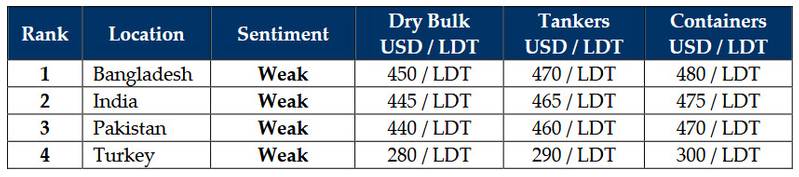

GMS demo rankings / pricing for week 5 of 2025 are: