Pressure Remains in the Ship Recycling Market

Pressure has been the main trend in the ship recycling market. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “ship recycling markets across South Asia and Türkiye remain under sustained pressure, with sentiment weak and no improvement in activity levels. In India, sluggish demand persists as cheaper local steel continues to limit market momentum, while monsoon conditions are disrupting yard operations and adding to the challenges faced by recyclers. Bangladesh is seeing buyers stay cautious, with HKC compliance processes still unclear and the DASR pending for both Bangladesh and India, keeping overall confidence low. Pakistan remains subdued, with very few buyers active as uncertainty over compliance continues to weigh on sentiment. In Türkiye, appetite for tonnage continues to decline, as steel mills are operating at much lower capacity and taking in only limited volumes”.

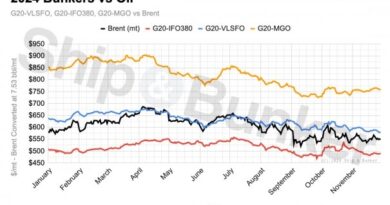

Source: Best Oasis

Best Oasis added that “across the board, markets remain quiet, with no immediate triggers for recovery in sight. Regional steel trade patterns are shifting as China steps up exports to Russia, filling gaps left by falling Russian steel production. With weak demand at home and growing barriers in other export markets, China is pushing more low-cost and specialized steel into Russia, where mills are struggling to meet domestic needs under the weight of sanctions. This has helped China maintain high export levels so far this year, but it is also adding to price pressure in nearby markets and fueling calls for new trade protections as countries move to shield their industries from cheap imports”.

In a separate report, shipbroker Intermodal added that “last week, the ship recycling sector maintained a subdued tone, impacted by the monsoon season and ongoing regulatory uncertainties across the Subcontinent. In India, the market faces mixed conditions, with both challenges and opportunities. While the demand remains sluggish and monsoon rains are impacting yard operations and working conditions, Indian recyclers hold a competitive edge compared to their neighbours, linked to the implementation of Hong Kong Convention. With over 100 certified yards versus 13 elsewhere in Subcontinent, Alang is considered as the primary option for an environmentally friendly ship dismantling. While this regulatory advantage has temporarily strengthened their position, it may erode soon, if the shipyards in Gadani and Chattogram accelerate upgrading works and the number of complied shipyards increase. Moreover, cheap local steel and subdued buying interest continue to pressure the steel market, though recent safeguard duties have reduced low-cost Chinese steel imports. On the trade front, government continues negotiations with USA to reach a trade agreement.

Source: Intermodal

At Gadani coasts, little has changed since last week, with buyers largely maintaining a wait-and-see approach amid lingering uncertainty following HKC implementation. So far, around 10 shipbreaking yards have opted to make the necessary upgrades to comply with HKC standards, with at least one to two months required before the works are completed. The sector remains non-compliant, dampening activity and weighing on market sentiment. Meanwhile, the domestic steel sector remains sluggish, further pressured by the ongoing monsoon season. On the economic front, Pakistan’s annual inflation rate eased to 3.2% in June, down from 3.5% in May, aligning with policymakers’ targets. The Bangladesh ship recycling market continues to face headwinds with muted buyer interest and subdued activity. So far, 13 shipyards have achieved HKC compliance, enabling them to import end of life vessels, and infrastructure upgrades are underway, with an estimated 20 more yards expected to become compliant within the next two to three months. The steel market is weak, impacted by low demand as price for recycled steel has dropped due to elevated inventories, cheap imported steel and a lack of public construction projects, while the monsoon rains are disrupting trade and operations. The monsoon season may offer a period for the market to pause, yards complete HKC upgrades and prepare for a potential rebound with renewed confidence. In Turkey the market remains lethargic, amid minimum activity and reduced steel demand, as steel mills operate well below normal levels. On a positive note, the Lira gained some ground against the US Dollar”, the shipbroker concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide